Get the free Invoice Example 3 - pensionprotectionfundorguk - pensionprotectionfund org

Show details

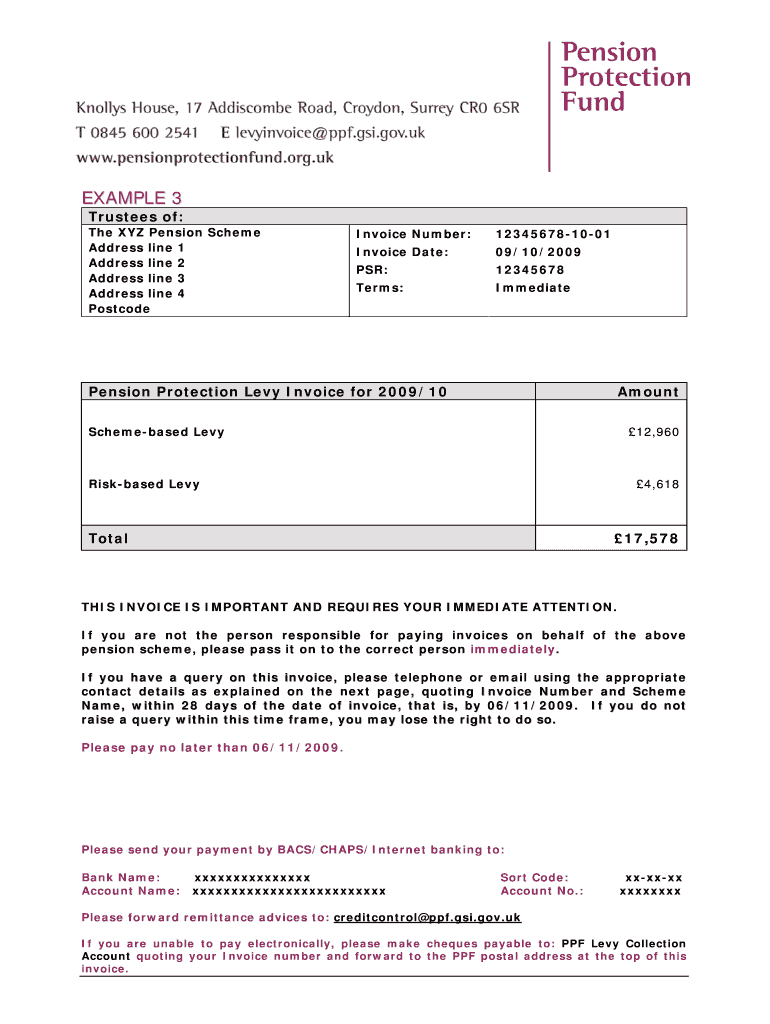

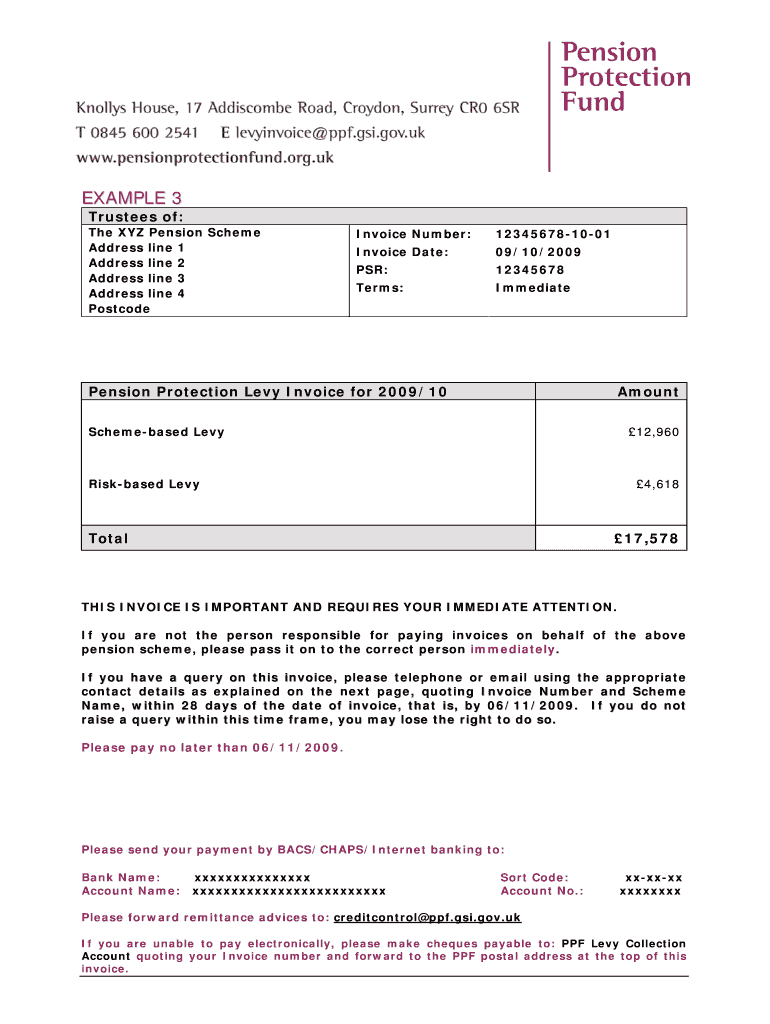

EXAMPLE 3 Trustees of: The XYZ Pension Scheme Address line 1 Address line 2 Address line 3 Address line 4 Postcode Invoice Number: 123456781001 Invoice Date: 09/10/2009 PSR: 12345678 Terms: Immediate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign invoice example 3

Edit your invoice example 3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your invoice example 3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit invoice example 3 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit invoice example 3. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out invoice example 3

How to fill out invoice example 3:

01

Start by identifying the invoice number and date. This is usually located at the top right corner of the invoice. Enter the unique invoice number and the date on which the invoice is being created.

02

Provide your contact information. Include your name or business name, address, phone number, and email address. This is usually placed below the invoice number and date, on the left side of the invoice.

03

Include the recipient's contact information. Enter the name or business name, address, phone number, and email address of the customer or client for whom the invoice is being generated. This information is typically placed below your contact information on the right side of the invoice.

04

Specify the products or services provided. Create a list of the items or services you are invoicing for. Include a description, quantity, unit price, and the total amount for each item or service. This information is usually organized in a table format and may include subtotals.

05

Calculate the total amount due. Add up all the amounts and provide a subtotal. If applicable, include any taxes, discounts, or additional fees. Sum up all the values to provide the final total amount due.

06

Include the payment terms and due date. Specify the accepted payment methods and any specific terms or instructions for payment. Clearly indicate the due date by which the invoice should be paid.

07

Add any additional notes or comments. This section can be used to provide further details or instructions related to the invoice, such as payment deadlines, late payment penalties, or any other relevant information.

08

Preview and proofread the invoice. Before finalizing the invoice, review the entire document for any errors or omissions. Ensure that all the necessary information is included and accurately represented.

09

Save and send the invoice. Once you are satisfied with the invoice, save it in a preferred format (PDF, Word, etc.) and send it to the recipient. You can send it via email, traditional mail, or through an online invoicing platform.

Who needs invoice example 3?

01

Freelancers: Freelancers who offer their services to multiple clients can use invoice example 3 to create professional and organized invoices for each project or assignment they work on.

02

Small business owners: Small business owners, especially those who sell products or provide services, can benefit from using invoice example 3 to generate invoices for their customers or clients.

03

Self-employed individuals: Self-employed individuals, such as consultants, contractors, or artists, who need to invoice their clients for the work they have completed can utilize invoice example 3 as a template for their invoices.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send invoice example 3 for eSignature?

Once you are ready to share your invoice example 3, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I fill out the invoice example 3 form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign invoice example 3. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How can I fill out invoice example 3 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your invoice example 3 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is invoice example 3?

Invoice example 3 is a sample invoice that showcases the format and layout of a typical invoice.

Who is required to file invoice example 3?

Any business or individual who provides goods or services and expects payment is required to file an invoice, including invoice example 3.

How to fill out invoice example 3?

To fill out invoice example 3, you need to include details such as the invoice number, date, description of goods/services, quantity, unit price, total amount, and payment terms.

What is the purpose of invoice example 3?

The purpose of invoice example 3 is to request payment for goods or services provided and serve as a record of the transaction.

What information must be reported on invoice example 3?

Invoice example 3 must include details such as the sender's contact information, recipient's contact information, invoice number, date, description of goods/services provided, quantity, unit price, and total amount due.

Fill out your invoice example 3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Invoice Example 3 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.