AU Post TRANS05015037 Tender Form free printable template

Show details

ABN 28 864 970 579 Tender Form for Non GST Registered Entities Topic Page Tender Form for Non GST Registered Entities ........................................ 1 About this document....................................................................................

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign AU Post TRANS05015037 Tender Form

Edit your AU Post TRANS05015037 Tender Form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AU Post TRANS05015037 Tender Form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AU Post TRANS05015037 Tender Form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit AU Post TRANS05015037 Tender Form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out AU Post TRANS05015037 Tender Form

How to fill out AU Post TRANS05.015.037 Tender Form

01

Obtain the AU Post TRANS05.015.037 Tender Form from the official Australia Post website or your local post office.

02

Review the guidelines and instructions provided with the form to understand the required information.

03

Fill in your business name and contact details in the designated sections.

04

Provide a detailed description of the services or products you are tendering for, ensuring clarity and completeness.

05

Include any relevant financial information, such as pricing or cost estimates, in the appropriate fields.

06

Attach any necessary supporting documents as specified in the tender requirements.

07

Review your completed form for accuracy and completeness before submission.

08

Submit the form by the specified deadline, either online or in person, as indicated in the tender instructions.

Who needs AU Post TRANS05.015.037 Tender Form?

01

Businesses or individuals looking to provide goods or services to Australia Post.

02

Contractors interested in potential partnerships or projects with Australia Post.

03

Suppliers aiming to participate in Australia Post's tendering process.

Fill

form

: Try Risk Free

People Also Ask about

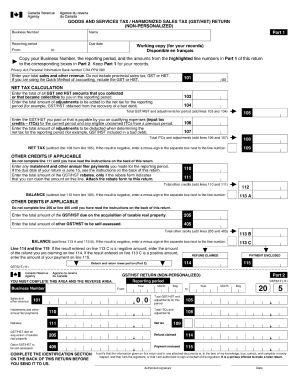

Do I need to file a GST return?

GST/HST registrants are required to file GST/HST returns on a monthly, quarterly, or annual basis. The reporting period a registrant has determines how often GST/HST returns are required to be prepared during the GST/HST year.

Do I have to file GST?

You must file a GST/HST return even if you have: no business transactions. no net tax to remit.

What is the GST tax in the US?

The U.S. generation-skipping transfer tax ( a.k.a. "GST tax") imposes a tax on both outright gifts and transfers in trust to or for the benefit of unrelated persons who are more than 37.5 years younger than the donor or to related persons more than one generation younger than the donor, such as grandchildren.

What is the form 706 for GST?

Form 706-GS(T) is used by a trustee to figure and report the tax due from certain trust terminations that are subject to the generation-skipping transfer (GST) tax.

What is GST on estate tax return?

The top federal gift and estate tax rate remains 40%. The federal GST exemption will similarly increase to $12.92 million. The GST tax is the tax on transfers to grandchildren or more remote descendants or unrelated individuals who are more than 37 ½ years younger than you. The GST tax rate remains a flat 40%.

What is the form for GST return?

GSTR-7 is a monthly return to be filed by persons required to deduct TDS (Tax deducted at source) under GST. This return will contain details of TDS deducted, the TDS liability payable and paid and TDS refund claimed if any. The due date to file GSTR-7 is the 10th of every month.

Which form is used for GST return?

GSTR-9. GSTR-9 is the annual return to be filed by taxpayers registered under GST. It is due by 31st December of the year following the relevant financial year, as per the GST law.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit AU Post TRANS05015037 Tender Form from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your AU Post TRANS05015037 Tender Form into a dynamic fillable form that you can manage and eSign from anywhere.

How do I complete AU Post TRANS05015037 Tender Form online?

Filling out and eSigning AU Post TRANS05015037 Tender Form is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit AU Post TRANS05015037 Tender Form on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute AU Post TRANS05015037 Tender Form from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is AU Post TRANS05.015.037 Tender Form?

The AU Post TRANS05.015.037 Tender Form is a document used by Australia Post for bidders to submit their proposals when responding to a request for tender. It outlines specific requirements and conditions for submitting tenders.

Who is required to file AU Post TRANS05.015.037 Tender Form?

Organizations or individuals who wish to participate in the tendering process for services or products required by Australia Post are required to file the AU Post TRANS05.015.037 Tender Form.

How to fill out AU Post TRANS05.015.037 Tender Form?

To fill out the AU Post TRANS05.015.037 Tender Form, participants must provide detailed information about their organization, the products or services being offered, pricing details, compliance with terms and conditions, and any additional documentation required by Australia Post.

What is the purpose of AU Post TRANS05.015.037 Tender Form?

The purpose of the AU Post TRANS05.015.037 Tender Form is to standardize the submission process for tenders, ensuring that Australia Post can effectively assess and compare the offers from different bidders.

What information must be reported on AU Post TRANS05.015.037 Tender Form?

The AU Post TRANS05.015.037 Tender Form requires information such as the bidder's name, contact details, the scope of work or services, pricing structures, compliance with Australia Post's requirements, and any relevant certifications or qualifications.

Fill out your AU Post TRANS05015037 Tender Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AU Post trans05015037 Tender Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.