Get the free Miscellaneous Form-5

Show details

This document is a payment request form used by UC Santa Barbara for miscellaneous payments that are not related to payroll. It includes details for requesting payments from petty cash or other funds,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign miscellaneous form-5

Edit your miscellaneous form-5 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your miscellaneous form-5 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing miscellaneous form-5 online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit miscellaneous form-5. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

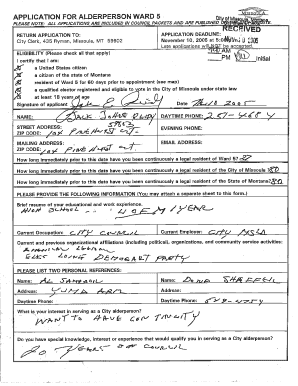

How to fill out miscellaneous form-5

How to fill out Miscellaneous Form-5

01

Begin by obtaining the Miscellaneous Form-5 from the appropriate authority or website.

02

Fill in your personal details in the designated sections, including name, address, and contact information.

03

Specify the purpose for which you are submitting the form.

04

Provide any required identification or supporting documents as indicated on the form.

05

Review all the filled information for accuracy and completeness.

06

Sign and date the form where required.

07

Submit the completed form to the relevant department or agency.

Who needs Miscellaneous Form-5?

01

Individuals or businesses who need to report or apply for miscellaneous items or services.

02

Those who are required to provide additional information to the relevant authority for specific cases or requests.

Fill

form

: Try Risk Free

People Also Ask about

Why did I receive a 1099-MISC from Meta?

If you earn money through Meta platforms like Facebook, Instagram, or their ad revenue-sharing programs, you may need to report this income to the IRS. For independent contractors and self-employed individuals, Meta issues a 1099 form if earnings exceed $600 in a calendar year.

What is considered as miscellaneous?

Something miscellaneous is made up of an odd bunch of things — things you might not expect to go together. A breakfast bar, a DVD, and a credit card bill are miscellaneous items that may be in your backpack.

What is a miscellaneous form?

Form 1099-MISC: Miscellaneous Information is an Internal Revenue Service (IRS) form used to report certain types of miscellaneous compensation, such as rent, prizes, awards, healthcare payments, and payments to an attorney.

What is the 1099 form used for?

A 1099 form reports income from self-employment, freelance work, investment, or other non-employee sources. A W-2 form reports wages, salaries, and taxes withheld for employees by their employer.

Who is required to receive a 1099?

Independent contractors, like freelancers and real estate agents, in the U.S. (citizens or resident aliens) filing a Form W-9 and other business service providers not on the payroll (receiving Form W-2) should expect to receive Form 1099-NEC from each client for payments exceeding the $600 or more reporting threshold.

What are examples of miscellaneous income?

About Form 1099-MISC, Miscellaneous Information Rents. Prizes and awards. Other income payments. Medical and health care payments. Crop insurance proceeds. Cash payments for fish (or other aquatic life) you purchase from anyone engaged in the trade or business of catching fish.

What is a 1099 miscellaneous form used for?

A Form 1099-MISC is used to report payments made in the course of a trade or business to another person or business who is not an employee. The form is required among other things, when payments of $10 or more in gross royalties or $600 or more in rents or compensation are paid.

What are examples of miscellaneous income?

About Form 1099-MISC, Miscellaneous Information Rents. Prizes and awards. Other income payments. Medical and health care payments. Crop insurance proceeds. Cash payments for fish (or other aquatic life) you purchase from anyone engaged in the trade or business of catching fish.

What does the IRS consider miscellaneous income?

Payments to others Depending on the nature of these payments, the IRS requires the amounts paid to be reported on either Form 1099-MISC in the case of payments for rent, royalties, prizes and awards, substitute payments in lieu of dividends and other items or 1099-NEC if the payments represent nonemployee compensation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Miscellaneous Form-5?

Miscellaneous Form-5 is a specific tax or reporting form used by individuals or entities to report miscellaneous income or transactions to the appropriate tax authority.

Who is required to file Miscellaneous Form-5?

Individuals or entities that receive miscellaneous income or certain transactions that fall under taxation regulations are required to file Miscellaneous Form-5.

How to fill out Miscellaneous Form-5?

To fill out Miscellaneous Form-5, gather all necessary financial information, complete the required sections of the form accurately, and submit it according to the guidelines provided by the tax authority.

What is the purpose of Miscellaneous Form-5?

The purpose of Miscellaneous Form-5 is to ensure that all miscellaneous income and relevant transactions are reported for tax compliance and to provide transparency for tax authorities.

What information must be reported on Miscellaneous Form-5?

Information that must be reported on Miscellaneous Form-5 includes details of the income sources, amounts received, the nature of the transactions, and identifying information of the filer and payees.

Fill out your miscellaneous form-5 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Miscellaneous Form-5 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.