Get the free Pre-Payment Closure of Loan Request Form 240714

Show details

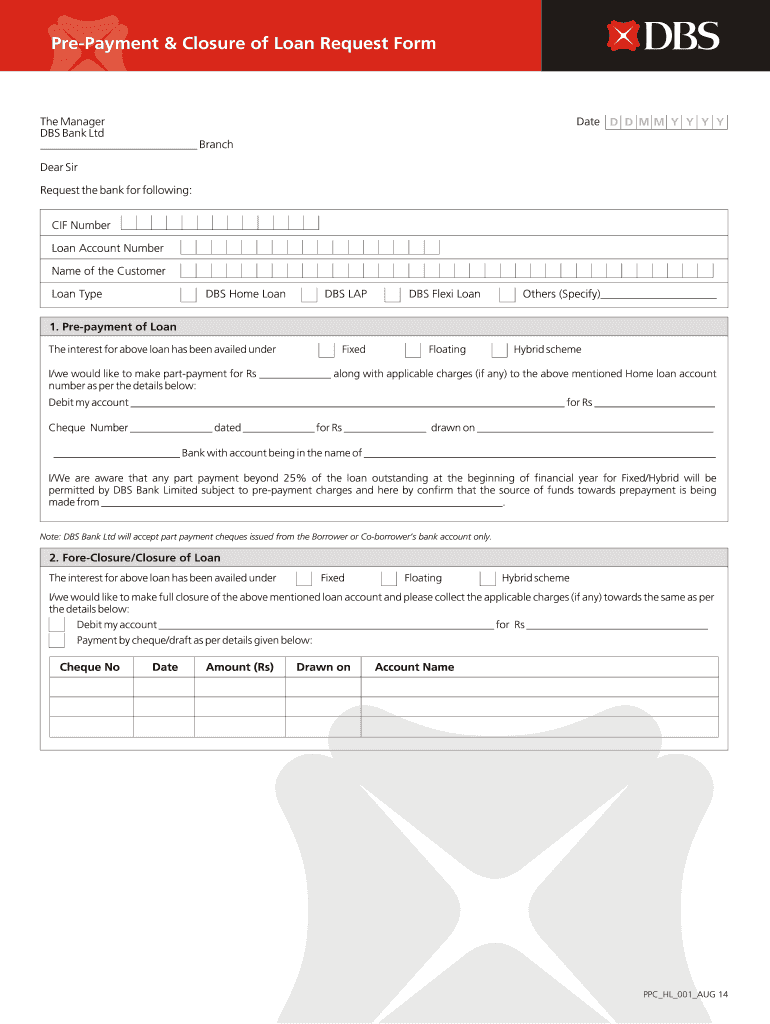

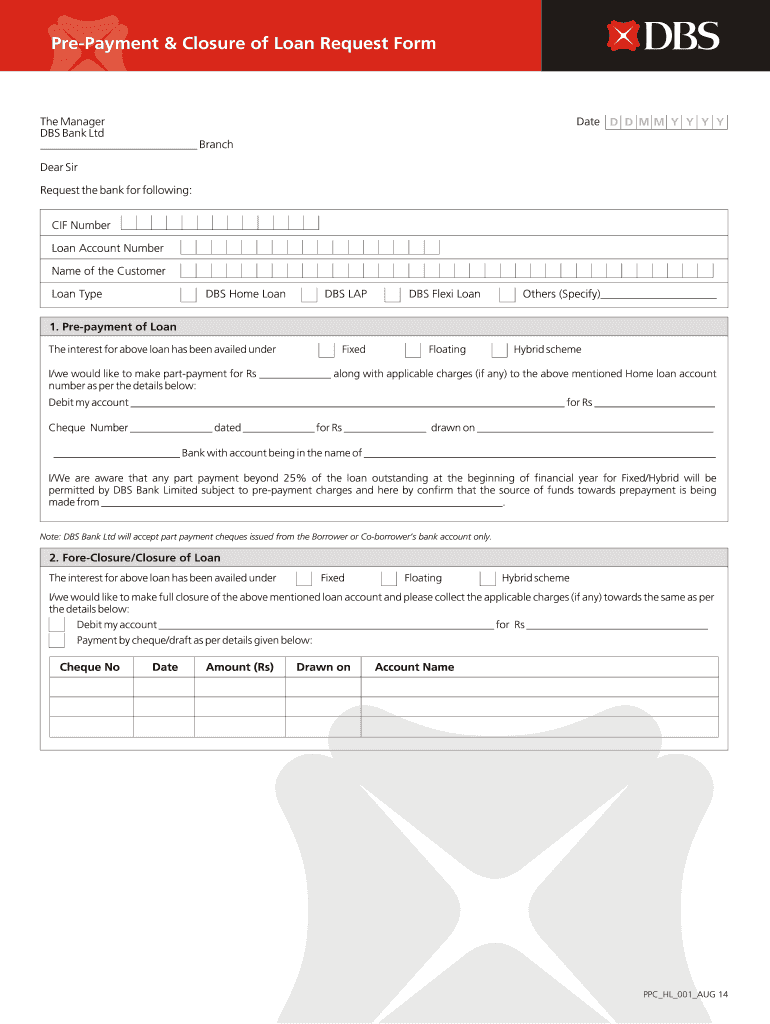

Prepayment & Closure of Loan Request Form Date D M M Y Y Y Y The Manager DBS Bank Ltd Branch Dear Sir Request the bank for following: CIF Number Loan Account Number Name of the Customer Loan Type

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pre-payment closure of loan

Edit your pre-payment closure of loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pre-payment closure of loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pre-payment closure of loan online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit pre-payment closure of loan. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pre-payment closure of loan

01

To fill out a pre-payment closure of loan, gather all the necessary documents related to the loan, such as the loan agreement, payment history, and any other relevant paperwork.

02

Review the terms and conditions of the loan agreement to understand the pre-payment clause. Some loans may have penalties or fees associated with early repayment, so it's important to be aware of these terms.

03

Contact your lender or loan servicing company to inform them of your intent to pre-pay the loan. They will provide you with the necessary forms or procedures to follow. Some lenders may require a written request, while others may have an online portal or specific instructions.

04

Fill out the pre-payment closure form accurately and completely. Provide all the required information, including your name, loan account number, contact details, and the amount you wish to pre-pay.

05

Attach any supporting documents that may be required, such as proof of identification or recent bank statements.

06

Double-check all the information filled in the form for accuracy and ensure that it matches the details mentioned in the loan agreement.

07

Submit the completed form and any supporting documents to the lender or loan servicing company through the designated method, whether it's by mail, email, fax, or through an online portal.

08

Follow up with the lender to confirm the receipt of your pre-payment closure request. It is essential to keep a record of all communication and copies of the submitted documents for future reference.

Who needs pre-payment closure of loan?

01

Individuals who have taken out loans and wish to pay off the remaining balance before the loan term ends may need pre-payment closure of the loan.

02

Borrowers who want to save on interest payments or reduce their debt burden often opt for pre-payment closure. By paying off the loan early, they can potentially save money on interest charges that would have accumulated over the remaining loan term.

03

Some individuals may also need pre-payment closure when refinancing their loans. By paying off the existing loan, they can qualify for better interest rates or loan terms with a new lender.

04

Businesses and organizations that want to clear outstanding debt and improve their credit profile may also seek pre-payment closure of loans.

In summary, filling out a pre-payment closure of loan requires gathering the necessary paperwork, reviewing the loan agreement, contacting the lender, completing the pre-payment closure form accurately, submitting it along with any supporting documents, and following up with the lender. Pre-payment closure of loans is typically sought by individuals or organizations looking to pay off their loans early, save on interest payments, or refinance their loans.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute pre-payment closure of loan online?

Completing and signing pre-payment closure of loan online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I create an eSignature for the pre-payment closure of loan in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your pre-payment closure of loan right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How can I edit pre-payment closure of loan on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing pre-payment closure of loan.

What is pre-payment closure of loan?

Pre-payment closure of loan refers to paying off the remaining balance of a loan before the scheduled due date.

Who is required to file pre-payment closure of loan?

The borrower or the individual who took out the loan is required to file pre-payment closure of loan.

How to fill out pre-payment closure of loan?

To fill out pre-payment closure of loan, the borrower must contact the lender to request the final payoff amount and then make the payment to close the loan.

What is the purpose of pre-payment closure of loan?

The purpose of pre-payment closure of loan is to settle the outstanding balance and end the loan agreement earlier than the original term.

What information must be reported on pre-payment closure of loan?

The information reported on pre-payment closure of loan includes the loan account number, the final payoff amount, and the date of closure.

Fill out your pre-payment closure of loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pre-Payment Closure Of Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.