Get the free Reading a Credit Card Statement - University of Illinois - cefe illinois

Show details

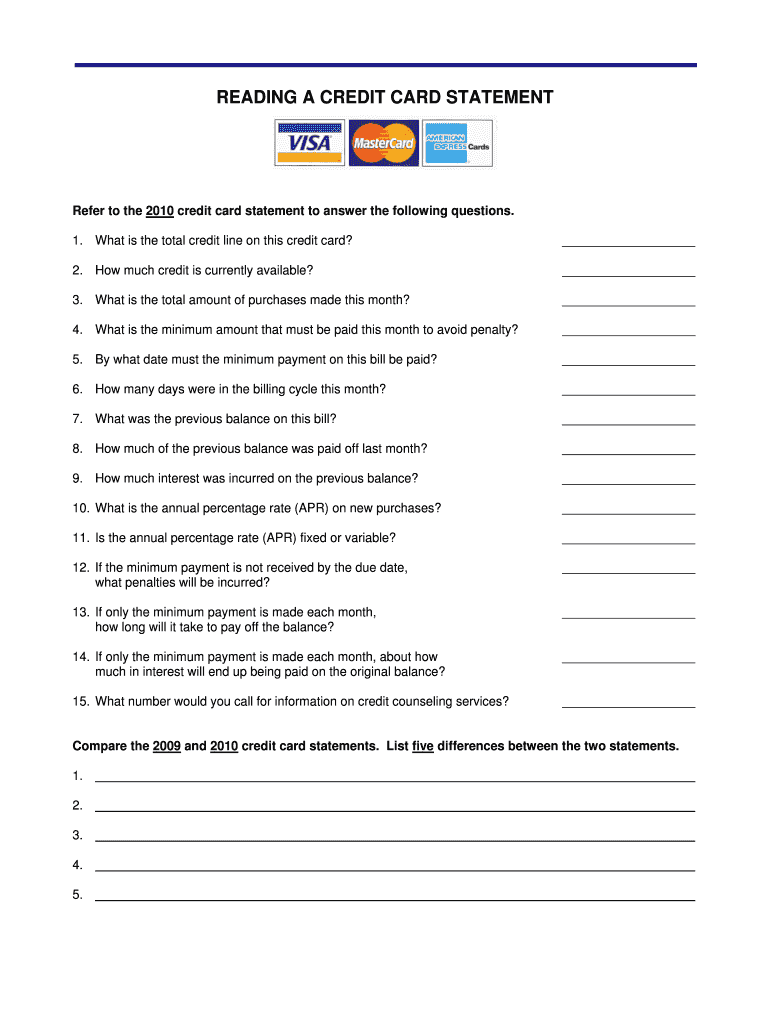

READING A CREDIT CARD STATEMENT Refer to the 2010 credit card statement to answer the following questions. 1. What is the total credit line on this credit card? 2. How much credit is currently available?

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign reading a credit card

Edit your reading a credit card form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your reading a credit card form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing reading a credit card online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit reading a credit card. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out reading a credit card

How to fill out a credit card application:

01

Gather all necessary information: Before filling out a credit card application, make sure you have all the required information handy. This typically includes your personal details such as your full name, date of birth, social security number, contact information, and current employment details.

02

Choose the right credit card: Research and select a credit card that best suits your needs. Consider factors such as interest rates, reward programs, annual fees, and any special benefits or offers that may be available.

03

Read and understand the terms and conditions: Carefully go through the terms and conditions of the credit card application. Understand the interest rates, fees, payment terms, and any other important information related to the card.

04

Provide accurate information: When filling out the application form, ensure that you provide accurate and up-to-date information. Double-check your personal details, employment history, and financial information to avoid any mistakes that could potentially delay or affect the approval process.

05

Complete all required sections: Fill out all the necessary sections of the application form, including your personal information, financial details, and any additional information required by the credit card issuer.

06

Review and double-check: Before submitting the application, carefully review all the information you have entered. Ensure that everything is accurate, and there are no errors or missing information.

07

Submit the application: Once you have reviewed the application form, sign and submit it either online or by mail, depending on the credit card issuer's instructions.

Who needs a credit card?

01

Individuals who want to build credit history: A credit card is a common tool used to establish and build credit history. Those who have limited or no credit history often apply for a credit card to start building a positive credit score.

02

People who want to manage their finances: Credit cards provide a convenient way to make purchases and manage expenses. They offer a detailed record of transactions, making it easier to track and manage your spending.

03

Individuals seeking emergency funds: Having a credit card can act as a financial safety net in case of emergencies or unexpected expenses. It provides quick access to funds, which can be helpful during unforeseen circumstances.

04

Travelers: Credit cards that offer travel rewards or perks can be beneficial for individuals who frequently travel. They can earn points, miles, or cashback on their purchases and enjoy additional travel-related benefits like airport lounge access or travel insurance.

05

Online shoppers: Credit cards are often the preferred mode of payment for online shopping. They offer convenience, security, and additional protection against fraudulent charges compared to other payment methods.

Note: It is important to use credit cards responsibly and within your means to avoid accumulating excessive debt or damaging your credit score.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send reading a credit card for eSignature?

Once your reading a credit card is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How can I edit reading a credit card on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit reading a credit card.

Can I edit reading a credit card on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute reading a credit card from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is reading a credit card?

Reading a credit card involves obtaining and recording the information stored on a credit card's magnetic strip or chip.

Who is required to file reading a credit card?

Businesses that process credit card transactions are required to file reading a credit card.

How to fill out reading a credit card?

To fill out reading a credit card, one must use a card reader device to extract the information from the card.

What is the purpose of reading a credit card?

The purpose of reading a credit card is to verify the authenticity of the card and process payment transactions.

What information must be reported on reading a credit card?

The information reported on reading a credit card typically includes the cardholder's name, card number, expiration date, and security code.

Fill out your reading a credit card online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Reading A Credit Card is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.