Scotiabank Declaration of Beneficial Ownership in a Corporation or Similar Entity 2008-2025 free printable template

Show details

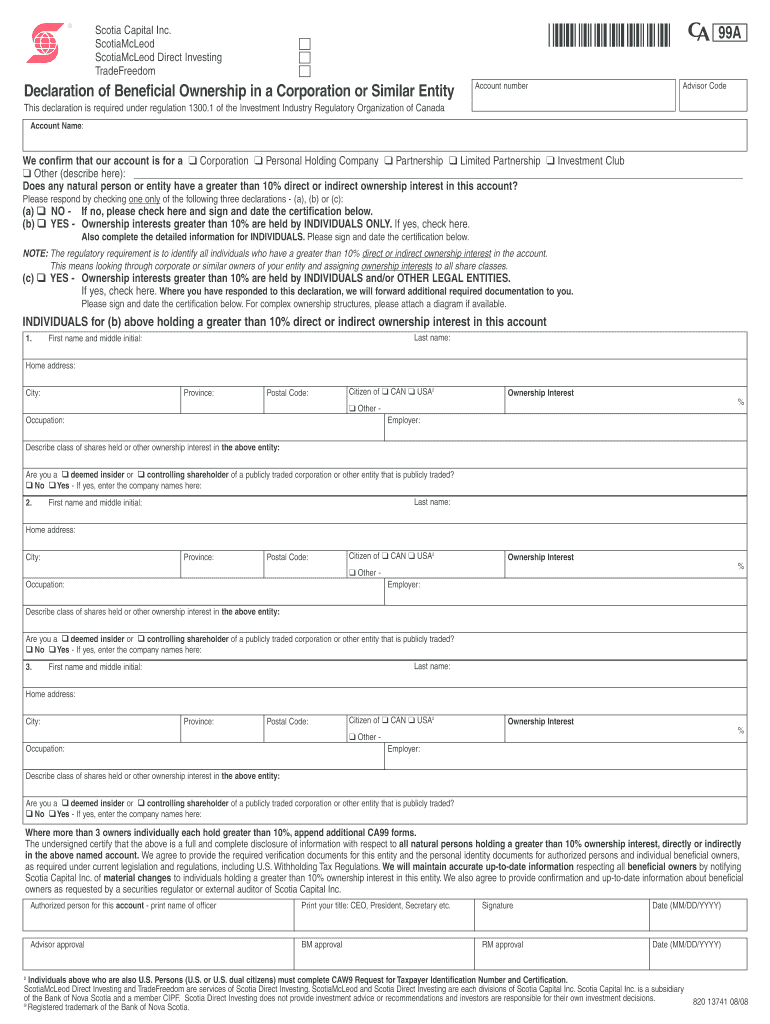

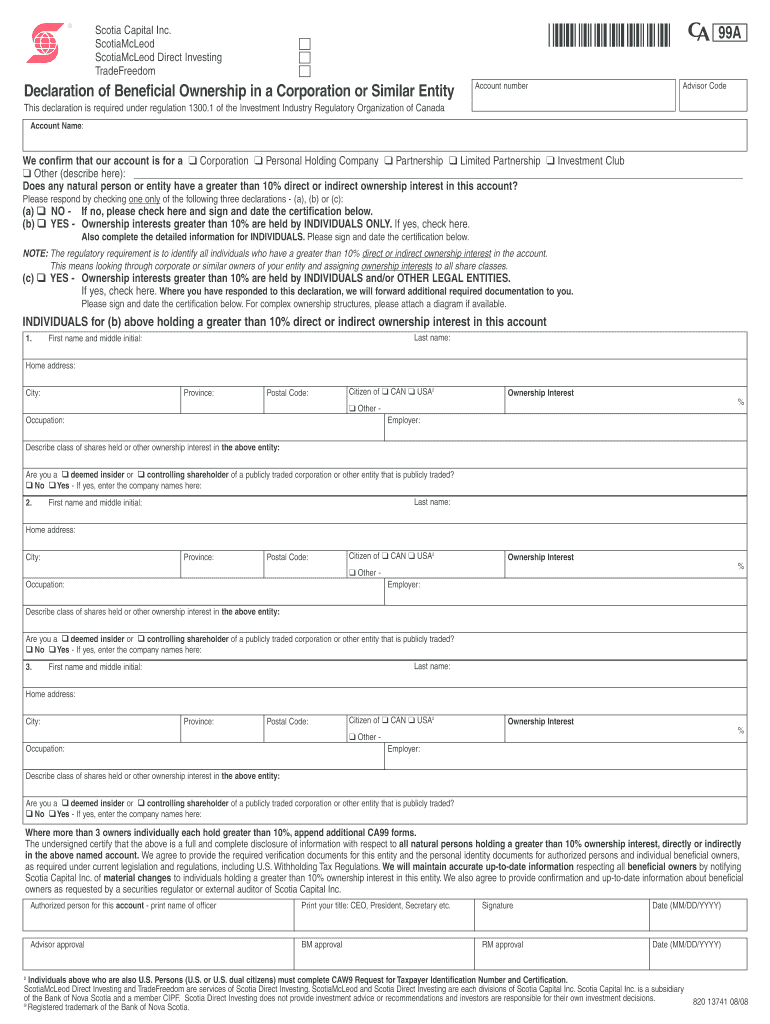

Scotia Capital Inc. Scotia McLeod Direct Investing TradeFreedom 99A c c c Declaration of Beneficial Ownership in a Corporation or Similar Entity Account number Advisor Code This declaration is required

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign corporate ownership structures

Edit your corporate ownership structures form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporate ownership structures form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing corporate ownership structures online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit corporate ownership structures. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out corporate ownership structures

How to fill out Scotiabank Declaration of Beneficial Ownership in a Corporation or Similar

01

Gather required information about the corporation and its beneficial owners.

02

Identify the individuals who have significant control over the corporation through ownership or other means.

03

Complete the declaration form with accurate details of each beneficial owner.

04

Ensure that all information is current and matches official documentation.

05

Review the completed declaration for any errors or omissions.

06

Submit the declaration to Scotiabank along with any required supporting documents.

Who needs Scotiabank Declaration of Beneficial Ownership in a Corporation or Similar?

01

All corporations and similar entities that have beneficial owners must submit the declaration.

02

Entities looking to open a bank account or establish a banking relationship with Scotiabank.

03

Corporations that require verification of ownership structure for compliance with regulations.

Fill

form

: Try Risk Free

People Also Ask about

What are the three 3 basic forms of business ownership?

The three major forms of business in the United States are sole proprietorships, partnerships, and corporations. Each form has implications for how individuals are taxed and resources are managed and deployed.

What are the forms of corporate ownership?

The most common corporate forms of business ownership are: Sole proprietorships. Limited liability companies (LLC). Corporations (for-profit or nonprofit).

What are the four types of corporate ownership?

4 Types of Legal Structures for Business: Sole Proprietorship. General Partnership. Limited Liability Company (LLC) Corporations (C-Corp and S-Corp)

What document determines corporate ownership?

Stock certificates and share ledgers are often used to prove business ownership. While stock certificates are commonly used in larger corporations, they are often not available in smaller corporations.

What are 5 forms of ownership?

5 Types of Business Ownership (+ Pros and Cons of Each) Sole proprietorship. Partnership. Limited liability company. Corporations. Cooperative.

What are the four types of business ownership structures?

The most common forms of business are the sole proprietorship, partnership, corporation, and S corporation.

What are the 4 types of corporations?

There are four general types of corporations in the United States: a sole proprietorship, a Limited Liability Company (LLC), an S-Corporation (S-Corp), and a C-Corporation (C-Corp).

What is the best ownership structure?

Corporations offer the strongest protection to its owners from personal liability, but the cost to form a corporation is higher than other structures. Corporations also require more extensive record-keeping, operational processes, and reporting.

How do you structure a company ownership?

To be clear, there are basically three levels of ownership in a share ownership structure. These are parents, affiliates, and subsidiaries. Here, parent companies own the subsidiaries. The amount of ownership interest can range from a fraction to even a complete 100%.

What is an example of an LLC ownership structure?

The two main LLC structure examples include a single-member LLC, which only has one member, and a multi-member LLC which can have an unlimited number of members. One of the best benefits of setting up an LLC structure is that you and other members of the LLC will enjoy greater flexibility in how you run the business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the corporate ownership structures form on my smartphone?

Use the pdfFiller mobile app to complete and sign corporate ownership structures on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Can I edit corporate ownership structures on an iOS device?

Create, edit, and share corporate ownership structures from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I complete corporate ownership structures on an Android device?

On Android, use the pdfFiller mobile app to finish your corporate ownership structures. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is Scotiabank Declaration of Beneficial Ownership in a Corporation or Similar?

The Scotiabank Declaration of Beneficial Ownership is a document that identifies the individuals who ultimately own or control a corporation or similar entity. It is used to ensure transparency in ownership and to comply with legal and regulatory requirements.

Who is required to file Scotiabank Declaration of Beneficial Ownership in a Corporation or Similar?

Any corporation or similar entity that holds an account with Scotiabank is required to file the Declaration of Beneficial Ownership. This includes all beneficial owners who have significant control or ownership interests in the entity.

How to fill out Scotiabank Declaration of Beneficial Ownership in a Corporation or Similar?

To fill out the declaration, provide the necessary details about the corporation or entity, including the names, addresses, and ownership percentages of the beneficial owners. Ensure that the information is accurate and up to date before submitting the form.

What is the purpose of Scotiabank Declaration of Beneficial Ownership in a Corporation or Similar?

The purpose of the Declaration is to promote transparency and prevent financial crimes such as money laundering and tax evasion by identifying the real owners behind corporate structures.

What information must be reported on Scotiabank Declaration of Beneficial Ownership in a Corporation or Similar?

The information that must be reported includes the names of beneficial owners, their addresses, the nature of ownership or control, the percentage of ownership, and any other relevant details that establish their beneficial interest in the entity.

Fill out your corporate ownership structures online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporate Ownership Structures is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.