Get the free VARIABLE RATE

Show details

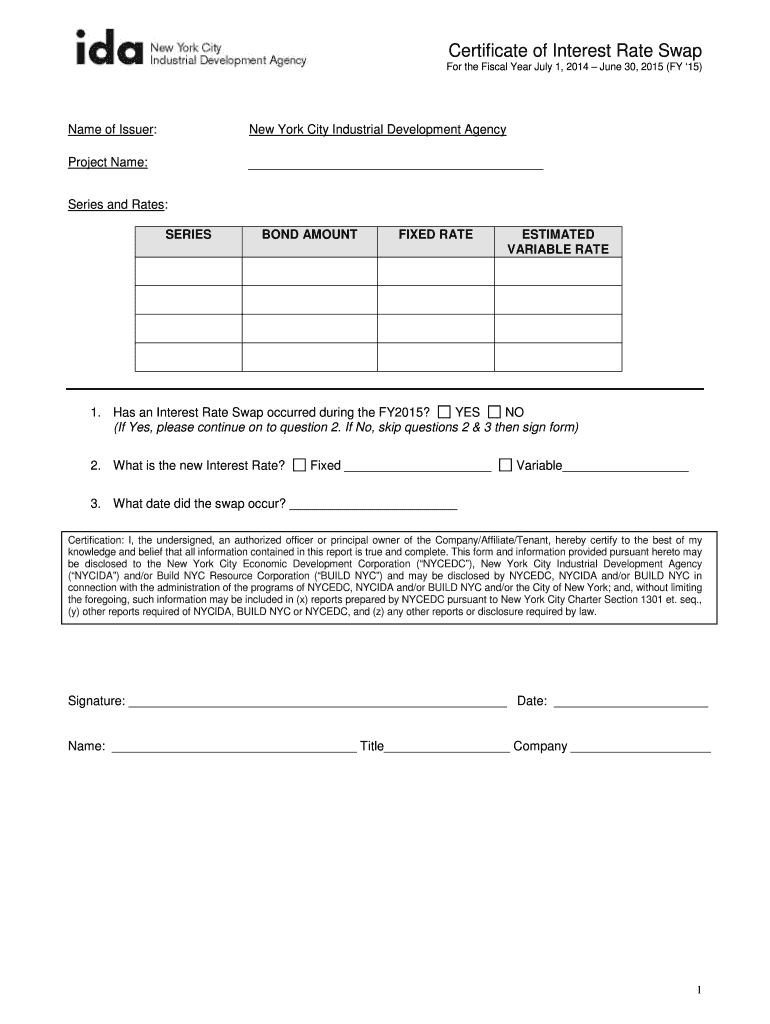

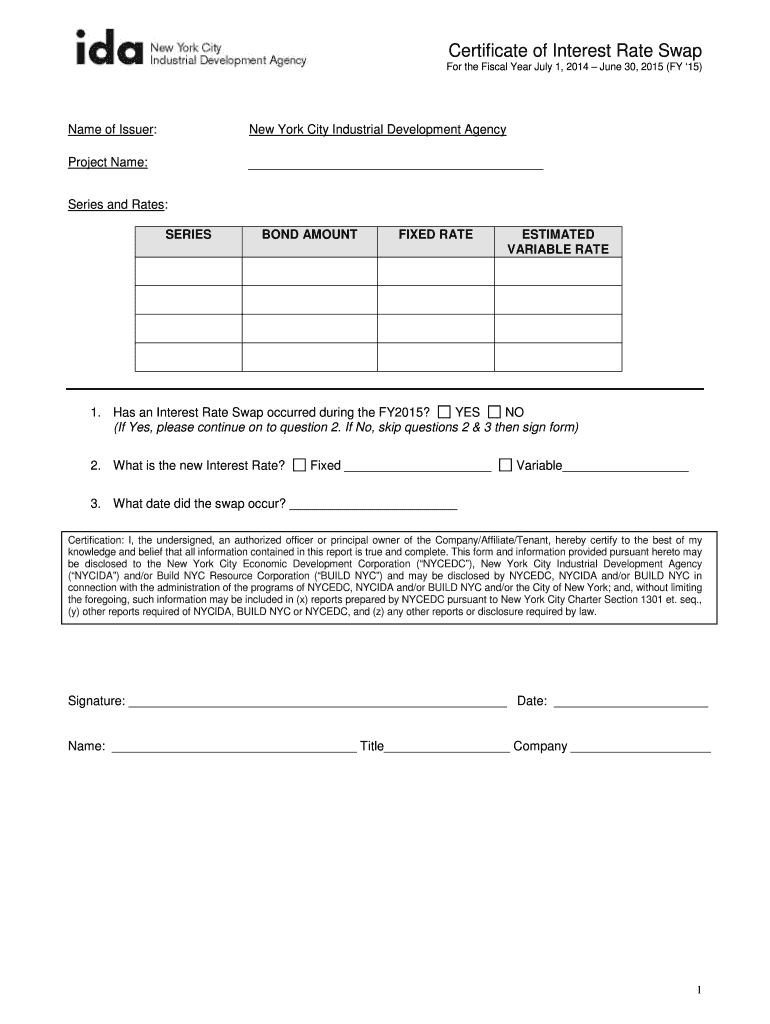

Certificate of Interest Rate Swap For the Fiscal Year July 1, 2014, June 30, 2015 (FY 15) Name of Issuer: New York City Industrial Development Agency Project Name: Series and Rates: SERIES BOND AMOUNT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign variable rate

Edit your variable rate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your variable rate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit variable rate online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit variable rate. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out variable rate

How to fill out variable rate:

01

Begin by understanding what a variable rate is. A variable rate refers to an interest rate that can change over time. It fluctuates based on various factors such as market conditions, economic indicators, or the terms specified in a loan or credit agreement.

02

Gather all the necessary information and documents required to fill out the variable rate. This may include your personal information, financial records, loan or credit agreement details, and any other relevant paperwork.

03

Start by reviewing the terms and conditions of your loan or credit agreement. Look for specific instructions or guidelines related to filling out the variable rate. Pay attention to any deadlines or specific formatting requirements.

04

Assess the current market conditions and economic indicators that may influence the variable rate. It is essential to stay informed about any potential changes in interest rates that could affect your loan or credit agreement.

05

Fill out the variable rate form provided by your lender or credit institution. Make sure to accurately input all the required information, including your personal details, loan amount, interest rate calculation method, and any other relevant fields.

06

Double-check all the information you have entered to ensure its accuracy. Mistakes or incorrect information could lead to financial discrepancies or issues in the future. If necessary, seek assistance from a financial advisor or contact your lender for clarification.

Who needs variable rate:

01

Individuals who prefer flexibility in their loan or mortgage repayment options may opt for a variable rate. It allows borrowers to take advantage of potential interest rate decreases, resulting in lower monthly payments.

02

Businesses or investors looking for short-term financing or funding options may find variable rates beneficial. They can adjust their financial strategies based on market conditions and take advantage of lower interest rates.

03

Individuals or businesses planning to pay off their loan or credit agreement in a shorter timeframe may consider a variable rate. This allows them to capitalize on potential interest rate decreases, saving money on interest payments.

04

Borrowers who understand and can financially handle potential interest rate fluctuations may choose a variable rate. It requires a level of risk tolerance and the ability to adjust their budget or financial plans accordingly.

Remember, it is essential to carefully evaluate your financial situation, risk appetite, and long-term goals before deciding whether a variable rate is suitable for you. Additionally, consult with financial advisors or lenders for personalized advice based on your specific circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute variable rate online?

Completing and signing variable rate online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I make edits in variable rate without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your variable rate, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I edit variable rate on an Android device?

With the pdfFiller Android app, you can edit, sign, and share variable rate on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is variable rate?

Variable rate refers to an interest rate that moves up and down based on changes in an underlying benchmark rate.

Who is required to file variable rate?

Individuals or businesses who have loans or investments with variable interest rates may be required to file variable rate reports.

How to fill out variable rate?

Variable rate information can be filled out on the appropriate forms provided by financial institutions or tax authorities.

What is the purpose of variable rate?

The purpose of variable rate is to track changes in interest rates and ensure accurate reporting of financial transactions.

What information must be reported on variable rate?

Variable rate reports typically require details such as the initial interest rate, index rate, margin, and any caps or floors on the interest rate.

Fill out your variable rate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Variable Rate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.