Get the free Promissory Note for Cash Advance - externalaffairs uga

Show details

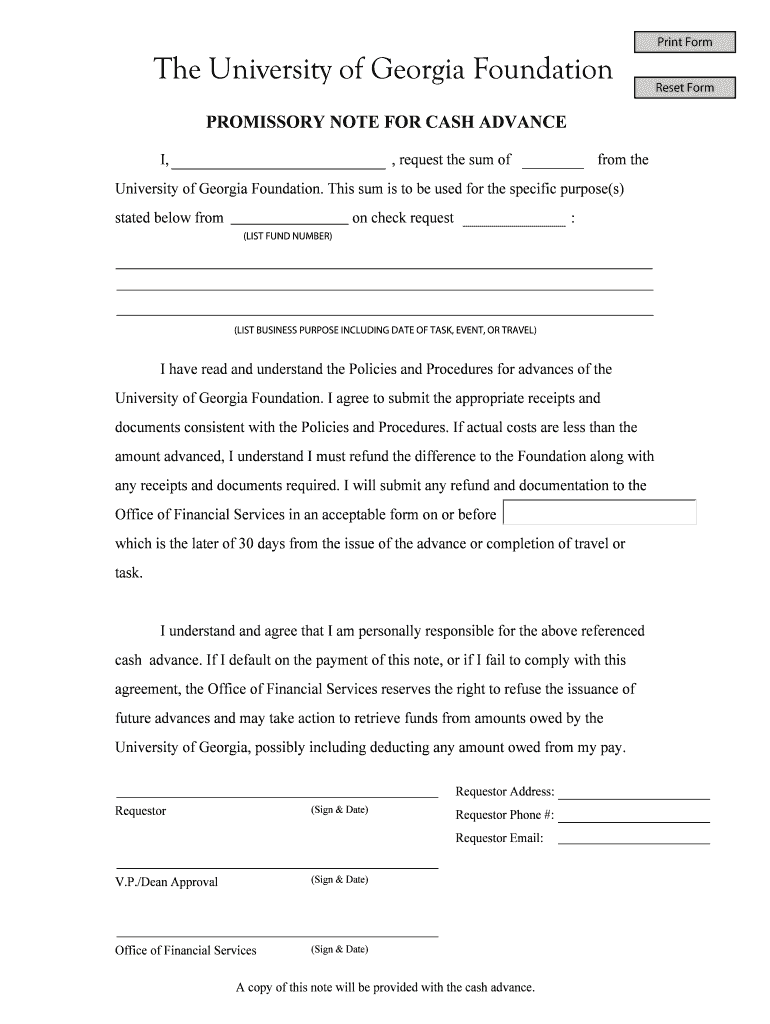

This document serves as a promissory note for requesting a cash advance from the University of Georgia Foundation, outlining responsibilities for repayment and documentation.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign promissory note for cash

Edit your promissory note for cash form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your promissory note for cash form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit promissory note for cash online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit promissory note for cash. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out promissory note for cash

How to fill out Promissory Note for Cash Advance

01

Title the document as 'Promissory Note'.

02

Include the date on which the note is being created.

03

Clearly state the amount of cash that is being advanced.

04

Specify the names and addresses of both the borrower and the lender.

05

Outline the repayment terms, including the due date and payment frequency.

06

Include any interest rate applicable to the loan, if applicable.

07

Specify the consequences of defaulting on the note.

08

Provide space for signatures of both the borrower and the lender.

Who needs Promissory Note for Cash Advance?

01

Individuals or businesses receiving a cash advance.

02

Lenders or creditors providing cash advances.

03

Any party requiring formal documentation of a loan agreement.

Fill

form

: Try Risk Free

People Also Ask about

Can you borrow money on a promissory note?

Any time a company, bank or person loans money to another individual, a promissory note should be used. Promissory notes can be used for a variety of circumstances, including mortgages, car loans, student loans and personal loans.

What is the difference between IOU and promissory note?

Unlike a promissory note, an IOU does not contain a promise to pay, nor does it specify a repayment date or other terms. It is not governed by specific legislation, such as the Bills of Exchange Act 1882, and lacks the formalities required to be considered a negotiable instrument.

How do you write a simple promissory note?

What to include in a promissory note Amount of money borrowed (principal amount) Amount to be repaid (principal and interest) When and how often payments will be made (payment schedule, or “due dates”) Interest rate and repayment specifics. Time frame and maturity date (date the loan will be fully repaid)

What are examples of promissory notes?

A simple promissory note might be for a lump sum repayment on a certain date. For example, let's say you lend your friend $1,000 and he agrees to repay you by December 1st. The full amount is due on that date, and there is no payment schedule involved.

Can anyone write a promissory note?

Although potentially issued by financial institutions, other organizations or individuals can use promissory notes to confirm the agreed terms of a loan. In short, a promissory note allows anyone to act as a lender.

How to make a valid promissory note?

A well-written note should include: The full names of the lender and borrower. The addresses of the lender and borrower. The amount of money being borrowed. Details on any collateral being used. Payment terms, including how often and what amount. What happens if there is a default in payment. Any miscellaneous provisions.

How to write a promissory note in English?

What do I need to write a promissory note? Names and contact information of the borrower and lender. Include their full legal names, addresses, and contact numbers — include any co-signers if applicable. Loan details. Collateral (if applicable) Consequences of default. Governing law. Signatures.

How to ask for cash advance?

You can visit a bank in person and ask a teller to run cash advance on your card. Also only works if the card allows it in the first place.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Promissory Note for Cash Advance?

A Promissory Note for Cash Advance is a written promise to pay a specified amount of money to a lender at a defined date in the future or on demand. It serves as a formal agreement between a borrower and a lender regarding the terms of the cash advance.

Who is required to file Promissory Note for Cash Advance?

The borrower who receives the cash advance is typically required to file the Promissory Note. This document outlines their obligation to repay the lender.

How to fill out Promissory Note for Cash Advance?

To fill out a Promissory Note, include the borrower’s name, lender’s name, the principal amount borrowed, interest rate (if any), repayment schedule, and any collateral information. Both parties should also sign and date the document.

What is the purpose of Promissory Note for Cash Advance?

The purpose of a Promissory Note for Cash Advance is to legally document the terms of the loan, establish repayment obligations, and protect the interests of both the borrower and the lender.

What information must be reported on Promissory Note for Cash Advance?

The information that must be reported on a Promissory Note includes the names of the borrower and lender, the loan amount, interest rate, repayment terms, due dates, and any conditions or agreements related to the loan.

Fill out your promissory note for cash online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Promissory Note For Cash is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.