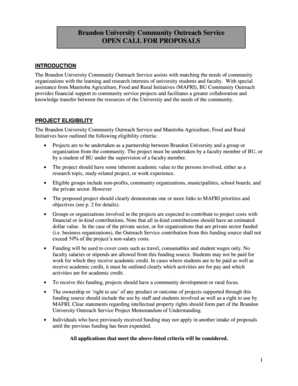

Get the free Ira Brown

Show details

Ira Brown

Full Name: Ira Brown

Position: Forward

Height/Weight: 64 / 220

Birthdates: August 3, 1982 (Corsican, Texas)

High School: Willis High (Conroe, Texas)

College: Gonzalo

Season

200708

200809

Totals

23

34

57FGM

12

35

47FGA

28

61

89PCT

.429

.574

.528FTM

2

17

19FTA

6

27

33PCT

.333

.630

.576REB

23

77

100AST

3

6

9TO

2

18

20STL

2

14

16BL

2

14

16PTS

27

90

117AVG

1.2

2.6

2.1Threepoint

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ira brown

Edit your ira brown form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ira brown form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ira brown online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ira brown. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ira brown

How to Fill Out IRA Brown:

01

Gather the necessary information: Before you start filling out the IRA Brown form, make sure you have all the required information handy. This may include personal details, financial information, and any relevant documents or statements.

02

Understand the form instructions: Take the time to carefully read and understand the instructions provided with the IRA Brown form. These instructions will guide you on how to accurately complete each section of the form and ensure that you are providing the necessary information.

03

Provide personal information: Begin by entering your personal information, such as your full name, date of birth, and Social Security number. Double-check the accuracy of these details to avoid any errors.

04

Include financial information: IRA Brown forms typically require you to provide financial information, such as your income, assets, liabilities, and expenses. Be sure to accurately report this information to the best of your knowledge and include any relevant supporting documents, if required.

05

Specify investment preferences: IRA Brown forms may ask you to specify your investment preferences, such as the type of funds or assets you wish to include in your IRA. Carefully review these options and select the ones that align with your investment goals and risk tolerance.

06

Seek professional advice if needed: If you find the IRA Brown form confusing or have any questions, it is advisable to seek professional advice from a financial advisor or tax specialist. They can provide guidance on how to accurately fill out the form and ensure compliance with any applicable regulations.

Who Needs IRA Brown:

01

Individuals planning for retirement: IRA Brown is relevant for individuals who are planning for their retirement and wish to open an Individual Retirement Account (IRA). It provides a means to save and invest for retirement, offering potential tax advantages.

02

Those looking for tax benefits: IRA Brown can be beneficial for individuals seeking tax advantages for their retirement savings. Depending on the type of IRA chosen, contributions may be tax-deductible, and earnings may grow tax-deferred or tax-free.

03

Individuals who want control over their investments: IRA Brown allows individuals to have greater control over their retirement investments compared to employer-sponsored retirement plans, such as 401(k)s. This can be appealing for those who prefer a more hands-on approach to managing their retirement savings.

04

People who want flexibility in contributions: IRA Brown allows individuals to contribute to their retirement savings at their own pace and within annual contribution limits set by the Internal Revenue Service (IRS). This flexibility can be advantageous for those with varying income levels or financial situations.

05

Those who want to pass on wealth to beneficiaries: IRA Brown may also be suitable for individuals who have estate planning goals and want to pass on their retirement savings to beneficiaries. Certain IRA types provide options for beneficiaries to inherit the assets and potentially stretch out distributions over their lifetimes, providing long-term financial security.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ira brown?

IRA Brown may refer to an individual or company named Brown with an individual retirement account (IRA).

Who is required to file ira brown?

Individuals or companies who have an individual retirement account (IRA) in the name of Brown may be required to file IRA Brown.

How to fill out ira brown?

To fill out IRA Brown, one must report the necessary information regarding the individual retirement account (IRA) in the name of Brown.

What is the purpose of ira brown?

The purpose of IRA Brown is to report information related to an individual retirement account (IRA) owned by Brown.

What information must be reported on ira brown?

Information such as account balance, contributions, withdrawals, and gains or losses must be reported on IRA Brown.

How do I modify my ira brown in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your ira brown and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I edit ira brown in Chrome?

Install the pdfFiller Google Chrome Extension to edit ira brown and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How can I edit ira brown on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing ira brown right away.

Fill out your ira brown online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ira Brown is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.