Get the free Independent Contractor Misclassification

Show details

Independent Contractor Misclassification: 2015 Legal Analysis October 16, 2015, Todd H. Horowitz Baker & Hosteler LLP PNC Center 1900 East Ninth Street, Suite 3200 Cleveland, OH 44114 216.861.7899

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign independent contractor misclassification

Edit your independent contractor misclassification form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your independent contractor misclassification form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit independent contractor misclassification online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit independent contractor misclassification. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out independent contractor misclassification

How to fill out independent contractor misclassification:

01

Begin by obtaining the necessary forms. These may vary depending on your jurisdiction, but typically include a misclassification questionnaire or form.

02

Carefully read through the instructions provided with the form. This will ensure that you understand what information is required and how to accurately complete the form.

03

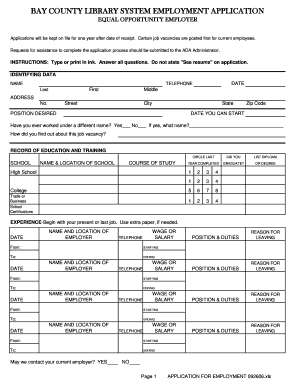

Provide your personal information, such as your name, address, and contact details. It is important to provide accurate information to avoid any errors or delays in the processing of your application.

04

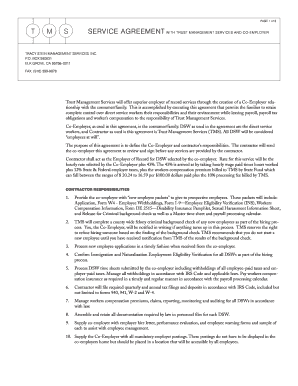

Answer any questions or sections pertaining to the nature of the work relationship. This includes providing details about the services you provide, the duration of the contracted work, and any specific terms or conditions.

05

Be prepared to provide supporting documentation. This may include contracts or agreement letters, invoices, or any other relevant documents that confirm the independent nature of your work.

06

Make sure to review your completed form for any errors or omissions before submitting it. Small mistakes or missing information could potentially delay the processing of your application.

Who needs independent contractor misclassification?

01

Businesses or employers who hire independent contractors should consider the classification of their workers. Misclassifying independent contractors as employees can result in legal and financial consequences.

02

Independent contractors themselves should also be aware of their classification. Understanding whether you are classified correctly as an independent contractor can help protect your rights and ensure proper payment and benefits.

03

Employment agencies or staffing firms that provide independent contractors for temporary or project-based work should also pay attention to misclassification to avoid legal liabilities.

Remember, it is essential to consult with legal and tax professionals for specific guidance as laws and regulations can vary depending on the jurisdiction.

Fill

form

: Try Risk Free

People Also Ask about

What is the IRS form for misclassification?

Misclassified worker Workers who believe they have been improperly classified as independent contractors can use IRS Form 8919, Uncollected Social Security and Medicare Tax on Wages to figure and report their share of uncollected Social Security and Medicare taxes due on their compensation.

What is the penalty for 1099 misclassification?

California law allows civil penalties to be charged to employers that intentionally misclassify workers. The fine can range between $5,000 and $15,000 per violation, and if there is a pattern of willful misclassification, the courts can fine employers an additional $10,000 to $25,000.

What is the penalty for misclassifying employee as independent contractor IRS?

Federal law violation fines This department hires auditors to identify and penalize independent contractor misclassification. At a minimum, consequences include paying back wages, but you could also face criminal penalties, including: Payment penalties of up $1,000 per misclassified employee. Jail time of up to a year.

What happens if an employee is misclassified as an independent contractor?

When employers incorrectly classify workers who are employees as independent contractors, it's called “misclassification.” If you are misclassified as an independent contractor, you may still qualify for unemployment benefits.

What happens if you misclassify an employee as an independent contractor?

Some consequences might include: Penalties and fines: You may be liable for back taxes and associated penalties for paying late. Back wages and benefits: You may be required to compensate workers for lost wages or benefits that resulted from the misclassification.

How to fill out 1099-MISC form for independent contractor?

You should have the following on hand to fill out the 1099-MISC form: Payer's (that's you!) name, address, and phone number. Your TIN (Taxpayer Identification Number) Recipient's TIN. Recipient's name and address. Your account number, if applicable. Amount you paid the recipient in the tax year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is independent contractor misclassification?

Independent contractor misclassification occurs when an employer incorrectly classifies a worker as an independent contractor rather than an employee.

Who is required to file independent contractor misclassification?

Employers who have misclassified workers as independent contractors are required to file independent contractor misclassification.

How to fill out independent contractor misclassification?

Employers must accurately report the misclassification of workers on the relevant forms provided by the tax authorities.

What is the purpose of independent contractor misclassification?

The purpose of independent contractor misclassification is to ensure that workers are classified correctly to prevent tax evasion and protect workers' rights.

What information must be reported on independent contractor misclassification?

Employers must report the names and social security numbers of the misclassified workers, as well as the reasons for the misclassification.

How can I modify independent contractor misclassification without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your independent contractor misclassification into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I get independent contractor misclassification?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the independent contractor misclassification. Open it immediately and start altering it with sophisticated capabilities.

How do I fill out independent contractor misclassification on an Android device?

Use the pdfFiller Android app to finish your independent contractor misclassification and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your independent contractor misclassification online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Independent Contractor Misclassification is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.