Get the free Bond to Indemnify Information Sheet - Denton County Texas

Show details

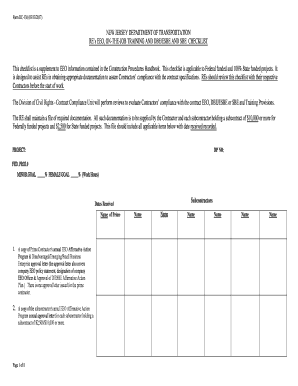

Bond to Indemnify Information Sheet Property Code 53.171 53.174 If a lien, other than a lien granted by the owner in a written contract, is fixed or is

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bond to indemnify information

Edit your bond to indemnify information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bond to indemnify information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bond to indemnify information online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit bond to indemnify information. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bond to indemnify information

To fill out a bond to indemnify information, follow these steps:

01

Gather the necessary information: You will need to collect all the relevant details about the party or organization that requires the bond to indemnify information. This includes their name, address, contact information, and any other relevant details.

02

Understand the purpose of the bond: It is important to understand why the bond is needed and what it is intended to cover. The bond to indemnify information is typically utilized to provide financial security and protection against any potential losses or damages resulting from the release of sensitive information.

03

Identify the type and amount of bond required: Determine the specific type of bond needed for the purpose of indemnifying information. This could range from a general indemnity bond to a specialized bond tailored to certain industries or professions. Additionally, ascertain the required bond amount, as this will vary based on the circumstances and requirements of the party requesting the bond.

04

Seek professional assistance if required: If you are uncertain about any aspect of the bond, it is advisable to consult with a legal professional or a bond provider who specializes in indemnity bonds. They can provide guidance and ensure that you meet all the necessary requirements.

05

Complete the bond application: Fill out the bond application accurately and thoroughly. Provide all the required information, pay any necessary fees or premiums, and sign the application as instructed. Ensure that all relevant parties involved in the bond agreement also sign the application, if applicable.

06

Submit the completed bond application: Send the completed bond application, along with any supporting documents or requirements, to the designated party or organization. This can typically be done through mail, email, or an online portal, depending on the preferred method of submission.

Who needs a bond to indemnify information?

A variety of parties may require a bond to indemnify information, including:

01

Businesses or organizations that handle highly sensitive or confidential data, such as medical offices, financial institutions, or government agencies.

02

Contractors or service providers who have access to proprietary or confidential information.

03

Consultants or advisors who provide expert advice or hold privileged information.

Overall, anyone who needs to safeguard sensitive information may require a bond to indemnify information in order to provide financial protection and assurance in case of any potential breaches or unauthorized disclosures.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my bond to indemnify information directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your bond to indemnify information and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I modify bond to indemnify information without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your bond to indemnify information into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I complete bond to indemnify information online?

pdfFiller makes it easy to finish and sign bond to indemnify information online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

What is bond to indemnify information?

Bond to indemnify information is a financial guarantee that provides protection or compensation for losses or damages.

Who is required to file bond to indemnify information?

Any individual or entity required by law or contract to provide a bond to indemnify is required to file the bond to indemnify information.

How to fill out bond to indemnify information?

To fill out bond to indemnify information, you will need to provide specific details about the bond amount, the parties involved, and the terms of indemnification.

What is the purpose of bond to indemnify information?

The purpose of bond to indemnify information is to ensure that parties are financially protected in the event of losses or damages resulting from a specific agreement or transaction.

What information must be reported on bond to indemnify information?

The bond to indemnify information must include details such as the bond amount, the parties involved, the effective date of the bond, and the terms of indemnification.

Fill out your bond to indemnify information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bond To Indemnify Information is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.