Get the free VENDOR Per Ton - El Paso County Texas

Show details

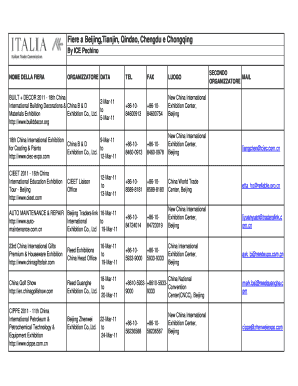

Purchasing Department Bid #08074, H.M.A.C. Labor for Overlay Program for Road & Bridge Opening Date: Wednesday, June 11, 2008, VENDOR Per Ton Allied Paving Company $5.50 Asphalt Pavers Inc.* $4.60

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign vendor per ton

Edit your vendor per ton form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vendor per ton form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit vendor per ton online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit vendor per ton. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out vendor per ton

How to fill out vendor per ton:

01

Gather all necessary information about the vendor, such as their name, contact details, and identification number.

02

Identify the specific product or service for which the vendor per ton is being calculated.

03

Determine the weight or quantity of the product or service that is being purchased from the vendor.

04

Calculate the total cost paid to the vendor for the specified quantity of the product or service.

05

Divide the total cost by the weight or quantity to obtain the vendor per ton value.

06

Record this value accurately on the appropriate documentation or report.

Who needs vendor per ton:

01

Manufacturers: Manufacturers may need to calculate the vendor per ton to understand the cost of raw materials for their production processes.

02

Suppliers: Suppliers may use the vendor per ton to evaluate the cost-effectiveness of different vendors and make informed decisions on their sourcing strategies.

03

Project Managers: Project managers involved in construction or infrastructure projects may use the vendor per ton to estimate material costs and plan their budgets accordingly.

04

Procurement Departments: Procurement departments may utilize the vendor per ton to compare prices, negotiate contracts, and ensure they are securing the best possible deals.

05

Financial Analysts: Financial analysts may analyze the vendor per ton to assess overall cost trends, identify cost-saving opportunities, and support forecasting and budgeting processes.

Overall, anyone involved in purchasing or cost analysis can benefit from understanding how to fill out the vendor per ton and recognizing its relevance in different industries and sectors.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is vendor per ton?

Vendor per ton is a tax on vendors based on the weight of items sold.

Who is required to file vendor per ton?

Vendors who sell taxable items by weight are required to file vendor per ton.

How to fill out vendor per ton?

Vendor per ton can be filled out online through the designated tax portal or submitted through mail.

What is the purpose of vendor per ton?

The purpose of vendor per ton is to generate revenue for the government based on the sales of items by weight.

What information must be reported on vendor per ton?

Vendors must report the total weight of taxable items sold and calculate the tax owed based on the weight.

How do I modify my vendor per ton in Gmail?

vendor per ton and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Can I sign the vendor per ton electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your vendor per ton in minutes.

How do I edit vendor per ton straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing vendor per ton right away.

Fill out your vendor per ton online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Vendor Per Ton is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.