Get the free Anti-Steering Loan Options Disclosure - Michigan Mutual Inc

Show details

AntiSteering Loan Options Disclosure Loan Number or Property Address: Borrower Name: Dear Borrower, You have applied for a mortgage loan through (mortgage originator name). To ensure you, the borrower(s),

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign anti-steering loan options disclosure

Edit your anti-steering loan options disclosure form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your anti-steering loan options disclosure form via URL. You can also download, print, or export forms to your preferred cloud storage service.

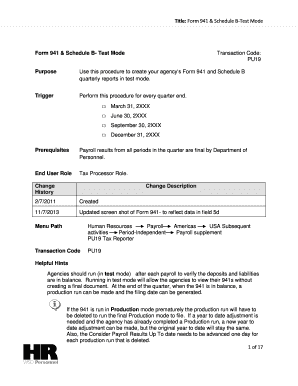

How to edit anti-steering loan options disclosure online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit anti-steering loan options disclosure. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out anti-steering loan options disclosure

Point by point, here's how to fill out the anti-steering loan options disclosure, and who needs it:

01

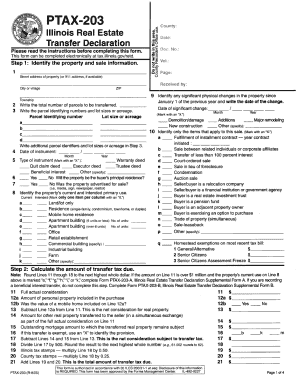

Start by providing the necessary information: Fill out the borrower's name, loan application number, and the date of the disclosure.

02

Identify the loan type: Specify whether it is a fixed-rate, adjustable-rate, or other type of loan.

03

State the purpose of the anti-steering loan options disclosure: Explain that it is a requirement under the Dodd-Frank Wall Street Reform and Consumer Protection Act to ensure borrowers have access to a range of loan options.

04

Clearly list the loan options available: Provide a detailed breakdown of the loan options, including the interest rates, annual percentage rates (APR), loan terms, and any features or benefits associated with each option. It should be clear and easy to understand for the borrower.

05

Highlight any potential risks or costs: Disclose any potential risks or costs associated with each loan option, such as prepayment penalties or balloon payments. Make sure the borrower understands the potential financial implications of each option.

06

Provide a comparison table: Create a visual representation, such as a table, that allows the borrower to compare the different loan options side by side. This can simplify the decision-making process and make it easier for the borrower to choose the most suitable option.

07

Explain the anti-steering provisions: Clearly explain that the purpose of the disclosure is to prevent any steering practices that could limit the borrower's access to certain loan options or steer them towards options that are not in their best interest.

08

Obtain the borrower's acknowledgment: Leave a section for the borrower to sign and date, confirming that they have received and understood the anti-steering loan options disclosure.

Who needs anti-steering loan options disclosure?

The anti-steering loan options disclosure is required for all borrowers who are applying for a mortgage loan. It is designed to protect borrowers from being steered towards loan options that may not be in their best interest and to provide them with a range of choices. Regardless of the borrower's background or financial situation, this disclosure ensures transparency in the loan process and allows borrowers to make informed decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit anti-steering loan options disclosure from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including anti-steering loan options disclosure, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Where do I find anti-steering loan options disclosure?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the anti-steering loan options disclosure in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I complete anti-steering loan options disclosure on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your anti-steering loan options disclosure, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is anti-steering loan options disclosure?

Anti-steering loan options disclosure is a document that provides borrowers with information about different loan options available to them and helps prevent lenders from steering borrowers towards loans that may not be in their best interest.

Who is required to file anti-steering loan options disclosure?

Lenders are required to file anti-steering loan options disclosure when they offer loan options to borrowers.

How to fill out anti-steering loan options disclosure?

To fill out anti-steering loan options disclosure, lenders need to provide detailed information about the different loan options available, including interest rates, fees, and terms.

What is the purpose of anti-steering loan options disclosure?

The purpose of anti-steering loan options disclosure is to help borrowers make informed decisions about their loan options and prevent lenders from steering them towards loans that may not be in their best interest.

What information must be reported on anti-steering loan options disclosure?

Anti-steering loan options disclosure must include information about different loan options, including interest rates, fees, and terms, to help borrowers compare and choose the best option for them.

Fill out your anti-steering loan options disclosure online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Anti-Steering Loan Options Disclosure is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.