Get the free AUTOMATED CUSTOMER ACCOUNT TRANSFER

Show details

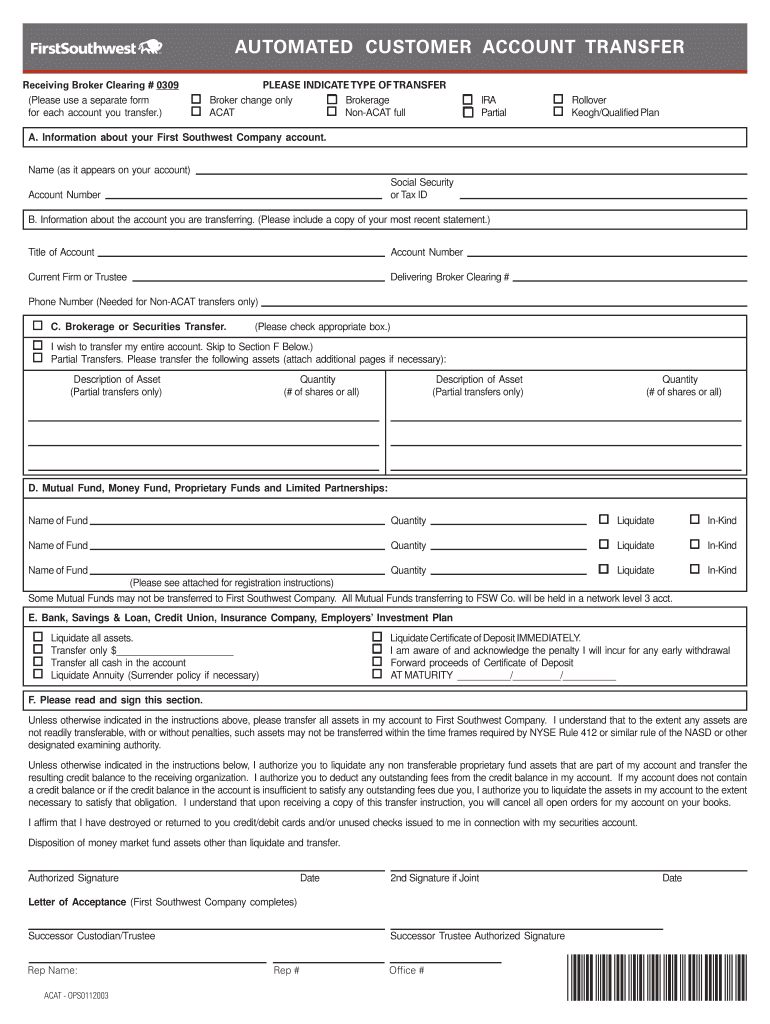

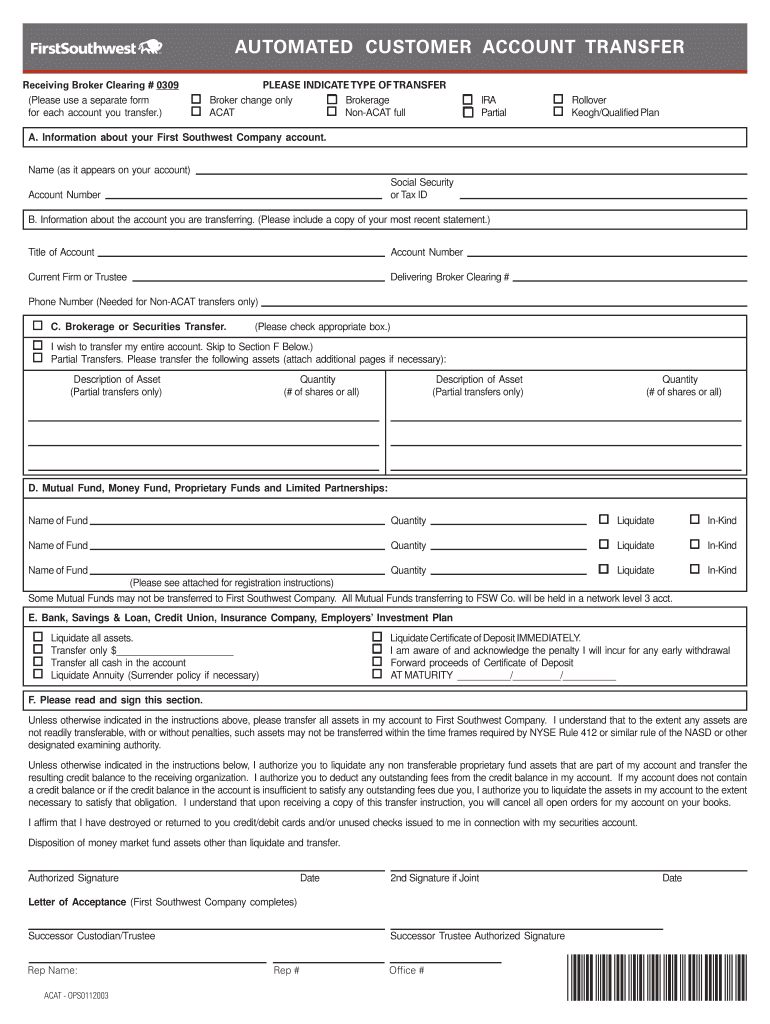

AUTOMATED CUSTOMER ACCOUNT TRANSFER Receiving Broker Clearing # 0309 (Please use a separate form for each account you transfer.) PLEASE INDICATE TYPE OF TRANSFER Broker change only Brokerage ACAT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign automated customer account transfer

Edit your automated customer account transfer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your automated customer account transfer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit automated customer account transfer online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit automated customer account transfer. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out automated customer account transfer

Point by point guide on how to fill out automated customer account transfer:

01

Begin by gathering all necessary information: Before starting the transfer process, make sure you have all the relevant details regarding the customer's account. This includes their account number, account type, and any specific instructions or requirements for the transfer.

02

Access the automated transfer platform: Most financial institutions offer online or automated platforms for customer account transfers. Log in to the platform using your credentials or follow the instructions provided to access the transfer feature.

03

Initiate the transfer: Once you have accessed the appropriate platform, find the option to initiate a customer account transfer. This may be labeled as "Transfer Funds," "Transfer Accounts," or a similar term. Click on the option to begin the transfer process.

04

Select the account to transfer from: Depending on the platform, you may be asked to choose the account from which the customer wishes to transfer funds. This can include checking accounts, savings accounts, investment accounts, or any other applicable accounts the customer may have.

05

Provide customer account details: In this step, you will need to enter the customer's account details, such as their account number and account type. Double-check these details to ensure accuracy, as any errors may lead to failed or incorrect transfers.

06

Enter transfer amount: Specify the exact amount the customer wants to transfer. This can be a specific dollar amount or a percentage of the total account balance. Verify the entered amount before proceeding.

07

Confirm transfer: Review all the details of the transfer, including the account numbers, transfer amount, and any associated fees or charges. Once you are confident that all the information is correct, click on the "Confirm" or "Submit" button to initiate the transfer.

08

Wait for completion: After confirming the transfer, the automated system will process the request. Depending on the financial institution and the complexity of the transfer, it may take a few minutes or longer for the transfer to complete. Advise the customer to monitor their accounts to ensure the transfer is successful.

Who needs automated customer account transfer?

Automated customer account transfer is beneficial for various individuals and organizations, including:

01

Customers who want to consolidate their accounts: Customers with multiple accounts across different financial institutions may find it convenient to transfer their funds to a single account using an automated transfer service.

02

Individuals undergoing a financial transition: People who are changing jobs, moving to a new location, or experiencing significant life events may need to transfer their accounts to a different financial institution. Automated customer account transfer simplifies this process.

03

Businesses managing cash flow: Enterprises that handle multiple bank accounts can streamline their cash management by utilizing automated customer account transfers. This allows for efficient fund allocation and consolidation.

Overall, automated customer account transfer is suitable for anyone who desires a seamless and efficient method of transferring funds between accounts.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit automated customer account transfer online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your automated customer account transfer to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an eSignature for the automated customer account transfer in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your automated customer account transfer right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How can I edit automated customer account transfer on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing automated customer account transfer right away.

What is automated customer account transfer?

Automated customer account transfer is the process of electronically transferring customer accounts from one financial institution to another.

Who is required to file automated customer account transfer?

Financial institutions are required to file automated customer account transfers.

How to fill out automated customer account transfer?

Automated customer account transfers can be filled out electronically or through specialized software provided by regulatory agencies.

What is the purpose of automated customer account transfer?

The purpose of automated customer account transfer is to ensure a smooth and efficient transfer of customer accounts between financial institutions.

What information must be reported on automated customer account transfer?

The automated customer account transfer must include information such as customer account details, transaction history, and customer preferences.

Fill out your automated customer account transfer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Automated Customer Account Transfer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.