Get the free or Indexed Deferred Annuity

Show details

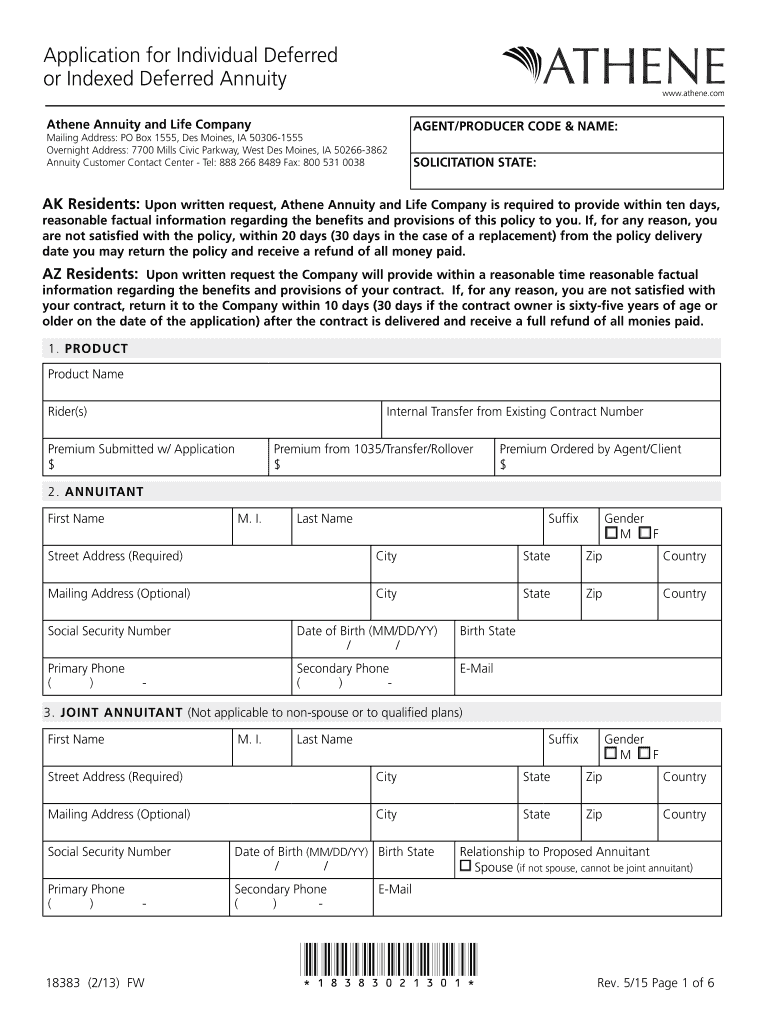

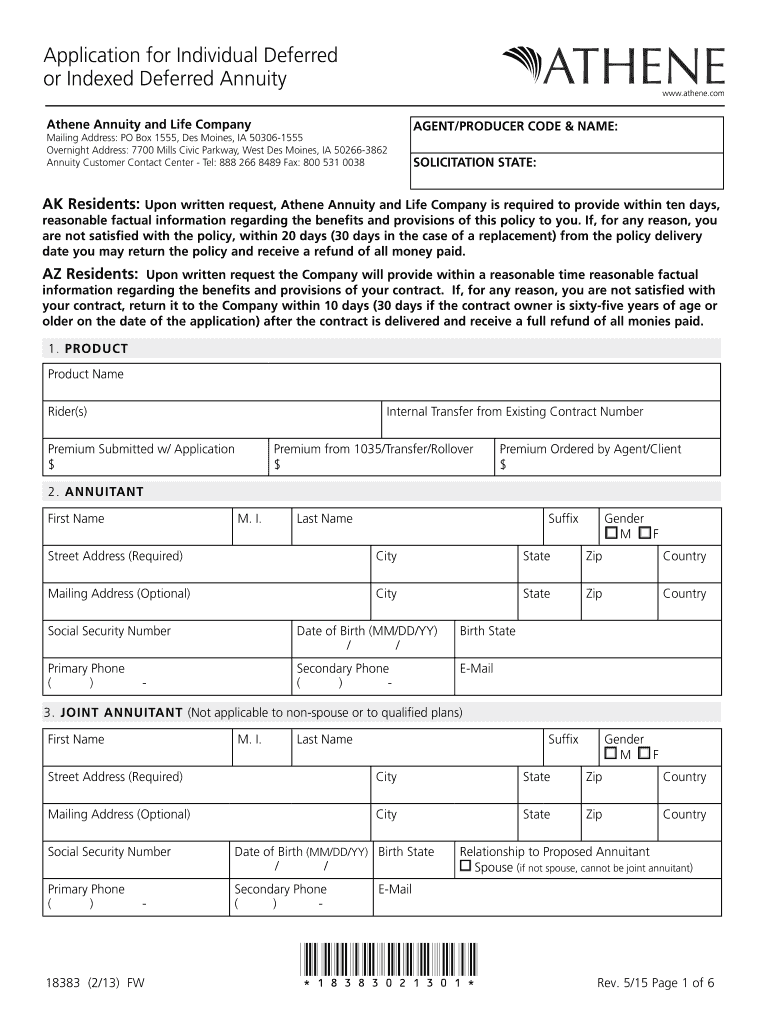

Application for Individual Deferred or Indexed Deferred Annuity www.athene.com Athene Annuity and Life Company Mailing Address: PO Box 1555, Des Moines, IA 50306-1555 Overnight Address: 7700 Mills

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign or indexed deferred annuity

Edit your or indexed deferred annuity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your or indexed deferred annuity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing or indexed deferred annuity online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit or indexed deferred annuity. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out or indexed deferred annuity

01

Determine your financial goals and objectives: Before filling out an indexed deferred annuity, it's important to have a clear understanding of your financial goals and objectives. Consider factors such as your desired retirement age, income needs, risk tolerance, and long-term financial plans.

02

Research and compare different indexed deferred annuity options: There are various insurance companies that offer indexed deferred annuities, each with different features, benefits, and costs. Take the time to research and compare different options to ensure you select one that aligns with your specific needs and preferences.

03

Understand the contract terms and features: Read through the annuity contract carefully to understand the terms and features of the indexed deferred annuity. Pay attention to details such as surrender charges, interest crediting methods, participation rates, and any optional riders or benefits available.

04

Determine the amount to allocate: Decide how much of your overall investment portfolio you want to allocate towards an indexed deferred annuity. Consider consulting with a financial advisor who can help you determine the optimal allocation based on your individual circumstances.

05

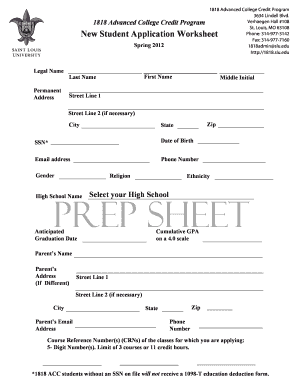

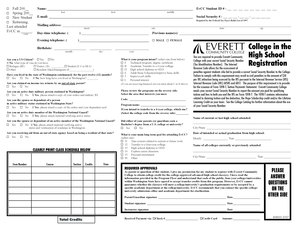

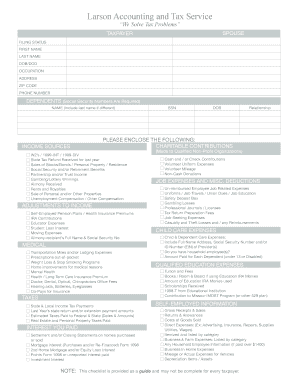

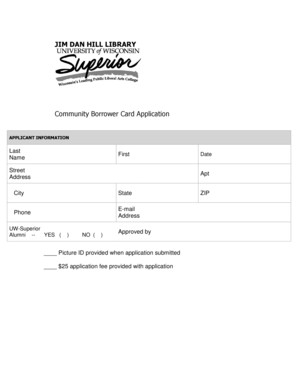

Complete the application: Once you have selected a suitable indexed deferred annuity, complete the application provided by the insurance company. Be sure to provide accurate and up-to-date information, as any inaccuracies could affect the annuity's terms or benefits.

06

Fund the annuity: Decide on the funding method for your indexed deferred annuity. This can be done through a single premium payment, multiple premium payments, or even through a rollover from an existing retirement account. Follow the specific instructions provided by the insurance company to ensure a smooth funding process.

07

Review and sign the annuity contract: Carefully review the annuity contract provided by the insurance company. Pay close attention to the contract's terms, fees, and any optional benefits you may have chosen. If you have any questions or concerns, reach out to the insurance company or a financial professional for clarification.

08

Keep a copy of the contract: Once you have signed the annuity contract, make sure to keep a copy for your records. It's important to have easy access to the contract in case you need to refer to it in the future or update your financial plans.

Who needs an indexed deferred annuity:

01

Individuals planning for retirement: An indexed deferred annuity can be a suitable option for individuals who are planning for retirement and looking for a guaranteed income stream in the future. It provides a way to accumulate funds over time and potentially increase earnings based on the performance of the indexed market.

02

Conservative investors: Indexed deferred annuities can be appealing to conservative investors who want to participate in the potential upside of the market but also desire protection against market downturns. These annuities offer a balance between growth potential and downside risk protection.

03

Tax-conscious individuals: Indexed deferred annuities offer tax-deferred growth, meaning you won't have to pay taxes on the earnings until you make withdrawals. This can be advantageous for individuals who want to minimize their current tax liability and potentially fall into a lower tax bracket in retirement.

04

Individuals seeking a death benefit: Indexed deferred annuities often include a death benefit, which ensures that if you pass away before starting to withdraw funds, your named beneficiaries will receive a specified amount. This can be attractive to individuals who want to provide financial support to their loved ones in the event of their death.

05

Individuals looking for asset protection: In some cases, indexed deferred annuities offer protection from creditors, making them appealing to individuals who are concerned about potential lawsuits or claims against their assets.

It's important to note that the suitability of an indexed deferred annuity can vary depending on individual circumstances. Consulting with a financial advisor or insurance professional is recommended to determine if an indexed deferred annuity is appropriate for your specific needs and goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find or indexed deferred annuity?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the or indexed deferred annuity in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit or indexed deferred annuity in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your or indexed deferred annuity, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I sign the or indexed deferred annuity electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your or indexed deferred annuity and you'll be done in minutes.

What is or indexed deferred annuity?

An indexed deferred annuity is a type of annuity that earns interest or provides benefits that are linked to a stock market index.

Who is required to file or indexed deferred annuity?

Individuals who have purchased an indexed deferred annuity are required to report it on their tax returns.

How to fill out or indexed deferred annuity?

To fill out an indexed deferred annuity, individuals need to provide information on the annuity contract, including any earnings or benefits received.

What is the purpose of or indexed deferred annuity?

The purpose of an indexed deferred annuity is to provide individuals with a way to save for retirement and potentially earn higher returns based on stock market performance.

What information must be reported on or indexed deferred annuity?

Individuals must report any earnings or benefits received from an indexed deferred annuity on their tax returns.

Fill out your or indexed deferred annuity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Or Indexed Deferred Annuity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.