Get the free 401(k) Waiver

Show details

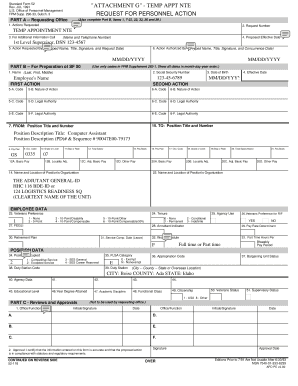

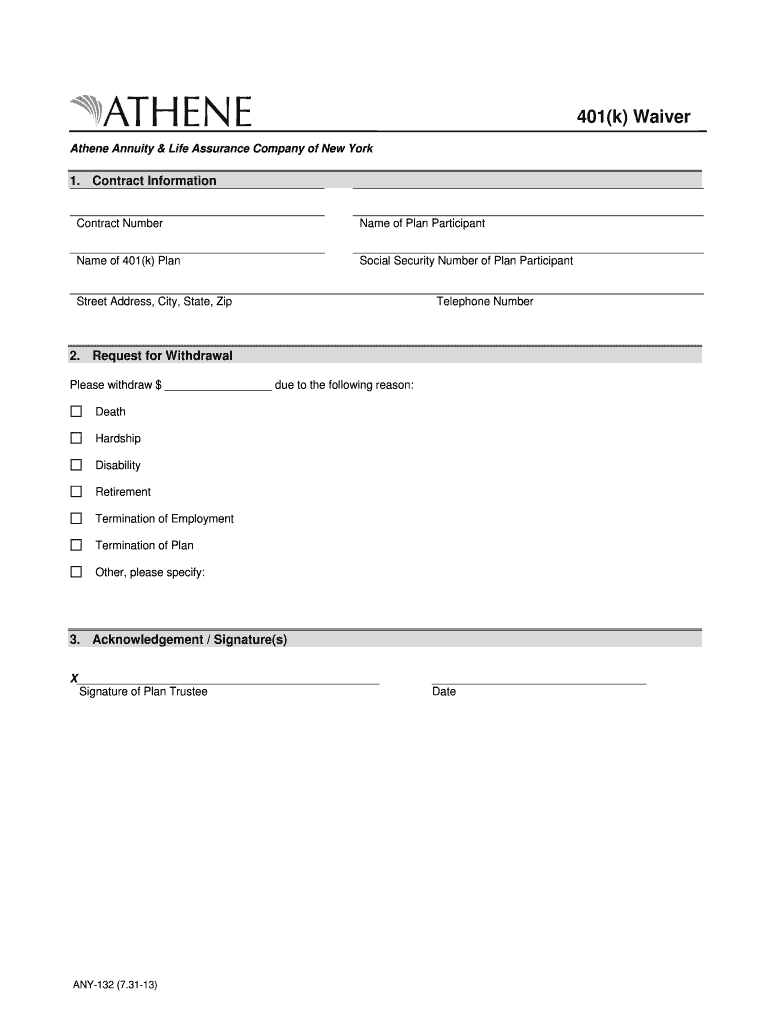

401(k) Waiver Athene Annuity & Life Assurance Company of New York 1. Contract Information Contract Number Name of Plan Participant Name of 401(k) Plan Social Security Number of Plan Participant Street

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 401k waiver

Edit your 401k waiver form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 401k waiver form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 401k waiver online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 401k waiver. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 401k waiver

How to fill out 401k waiver:

01

Obtain the form: The first step in filling out a 401k waiver is to obtain the necessary form from your employer or retirement plan administrator. They will provide you with the specific form required for your situation.

02

Read the instructions: Carefully read the instructions provided with the 401k waiver form. The instructions will guide you through the process and provide important information about the purpose and implications of signing the waiver.

03

Complete personal information: Fill in your personal details as requested on the form. This may include your name, address, date of birth, and social security number. Make sure to provide accurate and up-to-date information.

04

Understand the consequences: Before signing the waiver, it is crucial to understand the potential consequences. Consider consulting with a financial advisor or an attorney to ensure you fully comprehend the impact of waiving your rights to a 401k plan.

05

State your intention clearly: The form may ask you to specifically state your intention to waive your participation in the 401k plan. Be clear and concise in expressing your decision and ensure that it aligns with your financial goals and objectives.

06

Seek professional advice: If you have any doubts or concerns about filling out the 401k waiver form, it is always advisable to seek professional advice. An experienced financial advisor or attorney can provide guidance based on your individual circumstances.

Who needs a 401k waiver:

01

Employees covered by retirement plans: Individuals who are eligible for participation in an employer-sponsored 401k plan may need to consider a 401k waiver if they choose not to participate in the plan. This can include new employees, part-time employees, or those who have previously opted out of the plan.

02

Spouses of plan participants: In certain situations, the spouse of a plan participant might be required to sign a 401k waiver if they choose to waive any spousal benefits associated with the retirement plan.

03

Individuals with other investment strategies: Some individuals may have alternative investment strategies or retirement savings plans in place and may choose to waive their participation in a 401k plan. This could include those who prefer to invest in real estate, start their own business, or have a different retirement savings vehicle.

Remember, it is crucial to thoroughly understand the implications of a 401k waiver and consider seeking professional advice before making any final decisions regarding retirement savings.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 401k waiver to be eSigned by others?

Once your 401k waiver is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How can I get 401k waiver?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific 401k waiver and other forms. Find the template you want and tweak it with powerful editing tools.

How do I execute 401k waiver online?

pdfFiller has made it simple to fill out and eSign 401k waiver. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

What is 401k waiver?

A 401k waiver is a legal document signed by an employee to waive their right to participate in a 401k retirement plan offered by their employer.

Who is required to file 401k waiver?

Employees who choose not to participate in their employer's 401k plan are typically required to file a 401k waiver.

How to fill out 401k waiver?

To fill out a 401k waiver, employees need to provide their personal information, sign the document, and submit it to their employer's HR department.

What is the purpose of 401k waiver?

The purpose of a 401k waiver is to formally acknowledge that an employee is choosing not to participate in their employer's 401k plan.

What information must be reported on 401k waiver?

Employees need to provide their name, employee ID, signature, and the date on the 401k waiver form.

Fill out your 401k waiver online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

401k Waiver is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.