Get the free - BROKERAGE

Show details

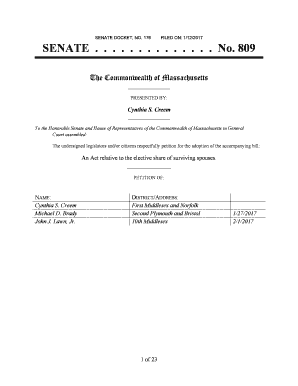

ROITIESENIESi BROKERAGE ACCOUNT OPENING FORM DUBAI GOLD & COMMODITIES EXCHANGE (DOCX) Date Client ID Emirates NAD Securities LLC. P.O. Box 9409, Dubai, UAE Under Securities and Commodities Authority

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign brokerage

Edit your brokerage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your brokerage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit brokerage online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit brokerage. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out brokerage

How to fill out brokerage?

01

Determine your investment goals: Before filling out a brokerage account application, it's important to have a clear idea of your investment goals. Are you looking to save for retirement, grow your wealth, or trade stocks actively? Understanding your objectives will help you choose the right type of brokerage account and the investments that align with your goals.

02

Research different brokerage firms: There are numerous brokerage firms available, each offering different features, services, and fees. Take some time to research and compare various brokerage firms to find the one that best suits your needs. Consider factors such as account minimums, trading fees, investment options, customer service, and user-friendly platforms.

03

Gather required documents: To open a brokerage account, you'll need certain documents and personal information. Typically, you will need your social security number, government-issued identification (such as a driver's license or passport), proof of address (such as a utility bill), and employment information. Gather these documents beforehand to streamline the application process.

04

Choose the right type of account: Depending on your investment goals, you may need to select a specific type of brokerage account. Some common types include individual brokerage accounts, joint accounts, retirement accounts (such as IRAs or 401(k)s), and education savings accounts (such as 529 plans). Carefully assess your needs to determine which account type is most suitable for you.

05

Fill out the brokerage application: Once you have selected a brokerage firm and account type, you can begin filling out the brokerage account application. This typically involves providing your personal information, employment information, financial details, and investment experience. Pay close attention to the instructions and make sure to provide accurate information.

06

Fund your account: After completing the application, you'll need to fund your brokerage account. This can be done through various methods, such as electronic fund transfers (ACH), wire transfers, or by mailing a check. Some brokerage firms may have account minimums or specific requirements for initial deposits, so ensure you meet these criteria.

07

Review and understand the terms and conditions: Before finalizing the application, carefully review and understand the terms and conditions of the brokerage account. Pay attention to fee structures, trading costs, account maintenance fees, and any other important disclosures. If you have any questions or concerns, don't hesitate to reach out to the brokerage firm's customer service for clarification.

Who needs brokerage?

01

Individuals looking to invest: Brokerage accounts are primarily used by individuals who want to invest in various financial instruments such as stocks, bonds, mutual funds, ETFs, or options. Those interested in growing their wealth, saving for retirement, or achieving specific financial goals can benefit from having a brokerage account.

02

Active traders: Active traders who frequently buy and sell securities may find brokerage accounts essential for their trading activities. These accounts often provide access to advanced trading platforms, real-time market data, and tools that facilitate quick and efficient trading. Active traders rely on brokerage accounts to execute trades promptly.

03

Those seeking professional advice: Many brokerage firms offer advisory services, providing individuals with access to financial professionals who can guide them in making investment decisions. This can be particularly beneficial for novice investors or those who prefer to have professional expertise when managing their investments.

04

Retirement savers: Brokerage accounts often offer retirement-specific accounts such as IRAs (Individual Retirement Accounts) or 401(k) plans. These accounts allow individuals to save for retirement in a tax-advantaged manner, offering various investment options to help grow retirement savings over time.

05

College savers: Some brokerage firms offer education savings accounts, such as 529 plans, which enable individuals to save for their children's or grandchildren's education expenses. These accounts come with tax advantages and can be used to invest in a range of investment options to help cover education costs in the future.

Overall, brokerage accounts are beneficial for those interested in investing, trading securities, seeking professional advice, or saving for retirement or education expenses.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the brokerage in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your brokerage in seconds.

How do I edit brokerage straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing brokerage right away.

How do I complete brokerage on an Android device?

Use the pdfFiller app for Android to finish your brokerage. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is brokerage?

Brokerage is a fee charged by a broker to facilitate transactions between buyers and sellers in financial markets.

Who is required to file brokerage?

Anyone who has engaged in brokerage activities or received brokerage fees may be required to file brokerage.

How to fill out brokerage?

Brokerage can be filled out by providing details of all brokerage activities, including fees received and transactions facilitated.

What is the purpose of brokerage?

The purpose of brokerage is to compensate brokers for their services in facilitating transactions and providing financial advice.

What information must be reported on brokerage?

Information such as fees received, transactions facilitated, and any other relevant details must be reported on brokerage.

Fill out your brokerage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Brokerage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.