Get the free Transaction & Deposit Form

Show details

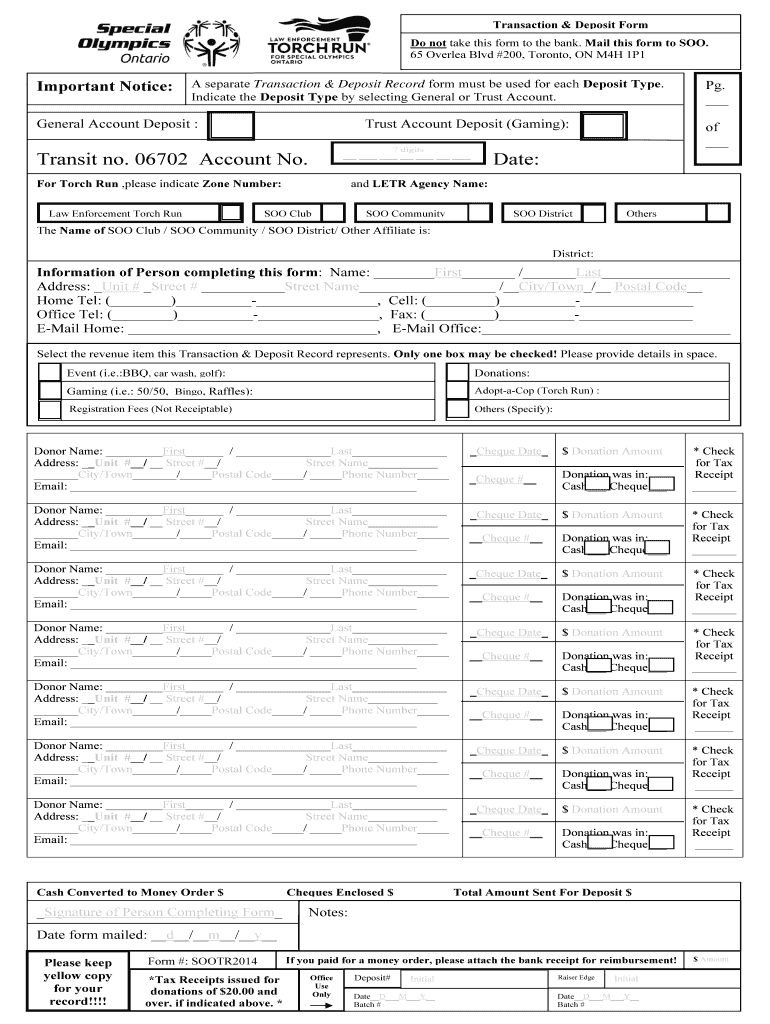

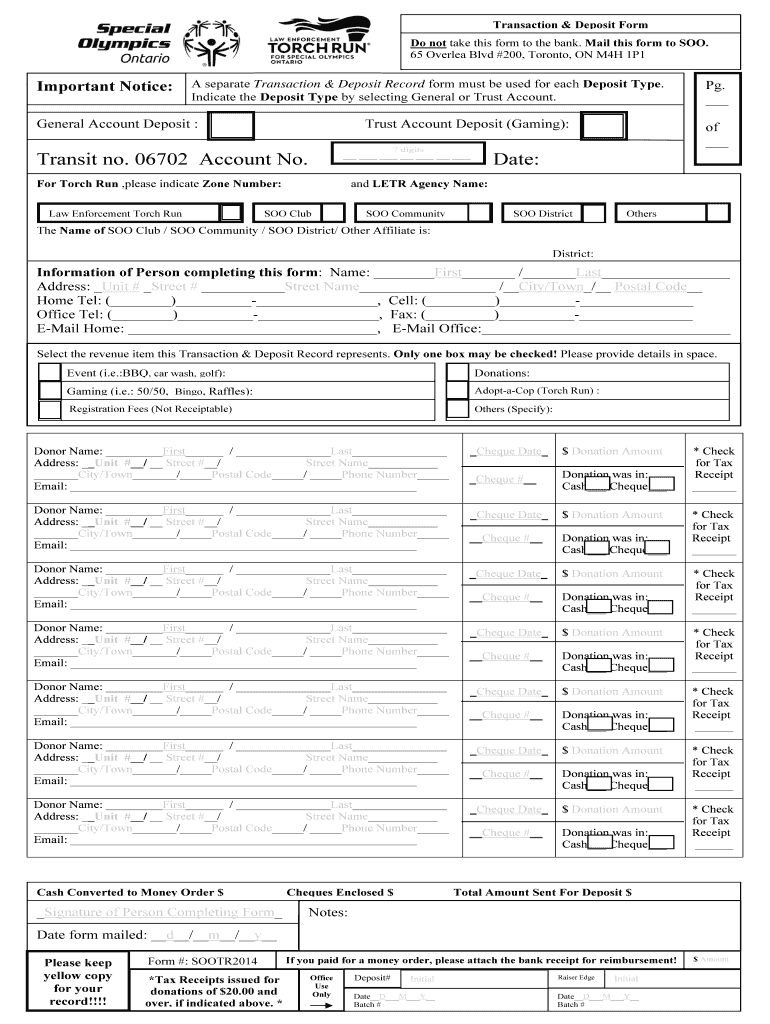

Transaction & Deposit Form Do not take this form to the bank. Mail this form to SO. 65 Oversea Blvd #200, Toronto, ON M4H 1P1 Deposit Record Important Notice: A separate Transaction & Deposit Record

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign transaction amp deposit form

Edit your transaction amp deposit form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your transaction amp deposit form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit transaction amp deposit form online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit transaction amp deposit form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out transaction amp deposit form

How to Fill Out a Transaction & Deposit Form:

01

Gather the required information: Before starting to fill out the form, make sure you have all the necessary details. This may include your personal information, account number, the amount you want to deposit or withdraw, and any additional instructions or endorsements.

02

Identify the sections: Transaction and deposit forms usually consist of different sections. These may include fields such as date, account information, transaction type (such as deposit, withdrawal, or transfer), and the amount involved. It is important to understand the purpose and requirements of each section before proceeding.

03

Fill in personal details: Begin by filling in your personal information, including your full name, address, phone number, and any other necessary contact details. Ensure that these details are accurate and up to date.

04

Provide account information: Next, enter the relevant account information such as your account number, type of account, and any other requested details. This is essential to ensure that the transaction is associated with your specific account.

05

Specify the transaction type: Indicate the type of transaction you wish to make. If you are making a deposit, specify whether it is cash or check and provide any additional information required, such as a check number or the name of the issuing bank. If you are making a withdrawal or transfer, include the necessary details for those transactions as well.

06

Mention the amount and additional instructions: Clearly state the amount involved in the transaction, whether it is a deposit or withdrawal. If you have any specific instructions or endorsements, write them clearly in the designated section. This could include details like endorsement for mobile deposit or instructions to deposit into a specific account.

07

Review and double-check: Once you have filled out all the necessary sections, take a moment to carefully review your entries. Ensure that you have provided accurate information and that the form is complete. Double-check for any errors or missing details that may hinder the processing of the transaction.

Who needs a Transaction & Deposit Form?

01

Individuals making cash or check deposits: Anyone who wants to deposit funds into their own or someone else's account may need a transaction and deposit form. This could include individuals depositing paychecks, bonus payments, or personal funds into their own or another person's account.

02

Individuals making withdrawals or transfers: People looking to withdraw money from their bank accounts or transfer funds from one account to another may also require a transaction and deposit form. This is to ensure that the bank accurately processes the transaction and aligns it with the correct accounts.

03

Organizations or businesses managing finances: Companies and organizations that handle financial transactions, such as cash deposits, check deposits, or money transfers, often use transaction and deposit forms. This helps maintain a record of transactions and ensures accurate processing while providing necessary documentation for financial tracking and auditing purposes.

In conclusion, filling out a transaction and deposit form involves gathering the required information, understanding the form's sections, providing personal and account details, specifying the transaction type, entering the amount, and reviewing the form for accuracy. This form is commonly used by individuals making cash or check deposits, making withdrawals or transfers, as well as organizations and businesses managing financial transactions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send transaction amp deposit form to be eSigned by others?

Once your transaction amp deposit form is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an eSignature for the transaction amp deposit form in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your transaction amp deposit form right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How can I fill out transaction amp deposit form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your transaction amp deposit form. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is transaction amp deposit form?

The transaction amp deposit form is a document used to report financial transactions and deposits.

Who is required to file transaction amp deposit form?

Individuals or businesses involved in financial transactions and deposits are required to file the transaction amp deposit form.

How to fill out transaction amp deposit form?

To fill out the transaction amp deposit form, you need to provide detailed information about the financial transactions and deposits being reported.

What is the purpose of transaction amp deposit form?

The purpose of the transaction amp deposit form is to track and monitor financial transactions and deposits for regulatory and compliance purposes.

What information must be reported on transaction amp deposit form?

The transaction amp deposit form must include details such as the amount of the transaction, the date it occurred, the source of the funds, and the recipient.

Fill out your transaction amp deposit form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Transaction Amp Deposit Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.