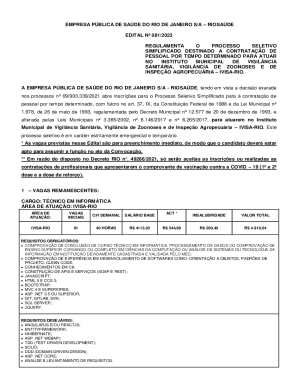

Get the free indemnity bond with surety

Show details

INDEMNITY BOND WITH SURETY This indemnity is made and executed on this day of 2015 by Sari/SMT. S/o/ D/o/ W/o Sari a permanent resident of hereinafter called Employee” AND Sari S/o/D/o/W/o Sari

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign indemnity bond with surety

Edit your indemnity bond with surety form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your indemnity bond with surety form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit indemnity bond with surety online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit indemnity bond with surety. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out indemnity bond with surety

How to fill out indemnity bond with surety:

01

Obtain the required form: Start by obtaining the specific indemnity bond form with surety from the appropriate source, such as a legal website or by requesting it from the relevant organization or authority.

02

Read and understand the instructions: Carefully read the instructions provided with the indemnity bond form. Understand the purpose of the bond, the responsibilities of the parties involved, and any specific requirements for filling out the form.

03

Fill in the details: Begin by providing the necessary details on the form, such as your name, address, and contact information. Fill out any other personal or company information required, ensuring accuracy and completeness.

04

Include the specifics: Include the specific details of the surety, such as the name, address, and contact information. Specify the amount of the bond and any terms or conditions related to suretyship.

05

Attach required documentation: If there are any supporting documents required, such as financial statements, agreements, or identification proofs, ensure that you attach them to the indemnity bond form as instructed.

06

Provide signatures: Sign the indemnity bond form and ensure that all other parties involved sign their respective sections as well. If required, have the signatures notarized or witnessed as per the instructions.

07

Submit the completed form: Once you have filled out the indemnity bond with surety form completely and accurately, submit it to the appropriate recipient or authority as specified. Follow any additional instructions regarding submission or filing.

Who needs indemnity bond with surety?

01

Individuals involved in legal proceedings: People who are involved in legal matters, such as court cases, may be required to obtain an indemnity bond with surety to ensure financial security and compliance with legal obligations.

02

Businesses or professionals in high-risk industries: Businesses operating in high-risk industries, such as construction, healthcare, or finance, may require an indemnity bond with surety to provide financial protection against potential liabilities or professional negligence.

03

Government agencies and organizations: Government agencies or organizations that handle valuable assets or sensitive information may require individuals or businesses to provide an indemnity bond with surety as a condition of engagement or contract.

04

Contractors or vendors working on government projects: Contractors or vendors working on government projects may need to furnish an indemnity bond with surety to guarantee their performance, satisfy contractual obligations, and secure payment.

05

Licensees and permit holders: Individuals or businesses seeking licenses or permits, such as liquor licenses or special event permits, may be required to provide an indemnity bond with surety to demonstrate financial responsibility and compliance with regulations.

06

Executors or administrators of estates: Executors or administrators of estates may be asked to furnish an indemnity bond with surety to safeguard the interests of beneficiaries and ensure proper management of assets during the probate process.

Note: The need for an indemnity bond with surety may vary depending on the jurisdiction, industry, or specific requirements of a particular situation. It is advisable to consult with legal professionals or relevant authorities to determine if such a bond is necessary.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit indemnity bond with surety from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your indemnity bond with surety into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I send indemnity bond with surety to be eSigned by others?

Once your indemnity bond with surety is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I make edits in indemnity bond with surety without leaving Chrome?

indemnity bond with surety can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

What is indemnity bond with surety?

An indemnity bond with surety is a legal agreement in which a third party agrees to take on the financial responsibility of one party in case of any breach of contract or loss.

Who is required to file indemnity bond with surety?

Indemnity bond with surety is typically required by creditors, banks, or other financial institutions when providing a loan or credit to a borrower.

How to fill out indemnity bond with surety?

To fill out an indemnity bond with surety, you must provide personal and financial information, the amount of the bond, and the terms of the agreement. It is recommended to seek legal advice when filling out this document.

What is the purpose of indemnity bond with surety?

The purpose of an indemnity bond with surety is to provide financial protection to the creditor or lender in case the borrower defaults on their obligations.

What information must be reported on indemnity bond with surety?

The information that must be reported on an indemnity bond with surety includes the names and contact information of the parties involved, the amount of the bond, the terms of the agreement, and the signature of the surety.

Fill out your indemnity bond with surety online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Indemnity Bond With Surety is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.