Get the free Pension Savings Account

Show details

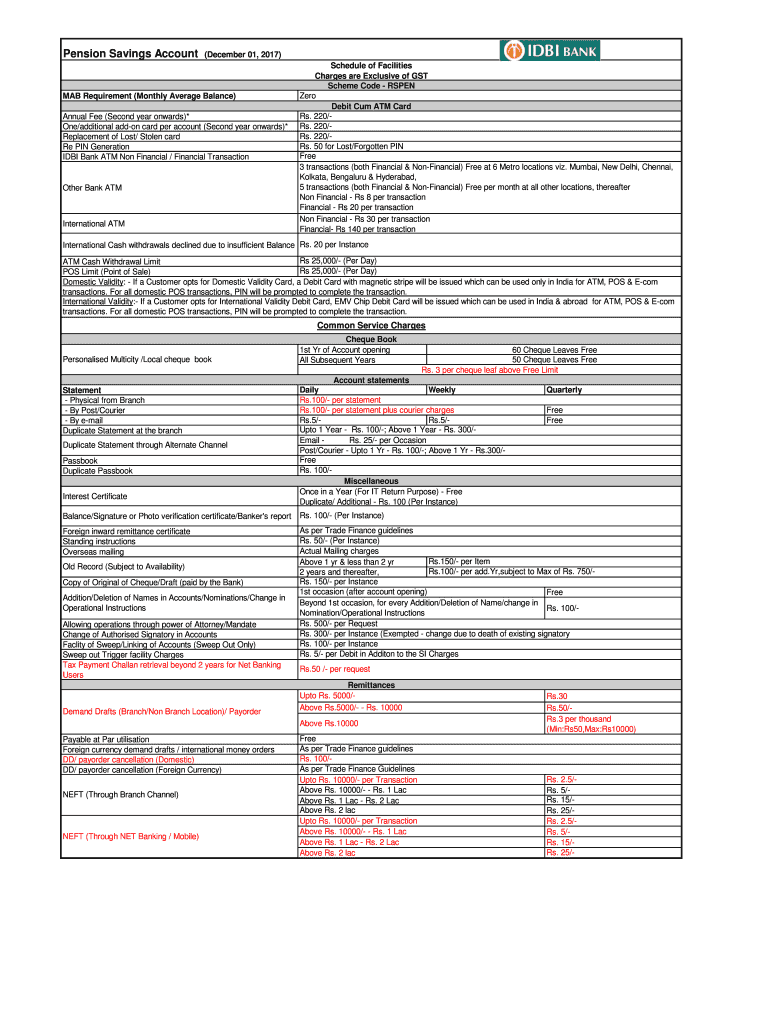

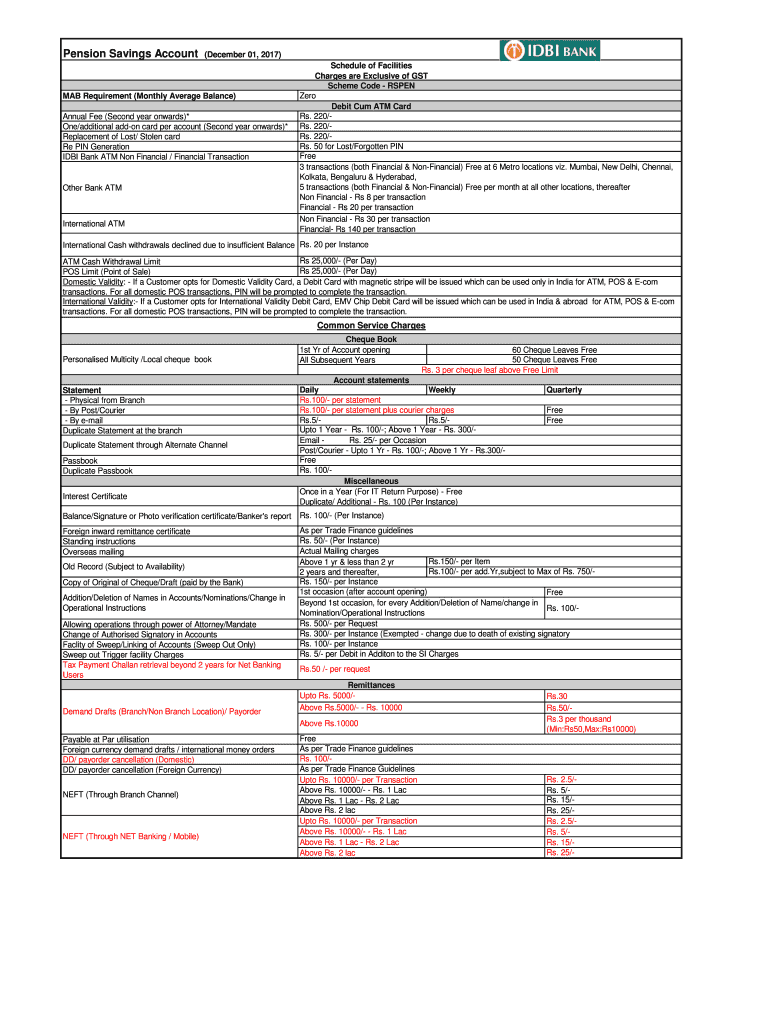

Pension Savings Account(December 01, 2017)MAY Requirement (Monthly Average Balance) Annual Fee (Second year onwards)* One/additional add-on card per account (Second year onwards)* Replacement of Lost/

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pension savings account

Edit your pension savings account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pension savings account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pension savings account online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pension savings account. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pension savings account

How to fill out a pension savings account:

01

Gather required documents: You will need your identification documents, such as a valid ID or passport, as well as your Social Security number or taxpayer identification number.

02

Research different providers: Look for financial institutions or insurance companies that offer pension savings accounts and compare their terms, fees, and potential returns. Consider consulting with a financial advisor to help you make an informed decision.

03

Contact the chosen provider: Once you have selected a provider, reach out to them either online, by phone, or in-person to initiate the account opening process. They will guide you through the necessary steps and provide you with the required forms.

04

Complete the application form: Fill out the necessary application form provided by the provider. This form will require personal information, such as your name, address, contact details, and employment details.

05

Choose your investment options: Select the investment options that align with your financial goals and risk tolerance. Pension savings accounts often offer a range of investment choices, such as stocks, bonds, mutual funds, or target-date funds.

06

Set up regular contributions: Decide how much you want to contribute regularly to the pension savings account. You may choose to contribute a fixed amount each month or make occasional lump sum payments. Ensure that your contributions are within the annual contribution limits set by the government.

07

Designate beneficiaries: Specify who will receive the funds in your pension savings account in case of your death. This step ensures that your loved ones are protected and can access the funds if needed.

Who needs a pension savings account?

01

Individuals planning for retirement: A pension savings account is particularly relevant for individuals who want to prepare for a comfortable retirement. It provides an opportunity to accumulate savings over time, which can be withdrawn during retirement to supplement other sources of income like Social Security.

02

Employees without a workplace pension: If your employer does not offer a pension plan or if you are self-employed, a pension savings account can serve as your primary retirement savings vehicle. It allows you to take control of your retirement planning and build a nest egg for the future.

03

Individuals seeking tax advantages: Pension savings accounts often offer tax advantages, such as tax-deferred growth and potential tax deductions on contributions. This makes them attractive for individuals looking to reduce their taxable income and maximize their savings.

04

Long-term savers: Pension savings accounts are designed for long-term saving. If you have a goal to save for retirement over an extended period, a pension savings account can help you achieve that objective by providing a dedicated account for accumulated funds.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my pension savings account directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign pension savings account and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit pension savings account on an Android device?

You can edit, sign, and distribute pension savings account on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

How do I complete pension savings account on an Android device?

On Android, use the pdfFiller mobile app to finish your pension savings account. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is pension savings account?

A pension savings account is a account where individuals contribute money to save for retirement.

Who is required to file pension savings account?

Individuals who have a pension plan or retirement savings account are required to file a pension savings account.

How to fill out pension savings account?

To fill out a pension savings account, individuals need to provide information on their contributions, investments, and earnings related to their retirement savings.

What is the purpose of pension savings account?

The purpose of a pension savings account is to help individuals save for retirement and ensure they have financial security in their later years.

What information must be reported on pension savings account?

Information such as contributions, earnings, and investments related to the retirement savings must be reported on a pension savings account.

Fill out your pension savings account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pension Savings Account is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.