Get the free DEED OF GIFT OF EASEMENT - Luray

Show details

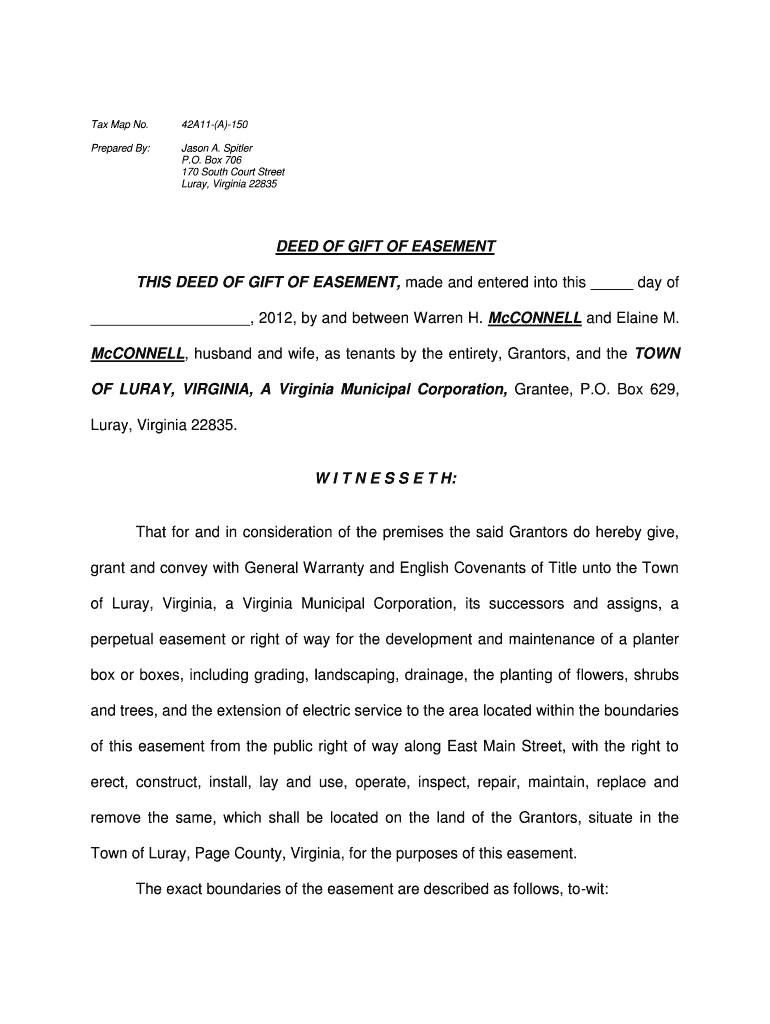

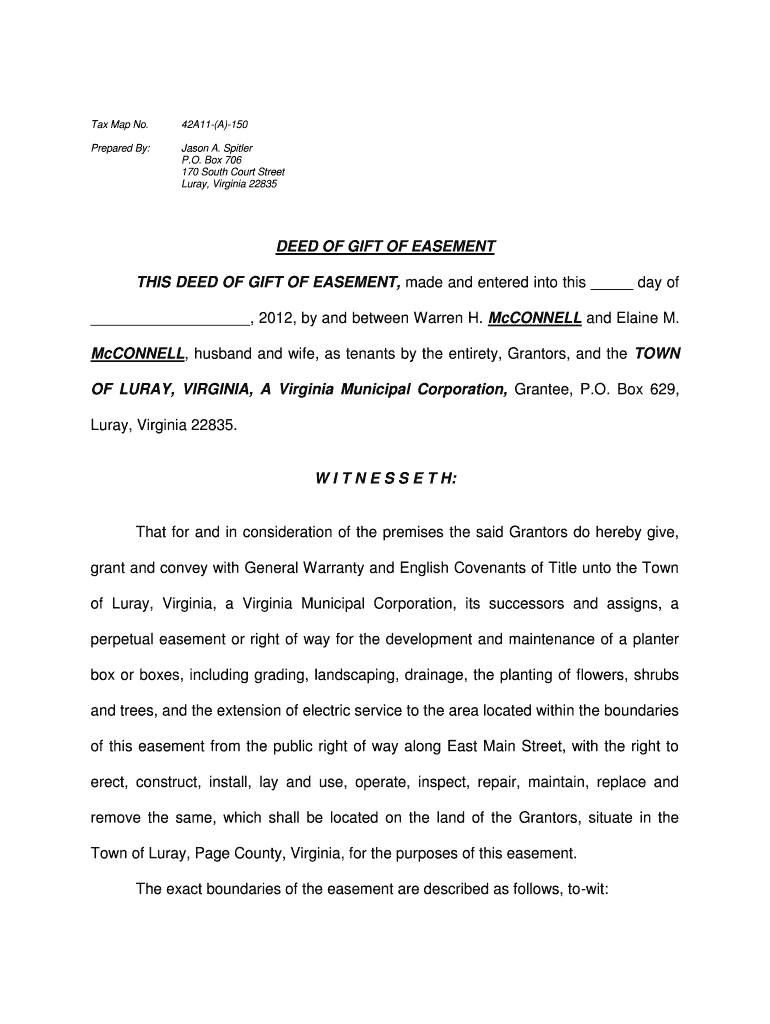

Tax Map No. 42A11(A)150 Prepared By: Jason A. Spitzer P.O. Box 706 170 South Court Street Lurgy, Virginia 22835 DEED OF GIFT OF EASEMENT THIS DEED OF GIFT OF EASEMENT, made and entered into this day

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deed of gift of

Edit your deed of gift of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deed of gift of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit deed of gift of online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit deed of gift of. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deed of gift of

How to fill out a deed of gift:

01

Start by identifying the parties involved in the gift: Provide the full legal names and addresses of the donor (the person giving the gift) and the recipient (the person receiving the gift).

02

Describe the gift: Clearly state the nature of the gift, including specific details such as the item or property being gifted, its value, and any conditions or restrictions attached to the gift.

03

Include a statement of intent: Clearly express the donor's intention to make a voluntary and unconditional gift, without any expectation of receiving anything in return.

04

Specify any applicable warranties or guarantees: If the gift comes with any warranties or guarantees, such as for the condition or authenticity of an item, make sure to include these details in the deed.

05

Address any tax implications: Depending on the jurisdiction, gifts above a certain value may have tax implications. Consult with a tax professional to ensure compliance with any applicable laws and include any necessary information related to tax matters in the deed.

06

State the effective date: Indicate the date when the gift will become effective, whether it is immediate or at a future date.

07

Attach any necessary documentation: If there are any supporting documents that need to be included, such as certificates of title or ownership, ensure that they are properly referenced and attached to the deed.

Who needs a deed of gift?

01

Individuals making significant gifts: If you are giving a valuable gift, such as real estate, artwork, or other high-value items, it is strongly recommended to have a deed of gift. This document helps establish legal clarity and protects both parties' rights and interests.

02

Individuals receiving significant gifts: If you are the recipient of a valuable gift, having a deed of gift can provide important legal protection and proof of ownership for the gifted item.

03

Charities and non-profit organizations: When accepting donations or gifts, charities often require a deed of gift to ensure legal compliance and establish the terms and conditions of the donation.

In conclusion, filling out a deed of gift requires accurately documenting the parties involved, providing a detailed description of the gift, expressing intent, addressing any warranties or guarantees, considering tax implications, stating the effective date, and attaching any necessary documentation. This legal document is important for individuals making or receiving significant gifts, as well as for charities and non-profit organizations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send deed of gift of to be eSigned by others?

Once your deed of gift of is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I execute deed of gift of online?

pdfFiller has made it easy to fill out and sign deed of gift of. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit deed of gift of on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share deed of gift of on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is deed of gift of?

The deed of gift is a legal document that transfers the ownership of a gift from one party to another.

Who is required to file deed of gift of?

The person transferring the gift is required to file the deed of gift.

How to fill out deed of gift of?

The deed of gift should be filled out with all relevant information about the gift and the parties involved.

What is the purpose of deed of gift of?

The purpose of the deed of gift is to legally transfer ownership of a gift to another party.

What information must be reported on deed of gift of?

The deed of gift must include details about the gift, the donor, the recipient, and any conditions or restrictions attached to the gift.

Fill out your deed of gift of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deed Of Gift Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.