Get the free Loan Planning Form - Northern Virginia Community College - nvcc

Show details

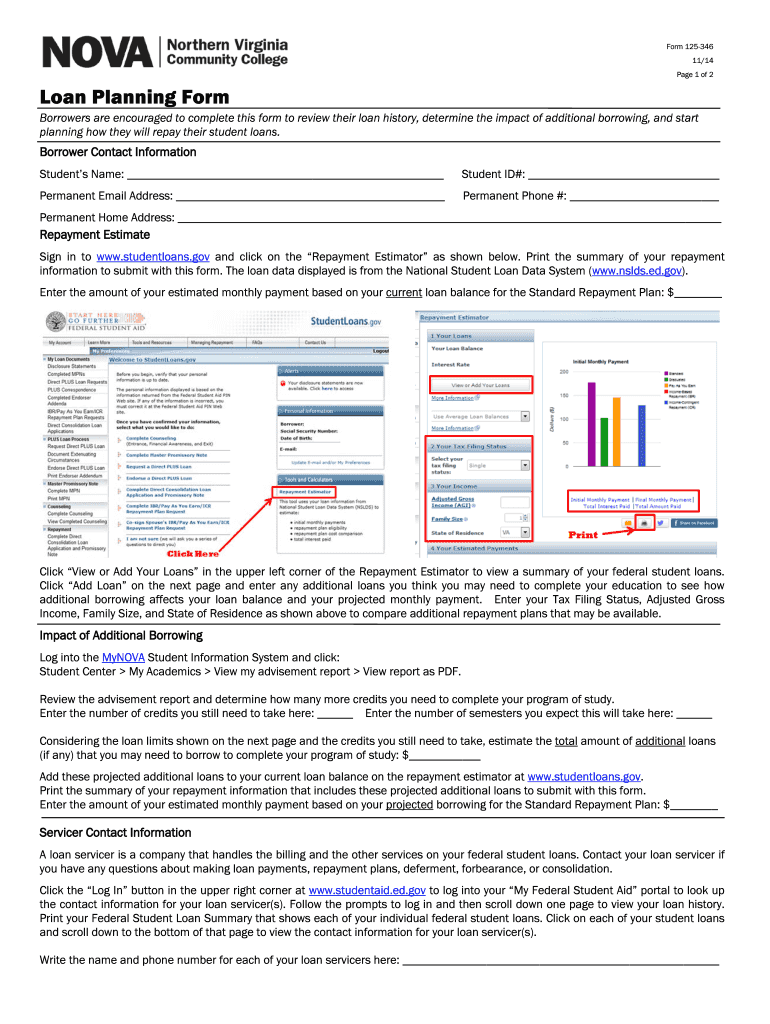

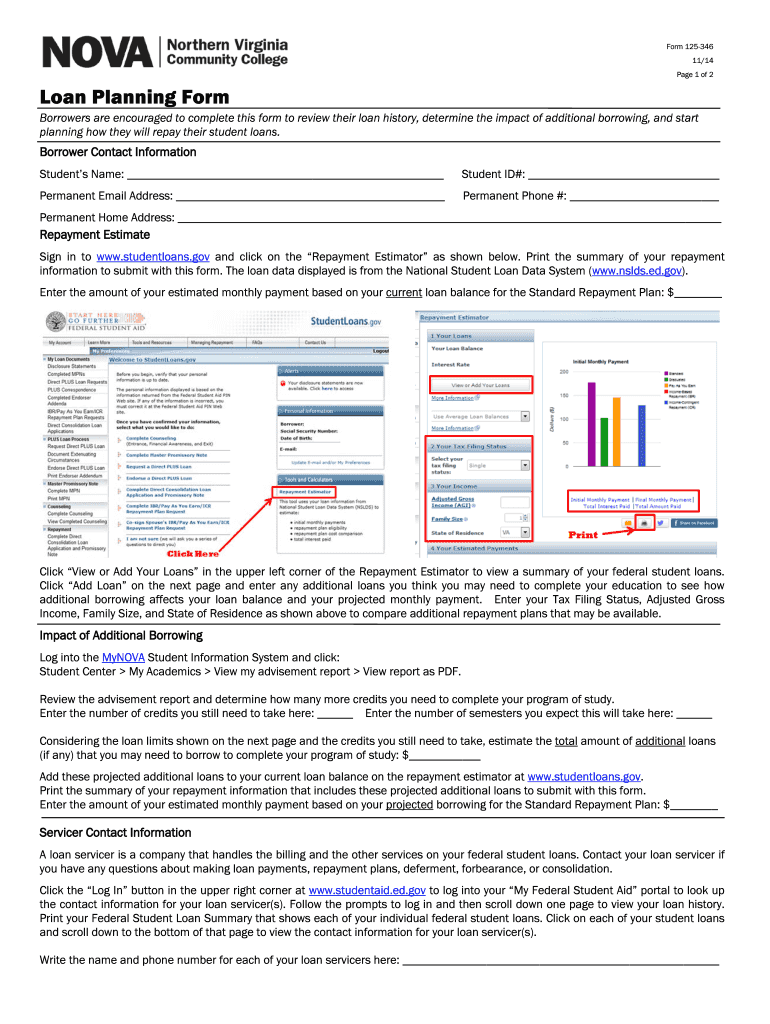

Form 125346 11/14-Page 1 of 2 Loan Planning Form Borrowers are encouraged to complete this form to review their loan history, determine the impact of additional borrowing, and start planning how they

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loan planning form

Edit your loan planning form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan planning form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing loan planning form online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit loan planning form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loan planning form

How to fill out a loan planning form:

01

Begin by gathering all the necessary information. This includes personal details such as your name, contact information, and social security number. You may also need to provide information about your employment history, income, and expenses.

02

Next, carefully review the form and understand the different sections. Pay attention to any instructions or guidelines provided. It is essential to fill out the form accurately and honestly.

03

Start by filling out the basic information section. This typically includes your name, address, phone number, and email address. Make sure to double-check the accuracy of the information before moving on.

04

Proceed to the financial details section. Here, you will need to provide information about your income, such as monthly salary or wages, any additional sources of income, and any outstanding debts or loans.

05

In the expenses section, list all your monthly expenses, including rent/mortgage payments, utility bills, transportation costs, groceries, and any other regular expenditures. Remember to be thorough and include every relevant expense.

06

If the loan planning form requires you to provide information about existing loans, debts, or credit cards, make sure to accurately list each one, including the outstanding balance and monthly payment.

07

Some loan planning forms may ask for additional documentation or supporting information. Be prepared to provide any required documents, such as pay stubs, bank statements, or tax returns.

08

Once you have completed filling out the form, carefully review it for any errors or missing information. It is crucial to ensure that all the information is accurate and up to date.

09

Finally, sign and date the completed loan planning form. By signing, you acknowledge that the information provided is true and accurate to the best of your knowledge.

Who needs a loan planning form?

01

Individuals who are considering taking out a loan: A loan planning form helps individuals assess their financial situation and plan for taking on a loan. It allows them to analyze their income, expenses, and debt obligations, helping them determine their loan repayment capacity.

02

Financial institutions or lenders: Loan planning forms serve as a tool for financial institutions to evaluate loan applicants. By reviewing the information provided in these forms, lenders can assess an individual's financial stability and the likelihood of repayment.

03

Financial advisors or counselors: Loan planning forms can be utilized by financial advisors or counselors to assist their clients in making informed financial decisions. By analyzing the information in these forms, advisors can offer personalized guidance and recommendations tailored to their clients' unique circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get loan planning form?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the loan planning form in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I complete loan planning form online?

pdfFiller has made filling out and eSigning loan planning form easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How can I edit loan planning form on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing loan planning form.

What is loan planning form?

Loan planning form is a document used to outline the details of a loan, including repayment terms and interest rates.

Who is required to file loan planning form?

Financial institutions and borrowers are required to file a loan planning form.

How to fill out loan planning form?

To fill out a loan planning form, borrowers and lenders must provide detailed information about the loan terms, including amount, interest rate, and repayment schedule.

What is the purpose of loan planning form?

The purpose of the loan planning form is to establish a clear understanding of the terms of a loan and ensure all parties are aware of their responsibilities.

What information must be reported on loan planning form?

On a loan planning form, information such as loan amount, interest rate, repayment schedule, and contact information for both parties must be reported.

Fill out your loan planning form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan Planning Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.