Get the free Dividend Reinvestment Plan Mandate Form - Vodafone

Show details

All correspondence to: Computer share Investor Services PLC Bridgewater Road Bristol BS99 6ZZ Telephone: 0870 702 0198 www.computershare.com Shareholder Reference Number (SON) Name and Address: Dividend

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dividend reinvestment plan mandate

Edit your dividend reinvestment plan mandate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dividend reinvestment plan mandate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit dividend reinvestment plan mandate online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit dividend reinvestment plan mandate. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dividend reinvestment plan mandate

How to fill out dividend reinvestment plan mandate:

01

Obtain the necessary forms: Start by contacting your stockbroker or the company in which you hold shares to request the dividend reinvestment plan (DRIP) forms. They may be available on the company's website or you can ask to have the forms mailed to you.

02

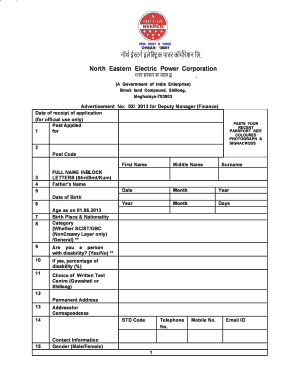

Provide personal information: Fill out the DRIP forms with your personal information, including your name, address, and contact details. This information is necessary for the company to ensure that your dividends and statements are sent to the correct address.

03

Indicate your account details: Specify the account in which you would like your dividends to be reinvested. This can be a new or existing brokerage account, directly held account, or any other type of investment account. Provide the account number and any other relevant details required by the company.

04

Choose investment options: Select the investment options offered by the company's DRIP. This may involve choosing specific stocks or funds in which you want your dividends to be reinvested. Some DRIPs also offer discounts on stock purchases or the ability to purchase fractional shares.

05

Review and sign the mandate: Carefully review all the information you have provided on the forms and ensure it is accurate. Sign and date the mandate, indicating your agreement to the terms and conditions of the dividend reinvestment plan.

Who needs dividend reinvestment plan mandate?

01

Individual investors: Individual investors who own stocks and want to reinvest their dividends can benefit from a dividend reinvestment plan mandate. It allows them to automatically reinvest their dividends into additional shares of stock, potentially increasing their ownership in the company over time.

02

Long-term investors: Investors with a long-term perspective and a desire to accumulate more shares over time can find a dividend reinvestment plan mandate advantageous. By reinvesting dividends, they can harness the power of compounding returns and potentially grow their investment portfolio.

03

Investors seeking cost-effective investing: Dividend reinvestment plans often offer lower fees or commissions compared to buying additional shares through a traditional brokerage account. Investors looking for a cost-effective way to increase their holdings may find a dividend reinvestment plan mandate beneficial.

Overall, a dividend reinvestment plan mandate is suitable for individual investors, long-term investors, and those seeking cost-effective investing strategies. It provides a convenient and automated way to reinvest dividends and potentially grow your investment portfolio over time.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is dividend reinvestment plan mandate?

A dividend reinvestment plan mandate is a written agreement between a shareholder and a company allowing the company to use the shareholder's dividends to purchase additional shares of stock.

Who is required to file dividend reinvestment plan mandate?

Shareholders who wish to participate in a dividend reinvestment plan offered by a company are required to file a dividend reinvestment plan mandate.

How to fill out dividend reinvestment plan mandate?

To fill out a dividend reinvestment plan mandate, shareholders must provide their personal information, account details, and authorize the company to reinvest their dividends.

What is the purpose of dividend reinvestment plan mandate?

The purpose of a dividend reinvestment plan mandate is to allow shareholders to automatically reinvest their dividends into additional shares of stock, helping to grow their investment over time.

What information must be reported on dividend reinvestment plan mandate?

Shareholders must report their personal details, account information, and authorization for the company to reinvest their dividends on the dividend reinvestment plan mandate.

How can I manage my dividend reinvestment plan mandate directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your dividend reinvestment plan mandate as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I make changes in dividend reinvestment plan mandate?

With pdfFiller, the editing process is straightforward. Open your dividend reinvestment plan mandate in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I sign the dividend reinvestment plan mandate electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your dividend reinvestment plan mandate in minutes.

Fill out your dividend reinvestment plan mandate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dividend Reinvestment Plan Mandate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.