Get the free Health Care Choice FSA maximum $2,500

Show details

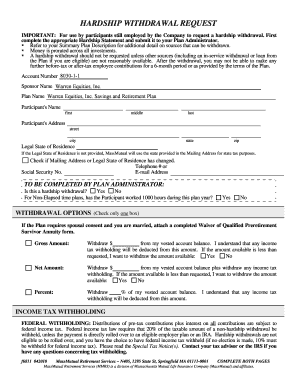

Disbar Flexible Spending Accounts Plan Year: January 1, 2015, December 31, 2015, Health Care Choice FSA maximum: $2,500.00 Health Care Choice FSA minimum: $0.00 Run Out Period: 90Days REMINDER: Receipts

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign health care choice fsa

Edit your health care choice fsa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your health care choice fsa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing health care choice fsa online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit health care choice fsa. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out health care choice fsa

How to fill out health care choice fsa?

01

Determine your eligibility: Make sure you are eligible for a health care choice FSA. Typically, these accounts are offered by employers as part of their benefits package.

02

Review the plan details: Familiarize yourself with the specific details of your health care choice FSA. Understand the contribution limits, reimbursement rules, and eligible expenses. This information is usually outlined in the plan documents provided by your employer.

03

Decide on your contribution amount: Determine how much money you want to contribute to your health care choice FSA for the year. Keep in mind that contributions are typically deducted from your paycheck before taxes, potentially reducing your taxable income.

04

Enroll in the FSA: Complete the necessary enrollment forms or follow the instructions provided by your employer to enroll in the health care choice FSA. This may involve online registration or submitting paperwork to your HR department.

05

Use the FSA funds: Once your FSA is active, you can start using the funds to pay for eligible medical expenses. Keep track of your expenses and save receipts to substantiate your claims.

06

File reimbursement claims: Depending on your FSA plan, you may need to submit reimbursement claims. This generally involves completing a claim form and attaching the supporting documentation (such as receipts or invoices) for the expenses incurred.

07

Follow the deadlines: Be mindful of any deadlines for filing reimbursement claims and spending the allocated funds. FSA plans typically have a "use it or lose it" provision, where any unspent funds may be forfeited at the end of the plan year.

Who needs health care choice fsa?

01

Employees with anticipated medical expenses: Health care choice FSAs are beneficial for individuals who expect significant medical expenses throughout the year. It can help offset costs for various eligible expenses, such as doctor visits, prescription medications, and even certain dental procedures.

02

Individuals with a qualifying high-deductible health plan (HDHP): Health care choice FSAs can be particularly advantageous for individuals enrolled in HDHPs, where out-of-pocket costs can be higher. The funds in the FSA can be used to cover deductibles, copayments, and other eligible medical expenses not covered by the insurance plan.

03

Individuals interested in tax savings: Contributions made to a health care choice FSA are typically deducted from your paycheck on a pre-tax basis. This can help lower your taxable income and potentially reduce your overall tax liability, resulting in savings.

Remember to consult with your employer or benefits coordinator for specific information about your health care choice FSA, as each plan may have unique requirements and regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in health care choice fsa?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your health care choice fsa to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I make edits in health care choice fsa without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing health care choice fsa and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I fill out health care choice fsa using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign health care choice fsa and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is health care choice fsa?

Health care choice FSA (Flexible Spending Account) is a pre-tax benefit account that can be used to pay for eligible medical, dental, and vision care expenses that are not covered by insurance.

Who is required to file health care choice fsa?

Health care choice FSA is typically offered by employers to their employees as a benefit option, so employees who choose to participate are required to file.

How to fill out health care choice fsa?

To fill out a health care choice FSA, participants need to estimate their health care expenses for the upcoming plan year and elect to contribute a specific amount from their paycheck on a pre-tax basis.

What is the purpose of health care choice fsa?

The purpose of health care choice FSA is to help individuals save money on eligible medical expenses by using pre-tax dollars to pay for them, thus reducing their taxable income.

What information must be reported on health care choice fsa?

Participants must report their estimated health care expenses for the plan year, the amount they wish to contribute to the FSA, and any eligible expenses they claim for reimbursement.

Fill out your health care choice fsa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Health Care Choice Fsa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.