Get the free MORTGAGE - Sage Title Agency

Show details

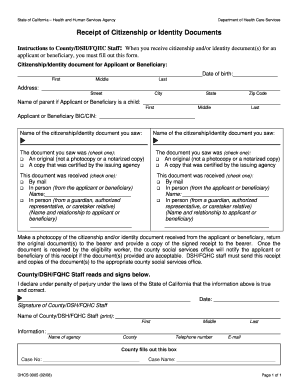

MORTGAGE This mortgage is made on BETWEEN the Borrower(s) Whose address is referred to as I, AND the Lender Whose address is referred to as the Lender. If more than one Borrower signs this Mortgage,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage - sage title

Edit your mortgage - sage title form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage - sage title form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage - sage title online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit mortgage - sage title. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage - sage title

How to fill out a mortgage - sage title:

01

Gather the necessary documents: Start by collecting all the required documents such as identification, income statements, bank statements, tax returns, and any other relevant paperwork.

02

Consult with a mortgage specialist: Reach out to a mortgage specialist or a loan officer at Sage Title to discuss your financial situation, preferences, and eligibility for a mortgage. They will provide guidance and help you choose the right mortgage options.

03

Complete the application: Fill out the mortgage application form accurately and thoroughly. Provide all the requested information, including personal details, employment history, financial assets, and liabilities.

04

Provide supporting documentation: Attach the necessary supporting documents to the application. This may include proof of income, bank statements, property information, insurance details, and any other documents required by the lender.

05

Review and sign the disclosures: Carefully read and understand the disclosures provided by Sage Title. These disclosures outline important terms, conditions, and responsibilities associated with the mortgage.

06

Submit your application: Once you have completed the application and gathered all the necessary documents, submit them to Sage Title for review. They will evaluate your application and documentation to determine your eligibility for a mortgage.

07

Attend the closing: If your application is approved, you will be invited to attend the closing process. Prepare all the necessary funds for the down payment, closing costs, and other fees associated with the mortgage.

Who needs a mortgage - sage title?

01

Homebuyers: Anyone looking to purchase a property, whether it's a first-time homebuyer or someone looking to upgrade or downsize, may need a mortgage from Sage Title to finance their purchase.

02

Real estate investors: Individuals or companies investing in real estate properties may require a mortgage to fund their investments. Sage Title can help provide mortgage options tailored to the specific needs of real estate investors.

03

Refinancers: Homeowners who wish to refinance their existing mortgage to lower their interest rate, shorten the loan term, or access equity in their property may seek a mortgage from Sage Title.

04

Those seeking to access home equity: Homeowners who want to tap into their home's equity to fund major expenses such as home improvements, education, or medical bills can explore mortgage options at Sage Title.

Regardless of the specific reasons for needing a mortgage, Sage Title can provide guidance, personalized assistance, and a range of mortgage options to meet the needs of different individuals and scenarios.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the mortgage - sage title electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your mortgage - sage title in seconds.

Can I create an eSignature for the mortgage - sage title in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your mortgage - sage title right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I complete mortgage - sage title on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your mortgage - sage title, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is mortgage - sage title?

A mortgage - sage title is a legal document giving a lender a security interest in a property in exchange for a loan.

Who is required to file mortgage - sage title?

The borrower is required to file the mortgage - sage title.

How to fill out mortgage - sage title?

To fill out a mortgage - sage title, the borrower needs to provide personal information, property details, loan amount, and terms of repayment.

What is the purpose of mortgage - sage title?

The purpose of a mortgage - sage title is to secure the loan and protect the lender's interest in the property.

What information must be reported on mortgage - sage title?

The mortgage - sage title must include details of the property, borrower's information, loan amount, and terms of repayment.

Fill out your mortgage - sage title online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage - Sage Title is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.