Get the free SEP IRA CONTRIBUTION ALLOCATION FORM

Show details

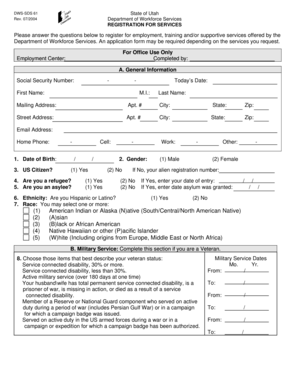

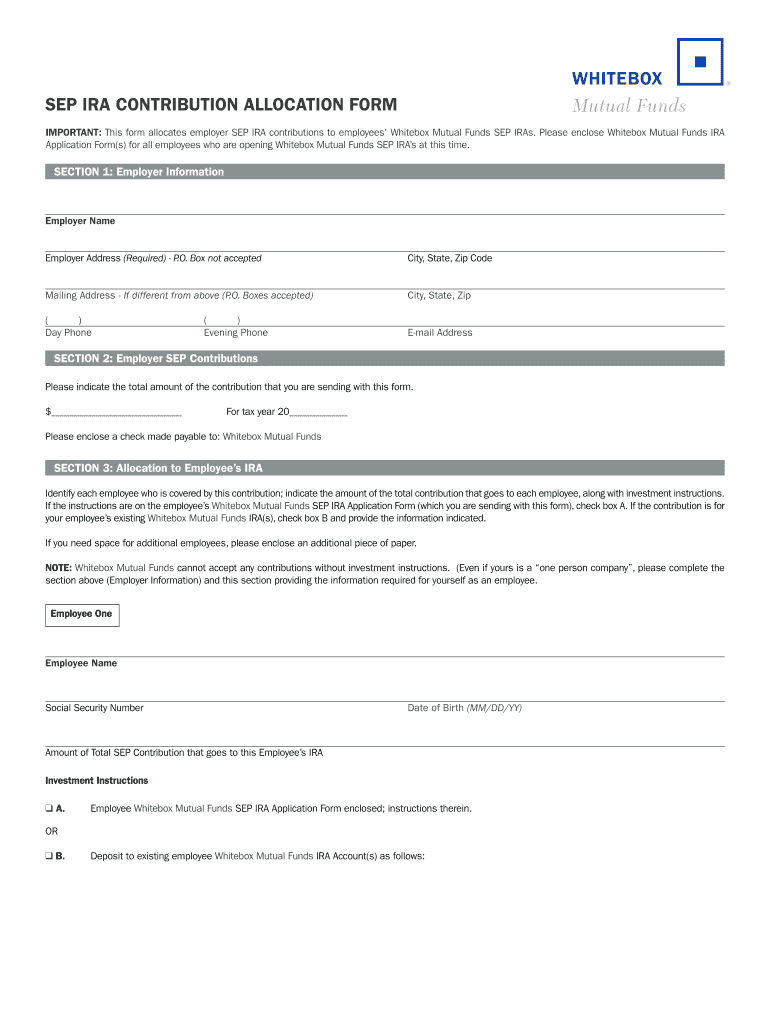

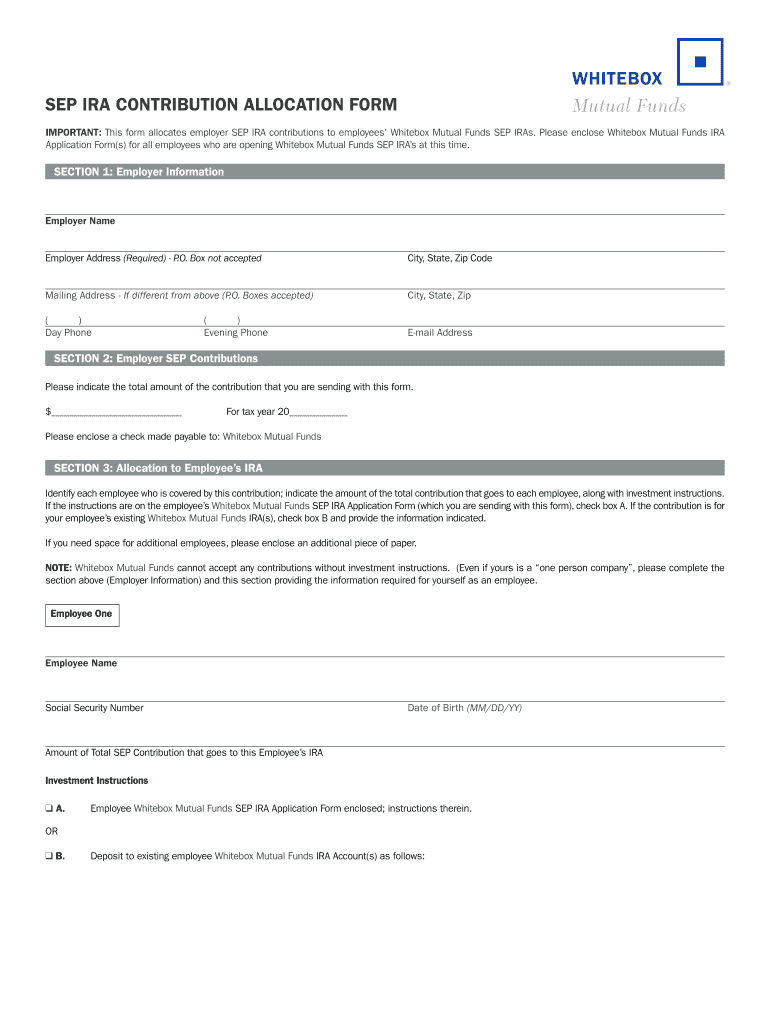

SEP IRA CONTRIBUTION ALLOCATION FORM IMPORTANT: This form allocates employer SEP IRA contributions to employees White box Mutual Funds SEP IRAs. Please enclose White box Mutual Funds IRA Application

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sep ira contribution allocation

Edit your sep ira contribution allocation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sep ira contribution allocation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sep ira contribution allocation online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit sep ira contribution allocation. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sep ira contribution allocation

How to Fill Out SEP IRA Contribution Allocation:

01

Obtain the correct form: To fill out the SEP IRA contribution allocation, you will need to obtain Form 5305-SEP or check if your financial institution has their own version of the form available.

02

Provide necessary information: Complete the top section of the form with your personal details, including your name, address, and Social Security number or employer identification number.

03

Determine the allocation method: Decide whether you want to allocate contributions on a percentage basis or a flat dollar amount basis. This determines how the contributions will be divided among eligible employees.

04

Calculate the contributions: If you choose the percentage basis, calculate the percentage of compensation for each eligible employee. If you opt for a flat dollar amount basis, specify the dollar amount for each employee.

05

Ensure total contributions meet IRS limits: Make sure that the total contributions allocated among all employees do not exceed the limits set by the IRS. For 2021, the maximum contribution limit is $58,000 per participant or 25% of their compensation, whichever is less.

06

Include required information: Provide the name and Social Security number or employer identification number for each eligible employee receiving a contribution and indicate their respective share of the total contribution.

07

Review and sign the form: Double-check all the information provided, including calculations and employee details. Sign the form along with any other required signatures, such as those of plan sponsors or trustees.

08

Submit the form: Once completed and signed, submit the SEP IRA contribution allocation form to your financial institution or plan administrator by the required deadline, typically the due date of your tax return (including extensions).

Who Needs SEP IRA Contribution Allocation?

01

Self-Employed Individuals: SEP IRA contribution allocation is commonly used by self-employed individuals, including sole proprietors, freelancers, and independent contractors.

02

Small Business Owners: Small business owners can take advantage of SEP IRAs to provide retirement benefits for themselves and their eligible employees.

03

Employers with Variable Contributions: If you have a business where the income and profits may fluctuate each year, a SEP IRA can be a flexible retirement savings option, as it allows for variable contribution amounts based on your business's financial performance.

04

Those Seeking Tax Advantages: Contributing to a SEP IRA offers potential tax benefits, allowing individuals to deduct contributions from their taxable income, potentially reducing their overall tax liability.

05

Individuals Looking for Retirement Savings: SEP IRAs provide an opportunity for individuals to save for retirement and invest in a tax-advantaged account specifically designed for self-employed individuals and small business owners.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sep ira contribution allocation to be eSigned by others?

When you're ready to share your sep ira contribution allocation, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit sep ira contribution allocation in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing sep ira contribution allocation and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I sign the sep ira contribution allocation electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your sep ira contribution allocation in seconds.

What is sep ira contribution allocation?

SEP IRA contribution allocation is the process of determining how much each eligible employee will receive in contributions to their SEP IRA account.

Who is required to file sep ira contribution allocation?

Employers who offer SEP IRAs to their employees are required to file sep ira contribution allocation.

How to fill out sep ira contribution allocation?

Employers can fill out sep ira contribution allocation by calculating the contribution percentage for each eligible employee and submitting the necessary forms to the financial institution managing the SEP IRA accounts.

What is the purpose of sep ira contribution allocation?

The purpose of sep ira contribution allocation is to ensure that each eligible employee receives the appropriate contribution to their retirement account based on their compensation.

What information must be reported on sep ira contribution allocation?

Information such as employee names, compensation amounts, contribution percentages, and total contributions must be reported on sep ira contribution allocation.

Fill out your sep ira contribution allocation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sep Ira Contribution Allocation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.