Get the free Lending to Municipalities Webinar - Sitemason

Show details

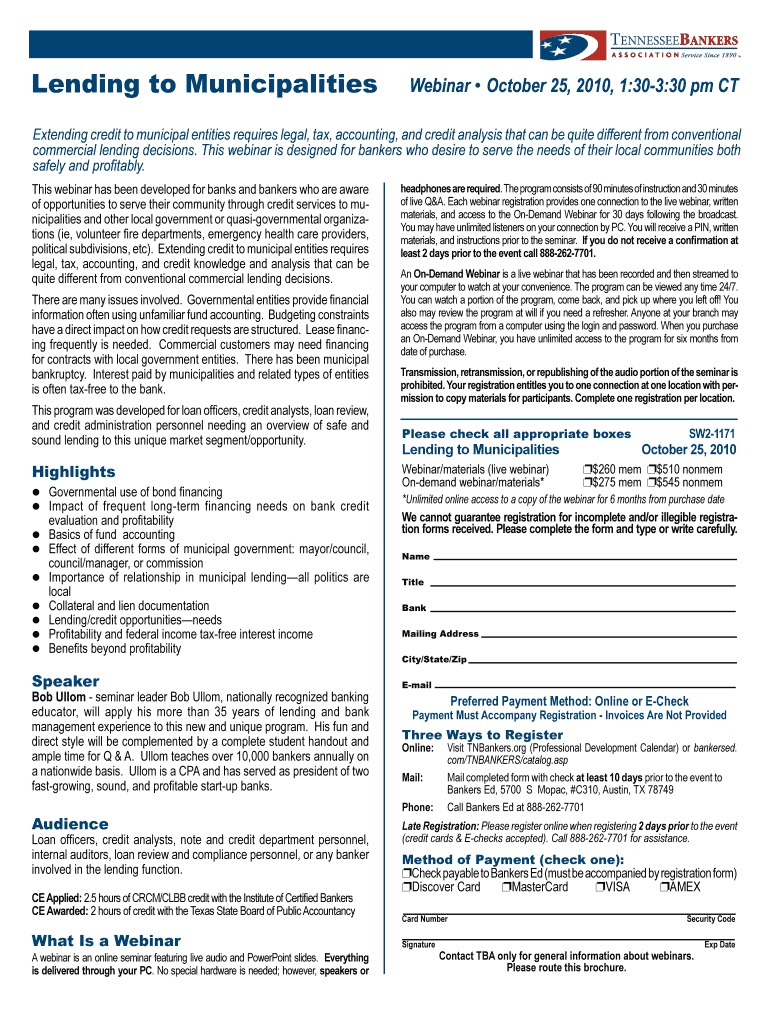

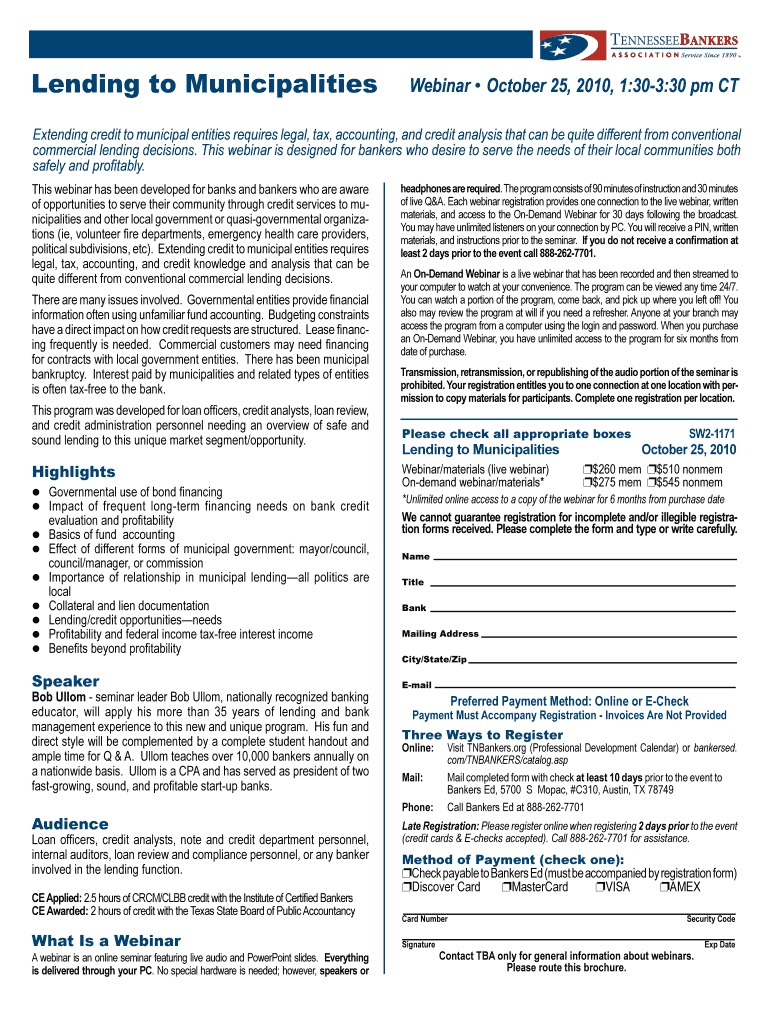

Lending to Municipalities Webinar October 25, 2010, 1:303:30 pm CT Extending credit to municipal entities requires legal, tax, accounting, and credit analysis that can be quite different from conventional

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lending to municipalities webinar

Edit your lending to municipalities webinar form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lending to municipalities webinar form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing lending to municipalities webinar online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit lending to municipalities webinar. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out lending to municipalities webinar

How to fill out a lending to municipalities webinar:

01

Conduct preliminary research on lending to municipalities. Understand the key concepts, processes, and regulations involved in lending to local government entities.

02

Develop a comprehensive agenda for the webinar. Identify the topics that need to be covered, such as types of loans available, eligibility criteria, repayment terms, and case studies of successful municipal lending.

03

Create engaging and informative presentation slides. Use visuals, graphs, and charts to effectively convey information and make the content more digestible for the audience.

04

Prepare relevant case studies or examples to illustrate the lending process and its benefits to municipalities. These real-world examples can help participants understand the practical application of the concepts discussed.

05

Incorporate interactive elements into the webinar, such as polling questions or Q&A sessions, to encourage participation and make the webinar more engaging for attendees.

06

Promote the webinar through various channels, such as email newsletters, social media, and professional networks. Target individuals and organizations involved in municipal finance, city management, or financial institutions that cater to municipalities.

07

Ensure the webinar platform is user-friendly and can accommodate the expected number of participants. Test the platform and troubleshoot any technical issues in advance to ensure a smooth webinar experience.

08

During the webinar, present the information clearly and concisely. Use a conversational tone and avoid jargon to make the content more accessible to a wide range of participants.

09

Offer opportunities for participants to ask questions and receive clarification on any points they may find confusing. Encourage active participation and foster a collaborative learning environment.

10

Follow up after the webinar with additional resources, such as PDF handouts or links to relevant articles or websites, to further support participants' learning on lending to municipalities.

Who needs a lending to municipalities webinar?

01

Government officials and employees involved in municipal finance, such as city treasurers, finance directors, or budget managers, who want to gain a better understanding of lending options available to local government bodies.

02

Financial institutions, such as banks or credit unions, that offer lending services to municipalities or are interested in exploring this market segment.

03

Professionals in the field of public finance or municipal consulting who need to stay updated on the latest trends and practices in lending to municipalities.

04

Researchers, academics, or students studying public administration, economics, or finance, who wish to deepen their knowledge and understanding of municipal borrowing.

Overall, the lending to municipalities webinar aims to provide valuable insights and practical guidance to individuals and organizations involved in financing local government projects, helping them make informed decisions when it comes to lending to municipalities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute lending to municipalities webinar online?

Completing and signing lending to municipalities webinar online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit lending to municipalities webinar online?

The editing procedure is simple with pdfFiller. Open your lending to municipalities webinar in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I edit lending to municipalities webinar on an iOS device?

Use the pdfFiller mobile app to create, edit, and share lending to municipalities webinar from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is lending to municipalities webinar?

Lending to municipalities webinar is a training session or online seminar focused on providing information and guidance on the process of lending to local government entities.

Who is required to file lending to municipalities webinar?

Anyone involved in the lending process to municipalities, including financial institutions, government agencies, and individuals, may be required to attend or participate in the webinar.

How to fill out lending to municipalities webinar?

To fill out lending to municipalities webinar, participants can follow the instructions provided during the webinar session or refer to any accompanying materials or resources shared during the session.

What is the purpose of lending to municipalities webinar?

The purpose of lending to municipalities webinar is to educate and inform participants about the regulations, requirements, and best practices related to lending funds to local government entities.

What information must be reported on lending to municipalities webinar?

Participants may be required to report on the types of loans being provided, the terms and conditions of the loans, the purpose of the loans, and any other relevant information requested during the webinar.

Fill out your lending to municipalities webinar online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lending To Municipalities Webinar is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.