Get the free MSA Program Checklist (Accounting/Audit Focus)

Show details

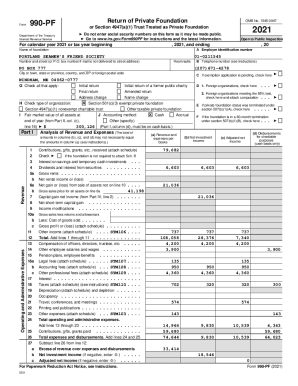

This document serves as a checklist for students admitted to the MSA program with an accounting focus, detailing course requirements, stages of completion, and related academic information.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign msa program checklist accountingaudit

Edit your msa program checklist accountingaudit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your msa program checklist accountingaudit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit msa program checklist accountingaudit online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit msa program checklist accountingaudit. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out msa program checklist accountingaudit

How to fill out MSA Program Checklist (Accounting/Audit Focus)

01

Begin by obtaining the MSA Program Checklist template from your institution's website or program coordinator.

02

Review the checklist categories and sections relevant to Accounting/Audit focus.

03

Gather all necessary documents such as course syllabi, transcripts, and relevant certifications.

04

For each section of the checklist, systematically enter documentation and evidence required to meet the criteria.

05

Cross-reference your entries with the program requirements to ensure completeness.

06

Make use of additional notes or comments sections to provide clarifying information when necessary.

07

Review the checklist for accuracy and completeness before submission.

08

Submit the completed checklist by the specified deadline to the program coordinator.

Who needs MSA Program Checklist (Accounting/Audit Focus)?

01

Students enrolled in the MSA program with an Accounting/Audit focus.

02

Academic advisors or program coordinators who assist students in completing program requirements.

03

Accrediting bodies that require documentation of program compliance.

04

Institutional review committees that assess program effectiveness.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MSA Program Checklist (Accounting/Audit Focus)?

The MSA Program Checklist (Accounting/Audit Focus) is a structured tool designed to ensure that accounting and audit procedures meet established standards and regulations. It assists organizations in evaluating their compliance and readiness in these areas.

Who is required to file MSA Program Checklist (Accounting/Audit Focus)?

Organizations involved in accounting and auditing practices that are subject to regulatory oversight or those aiming to ensure compliance with industry standards are required to file the MSA Program Checklist.

How to fill out MSA Program Checklist (Accounting/Audit Focus)?

To fill out the MSA Program Checklist, an organization should gather relevant documentation, assess each section of the checklist, and provide accurate information based on their accounting and audit practices. It is important to seek clarification on any ambiguous points and ensure that all required fields are completed.

What is the purpose of MSA Program Checklist (Accounting/Audit Focus)?

The purpose of the MSA Program Checklist is to facilitate compliance, enhance internal controls, and promote best practices within accounting and auditing functions. It serves as a guide for organizations to ensure they adhere to necessary regulatory requirements.

What information must be reported on MSA Program Checklist (Accounting/Audit Focus)?

The information reported on the MSA Program Checklist typically includes details on internal controls, audit findings, compliance with regulations, accounting practices, and any corrective actions taken. Specific fields may vary based on the regulatory body overseeing the checklist.

Fill out your msa program checklist accountingaudit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Msa Program Checklist Accountingaudit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.