Get the free DUE BY 2016 EMPLOYER QUARTERLY LOCAL SERVICE TAX LST

Show details

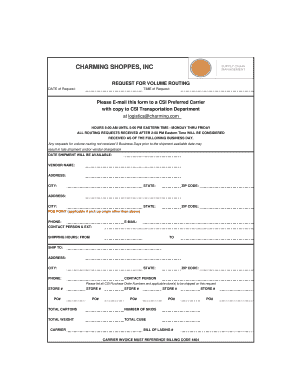

Do BY: 1ST MTR APRIL 2ND MTR JULY 3RD MTR OCT 4TH MTR JAN 30 2016 31 2016 31 2016 31 2017 2016 EMPLOYER QUARTERLY LOCAL SERVICE TAX (LST) WITHHOLDING RETURN CAPITAL TAX COLLECTION BUREAU Combined

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign due by 2016 employer

Edit your due by 2016 employer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your due by 2016 employer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit due by 2016 employer online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit due by 2016 employer. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out due by 2016 employer

How to Fill Out Due by 2016 Employer:

01

Gather necessary information: Before filling out the due by 2016 employer, you will need to collect certain information. This may include your personal details, such as your full name, social security number, and contact information. You may also need information about your employer, such as their name, address, and employer identification number (EIN). Additionally, you may need to gather details about your income for the year 2016, such as your total wages, tips, and other compensation.

02

Obtain the appropriate forms: The due by 2016 employer form typically refers to the Form W-2, which is used to report wages paid to employees and the taxes withheld from those wages. You can obtain the Form W-2 from your employer, who is responsible for providing it to you by the end of January following the tax year.

03

Fill out the form accurately: Once you have obtained the Form W-2, you must carefully fill out the required sections. This includes providing your personal information, such as your name, social security number, and address. You will also need to enter your employer's information, including their name, EIN, and address. In the income section, report your total wages, tips, and any other compensation received during the year. Lastly, review the form for accuracy, ensuring that all the information is entered correctly.

04

Submit the form: After completing the due by 2016 employer form, you will need to submit it to the appropriate entities. The form typically consists of multiple copies, with one copy for your records, one to be filed with your federal income tax return, and others to be sent to the Social Security Administration and applicable state tax authorities. Make sure to follow the instructions provided along with the form to submit the copies to the correct recipients.

Who needs due by 2016 employer?

01

Employees: Individuals who worked as employees during the tax year 2016 will need the due by 2016 employer form. Employees must fill out this form to report their wages, tips, and other compensation, as well as the taxes withheld from their paychecks. The form helps the Internal Revenue Service (IRS) track income and ensure that employees are accurately reporting their earnings.

02

Employers: Employers are responsible for providing employees with the due by 2016 employer form, also known as Form W-2. They must accurately fill out this form for each employee and provide it to them by the end of January following the tax year. Employers need to report the wages paid to employees, the taxes withheld, and other relevant information required by the IRS. It is important for employers to submit the forms on time and accurately, as discrepancies may lead to penalties or audits.

03

Tax Authorities: State and federal tax authorities require employees to submit the due by 2016 employer form to monitor income and tax compliance. These authorities use the information provided on the Form W-2 to verify an individual's income, ensure accurate tax filing, and facilitate the enforcement of tax laws.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify due by 2016 employer without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your due by 2016 employer into a dynamic fillable form that you can manage and eSign from anywhere.

How do I execute due by 2016 employer online?

pdfFiller makes it easy to finish and sign due by 2016 employer online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit due by 2016 employer on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign due by 2016 employer on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your due by 2016 employer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Due By 2016 Employer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.