Get the free Independent Contractor Classification Documentation - umsystem

Show details

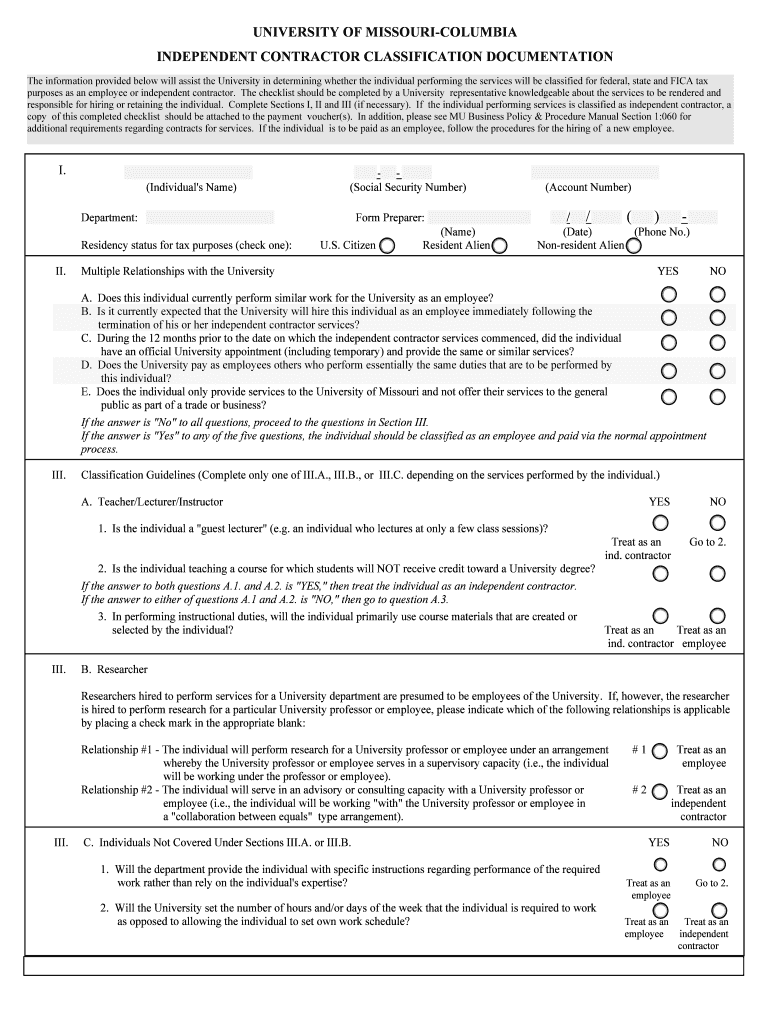

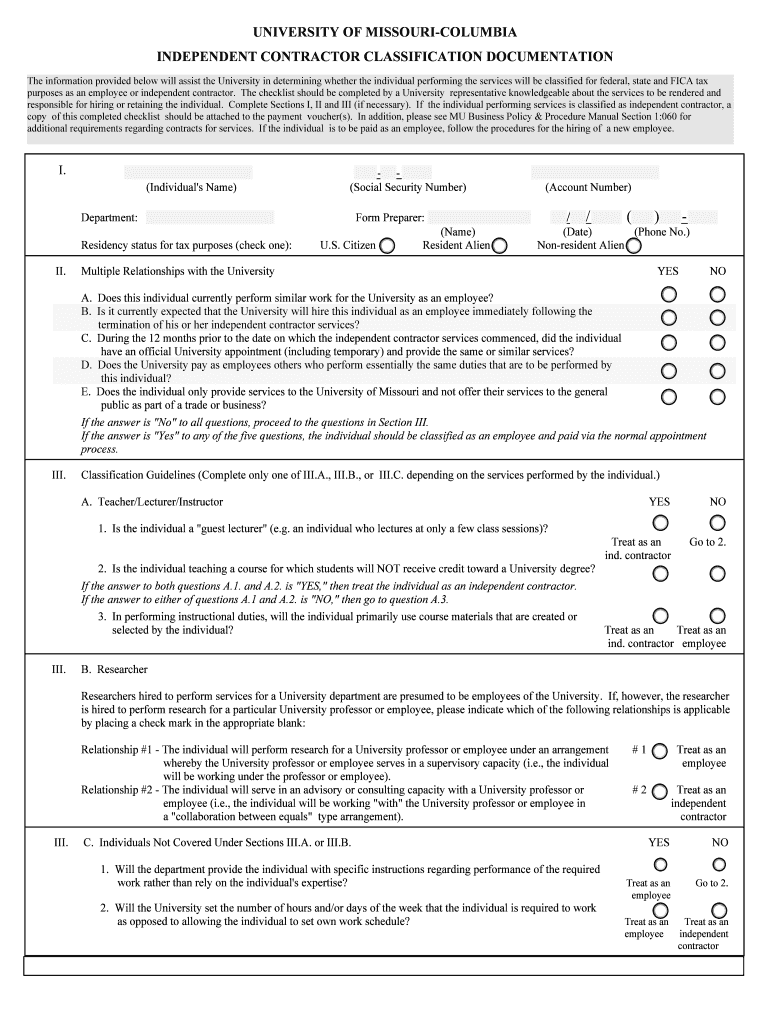

This document assists the University of Missouri-Columbia in determining whether an individual performing services is classified as an employee or independent contractor for tax purposes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign independent contractor classification documentation

Edit your independent contractor classification documentation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your independent contractor classification documentation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit independent contractor classification documentation online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit independent contractor classification documentation. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out independent contractor classification documentation

How to fill out Independent Contractor Classification Documentation

01

Obtain the Independent Contractor Classification Documentation form from your employer or client.

02

Start by filling in your personal information such as your name, address, and Social Security number or Employer Identification Number.

03

Indicate the nature of services you will provide as an independent contractor.

04

Specify the terms of the contract, including payment details, duration of the contract, and any other relevant terms.

05

Provide information on your business structure (e.g., sole proprietorship, partnership, LLC) if applicable.

06

Sign and date the document to confirm your agreement to abide by the terms outlined.

Who needs Independent Contractor Classification Documentation?

01

Independent contractors who work for clients or companies and need to establish their status for tax purposes.

02

Businesses or organizations hiring independent contractors to legally classify their workers and comply with tax and labor regulations.

03

Freelancers seeking to clarify their independent status and maintain proper documentation for their clients.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of an independent contractor?

Dance instructors who select their own dance routines to teach, locate and rent their own facilities, provide their own sound systems, music and clothing, collect fees from customers, and are free to hire assistants are examples of independent contractors.

What is another name for an independent contractor?

Independent professionals go by many names: consultant, contractor, freelancer, self-employed, and small business owner may be used to accurately describe a non-employee who performs work for a company for a period of time for an agreed-upon price.

What is the difference between a freelance and an independent contractor?

What is a Freelancer? A freelancer is similar to an independent contractor, but they tend to work on a project-to-project basis and have multiple employers at the same time. Independent contractors will be on long-term contracts, where freelancers are usually hired on short-term contracts.

Am I a freelancer or independent contractor?

As a freelancer, you also have to manage invoicing and following up on payments. When you work as an independent contractor, you work on an hourly or project-based rate that may vary from client to client or job to job. If you work independently, you have control over setting and negotiating your rates.

What are methods to identify independent contractors?

Facts that provide evidence of the degree of control and independence fall into three categories: Behavioral: Does the company control or have the right to control what the worker does and how the worker does his or her job? Financial: Are the business aspects of the worker's job controlled by the payer?

What is it called when you are an independent contractor?

Independent contractors are considered to be self-employed, which means working for yourself rather than exclusively for an employer. Being an independent contractor means providing labour or services on a contractual basis as a non-employee. An independent contractor is self-employed.

How to write an independent contractor?

Below are eight important points to consider including in an independent contractor agreement. Define a Scope of Work. Set a Timeline for the Project. Specify Payment Terms. State Desired Results and Agree on Performance Measurement. Detail Insurance Requirements. Include a Statement of Independent Contractor Relationship.

What is the best structure for an independent contractor?

Sole proprietorship This simple structure is ideal for independent, individual contractors. You have full control of the enterprise, although there is no legal separation between you (the owner) and the business. A sole proprietorship is the easiest and most affordable option.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Independent Contractor Classification Documentation?

Independent Contractor Classification Documentation is a set of forms and information used to determine whether a worker is classified as an independent contractor or an employee for tax and legal purposes.

Who is required to file Independent Contractor Classification Documentation?

Businesses that hire workers and need to classify them as either independent contractors or employees are required to file Independent Contractor Classification Documentation.

How to fill out Independent Contractor Classification Documentation?

To fill out Independent Contractor Classification Documentation, provide the worker's personal information, the nature of the work performed, payment details, and factors that support the independent contractor classification.

What is the purpose of Independent Contractor Classification Documentation?

The purpose of Independent Contractor Classification Documentation is to ensure proper classification of workers to comply with tax regulations and avoid potential legal issues.

What information must be reported on Independent Contractor Classification Documentation?

The information that must be reported includes the worker's name, contact information, tax identification number, work details, payment terms, and the nature of the business relationship.

Fill out your independent contractor classification documentation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Independent Contractor Classification Documentation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.