Get the free Business credit application - PrimaFinancial

Show details

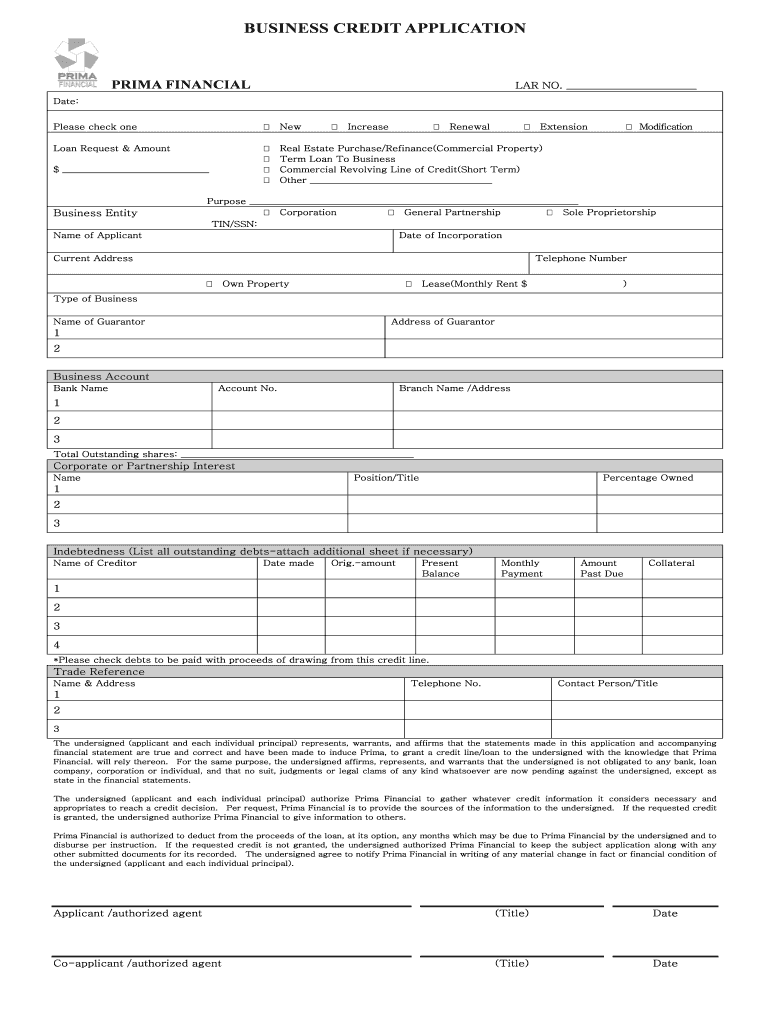

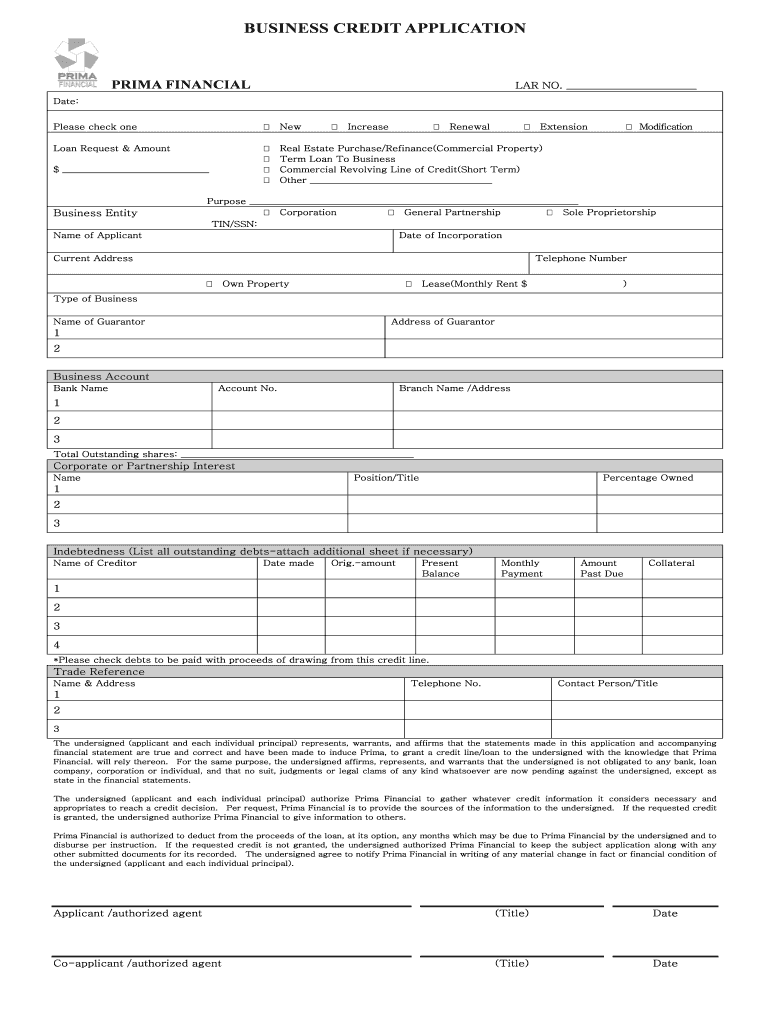

BUSINESS CREDIT APPLICATION PRIME FINANCIAL LAR NO. Date: Please check one New Loan Request & Amount Real Estate Purchase/Refinance(Commercial Property) Term Loan To Business Commercial Revolving

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business credit application

Edit your business credit application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business credit application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business credit application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit business credit application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business credit application

How to Fill Out a Business Credit Application:

01

Start by gathering all necessary documentation. This may include your business license, tax ID number, financial statements, and any other relevant legal or financial documents.

02

Read through the application carefully and ensure that you understand all the questions and requirements. Pay attention to any specific instructions or guidelines provided by the creditor.

03

Begin filling out the application by providing your basic business information, such as your company name, address, and contact details. Make sure to provide accurate and up-to-date information.

04

Next, provide details about your business structure, ownership, and legal status. Include information about any subsidiaries or affiliated companies if applicable.

05

Provide information about your business's financial history, such as your annual revenue, number of employees, and any outstanding debts or loans. Include details about any major clients or contracts that may be relevant.

06

Fill out the section that asks for your personal financial information. This may include your personal income, assets, liabilities, and credit history. Be honest and accurate in your responses.

07

If required, provide references from other suppliers, creditors, or business partners who can vouch for your reliability and creditworthiness. Include their contact information and any additional details that may support your application.

08

Review the completed application form thoroughly before submitting. Double-check for any errors or missing information. Ensure that you have included all necessary supporting documents and signatures.

Now, let's answer the question - Who needs a business credit application?

01

Any business that wishes to establish and build a separate credit history from its owners or shareholders.

02

Startups and small businesses seeking financing or credit facilities from financial institutions or lenders.

03

Businesses that aim to build relationships with suppliers and vendors who may require credit checks before extending trade credit or offering favorable payment terms.

04

Companies looking to lease or finance equipment or other assets.

05

Businesses planning to apply for credit cards or business lines of credit to manage cash flow or cover expenses.

06

Organizations seeking to participate in certain government or institutional programs that require credit checks or proof of financial stability.

Remember, a business credit application is an important tool to demonstrate your company's creditworthiness and financial stability to potential creditors or partners.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my business credit application directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign business credit application and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit business credit application in Chrome?

Install the pdfFiller Google Chrome Extension to edit business credit application and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I edit business credit application on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute business credit application from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is business credit application?

A business credit application is a form that a company fills out to request credit from a lender or supplier.

Who is required to file business credit application?

Any business looking to establish credit with a lender or supplier is required to file a business credit application.

How to fill out business credit application?

To fill out a business credit application, a company must provide detailed information about their business, including financial data and references.

What is the purpose of business credit application?

The purpose of a business credit application is to help lenders and suppliers assess the creditworthiness of a company before extending credit.

What information must be reported on business credit application?

Information that must be reported on a business credit application typically includes company details, financial statements, and trade references.

Fill out your business credit application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Credit Application is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.