Get the free non-pse capital withdrawal / rrsp roll-over / accumulated ...

Show details

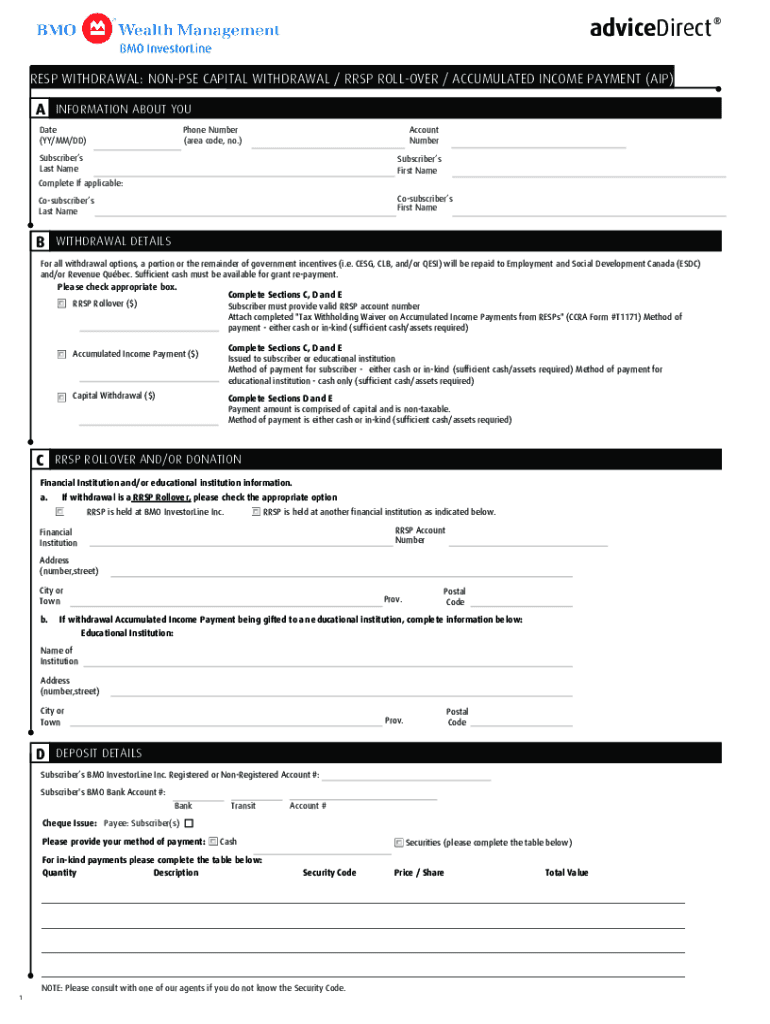

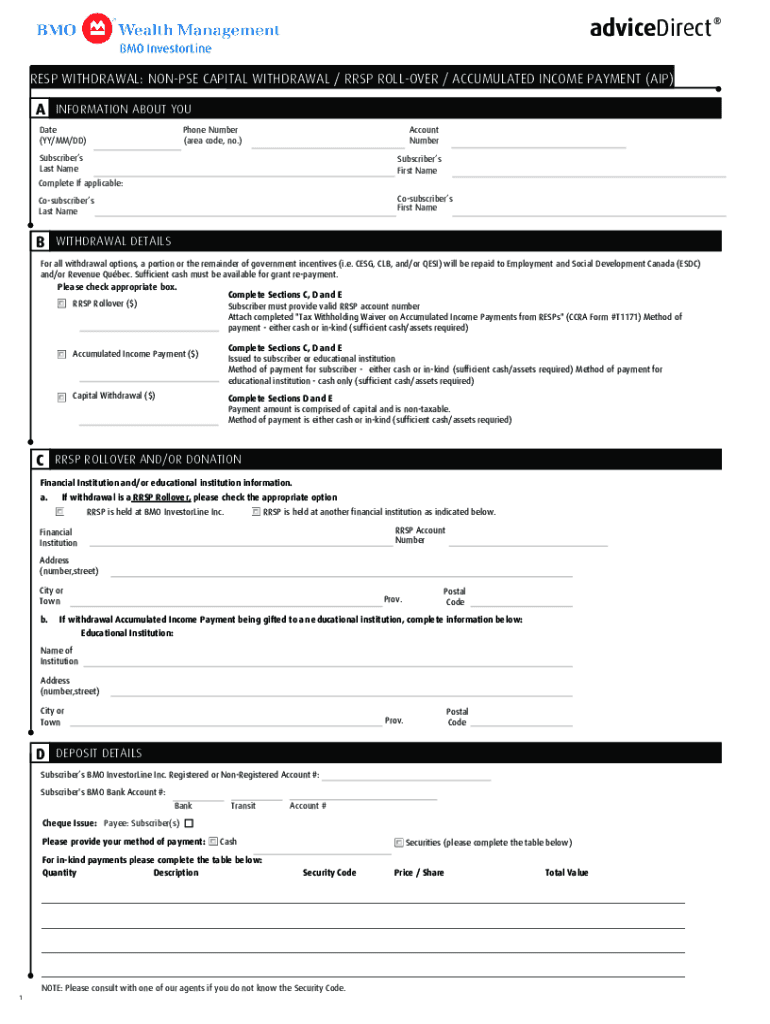

AdviceDirectReset Fortress WITHDRAWAL: NONPSE CAPITAL WITHDRAWAL / RESP ROLLOVER / ACCUMULATED INCOME PAYMENT (AIP)A INFORMATION ABOUT YOU

Date

(BY/MM/DD)Phone Number

(area code, no.) Account

NumberSubscribers

Last

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-pse capital withdrawal rrsp

Edit your non-pse capital withdrawal rrsp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-pse capital withdrawal rrsp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit non-pse capital withdrawal rrsp online

To use the professional PDF editor, follow these steps below:

1

Sign into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit non-pse capital withdrawal rrsp. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non-pse capital withdrawal rrsp

How to fill out non-pse capital withdrawal RRSP:

01

Gather the necessary documents: Before starting the process, make sure you have all the required documents, such as your RRSP account information, identification, and any relevant tax forms.

02

Determine your eligibility: Non-PSE (Post-Secondary Education) capital withdrawal from RRSPs is available for individuals who plan to use the funds for either their own post-secondary education or that of their spouse or common-law partner. Confirm that you meet the eligibility criteria before proceeding.

03

Complete the withdrawal form: Contact your RRSP provider and request the appropriate withdrawal form. Fill out the form accurately, providing all the necessary information, including your personal details, the amount you wish to withdraw, and the purpose of the withdrawal.

04

Provide supporting documentation: Along with the withdrawal form, you may need to submit supporting documentation, such as proof of enrollment in a post-secondary institution or an acceptance letter.

05

Submit the form: Once you have completed the form and gathered all the required documents, submit them to your RRSP provider following their specified instructions. Double-check that everything is signed and dated correctly.

06

Await confirmation: Your RRSP provider will review your withdrawal request and the supporting documentation. They will notify you by mail or email regarding the status of your request. This process usually takes a few business days.

07

Determine tax implications: It's crucial to understand the potential tax implications of withdrawing funds from your RRSP. Speak with a financial advisor or tax professional to ensure you are aware of any tax obligations associated with the withdrawal.

Who needs non-pse capital withdrawal RRSP:

01

Students pursuing post-secondary education: Non-PSE capital withdrawal RRSP is beneficial for individuals who plan to use the funds to finance their own post-secondary education, such as university or college.

02

Spouses or common-law partners of students: If you are married to or in a common-law relationship with a student, you may also be eligible to withdraw funds from your RRSP to support their post-secondary education expenses.

03

Individuals planning for education-related expenses: Even if you are not currently studying or have a partner who is a student, you may still require a non-PSE capital withdrawal RRSP if you are saving for future education-related expenses for yourself or your loved ones.

Note: It is important to consult with a financial advisor or tax professional to determine the suitability and implications of a non-PSE capital withdrawal RRSP based on your specific circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the non-pse capital withdrawal rrsp electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your non-pse capital withdrawal rrsp in seconds.

How do I edit non-pse capital withdrawal rrsp straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing non-pse capital withdrawal rrsp.

How do I complete non-pse capital withdrawal rrsp on an Android device?

On Android, use the pdfFiller mobile app to finish your non-pse capital withdrawal rrsp. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is non-pse capital withdrawal rrsp?

Non-PSE capital withdrawal RRSP refers to the withdrawal of capital from a Registered Retirement Savings Plan (RRSP) that does not involve a Pooled Registered Pension Plan (PRPP) or Specified Pension Plan (SPP).

Who is required to file non-pse capital withdrawal rrsp?

Individuals who have made non-PSE capital withdrawals from their RRSP are required to file the necessary forms for reporting these withdrawals to the Canada Revenue Agency (CRA).

How to fill out non-pse capital withdrawal rrsp?

To fill out the non-PSE capital withdrawal RRSP form, individuals must provide information about the amount withdrawn, the date of the withdrawal, and any applicable tax implications.

What is the purpose of non-pse capital withdrawal rrsp?

The purpose of reporting non-PSE capital withdrawals from an RRSP is to ensure that these transactions are properly documented for tax purposes and compliance with Canadian tax laws.

What information must be reported on non-pse capital withdrawal rrsp?

The information to be reported on the non-PSE capital withdrawal RRSP form includes the amount withdrawn, date of withdrawal, and any relevant tax details.

Fill out your non-pse capital withdrawal rrsp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Pse Capital Withdrawal Rrsp is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.