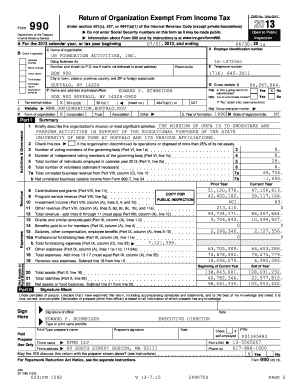

Get the free reports required to be filed by Section 13 or 15(d) of the Securities

Show details

SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-Q x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended June 30,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign reports required to be

Edit your reports required to be form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your reports required to be form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing reports required to be online

Follow the steps down below to use a professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit reports required to be. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out reports required to be

How to fill out reports required to be:

01

Gather all necessary information and documentation: Start by collecting all the relevant information and documents that are required to complete the report. This may include financial statements, expense receipts, sales data, or any other information specific to the report.

02

Understand the reporting guidelines: It is important to familiarize yourself with the guidelines and requirements for the specific report you are filling out. This could involve researching industry standards, consulting with superiors or colleagues, or referring to specific regulations or guidelines.

03

Organize the information: Once you have gathered all the necessary information, it is important to organize it in a clear and logical manner. This may involve creating tables, charts, or graphs to present the data effectively. Make sure all the information is accurate and up-to-date.

04

Follow the designated format: Many reports have a specific format that needs to be followed. Pay attention to headings, sections, and any other formatting requirements. This will help ensure that the report is clear, easy to read, and meets the necessary standards.

05

Provide detailed explanations and analysis: Depending on the nature of the report, it may be necessary to provide detailed explanations or analysis of the data. This could involve interpreting financial information, analyzing trends, or providing insights into the performance of a particular area or department.

06

Review and proofread: Before submitting the report, take the time to review and proofread it thoroughly. Check for any grammatical errors, typos, or inconsistencies. Consider having a colleague or supervisor review it as well to get a fresh perspective and catch any mistakes that may have been overlooked.

Who needs reports required to be:

01

Business owners and managers: Reports required to be are often necessary for business owners and managers to make informed decisions. These reports provide valuable insights and data that can help in strategic planning, financial analysis, and performance evaluation.

02

Regulatory bodies and government agencies: Various reports required to be are mandated by regulatory bodies and government agencies to ensure compliance with specific regulations or legislation. These reports may include financial statements, tax returns, environmental impact assessments, or safety reports.

03

Investors and stakeholders: Reports required to be are often used to communicate key financial and operational information to investors and stakeholders. These reports provide transparency and accountability, allowing investors to assess the performance and financial health of a company.

04

Auditors and accountants: Reports required to be are essential for auditors and accountants to assess the accuracy and integrity of financial information. These reports help auditors in conducting audits, evaluating internal controls, and ensuring compliance with accounting principles and standards.

05

Researchers and analysts: Researchers and analysts may require reports to conduct market research, industry analysis, or trend forecasting. These reports provide valuable data and insights that can be used to make informed decisions and recommendations.

In conclusion, filling out reports required to be involves gathering and organizing data, following specific guidelines and formats, providing analysis and explanations, and reviewing for accuracy. These reports are needed by various stakeholders, including business owners, regulatory bodies, investors, auditors, and researchers.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is reports required to be?

Reports required to be are documents or forms that must be submitted detailing specific information.

Who is required to file reports required to be?

Individuals, businesses, or organizations who are mandated by law or regulation to submit these reports are required to file reports required to be.

How to fill out reports required to be?

Reports required to be can typically be filled out online, through mail, or in person depending on the specific requirements.

What is the purpose of reports required to be?

The purpose of reports required to be is to provide information to relevant authorities or stakeholders for regulatory compliance, financial transparency, or decision-making purposes.

What information must be reported on reports required to be?

The specific information to be reported on reports required to be can vary, but typically includes financial data, operational details, or compliance information.

How can I send reports required to be for eSignature?

Once you are ready to share your reports required to be, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I make edits in reports required to be without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing reports required to be and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I fill out reports required to be using my mobile device?

Use the pdfFiller mobile app to fill out and sign reports required to be. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Fill out your reports required to be online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Reports Required To Be is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.