Get the free NON-RECOURSE AGREEMENT AND RELEASE

Show details

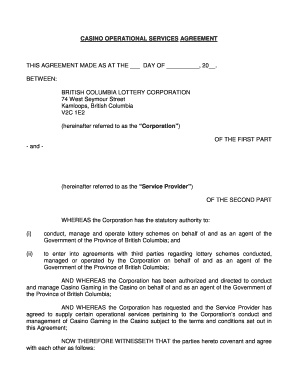

This document outlines the terms of a non-recourse agreement between a Company and a Beneficiary, detailing the release of a Shareholder from personal liability on a Promissory Note secured by a Deed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-recourse agreement and release

Edit your non-recourse agreement and release form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-recourse agreement and release form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit non-recourse agreement and release online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit non-recourse agreement and release. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non-recourse agreement and release

How to fill out NON-RECOURSE AGREEMENT AND RELEASE

01

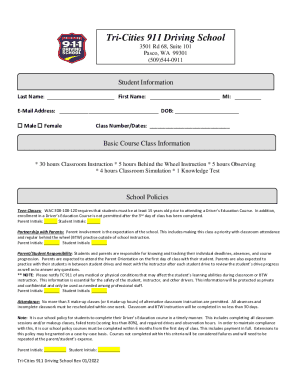

Read the entire Non-Recourse Agreement and Release document carefully to understand its terms and conditions.

02

Fill in the date at the top of the document.

03

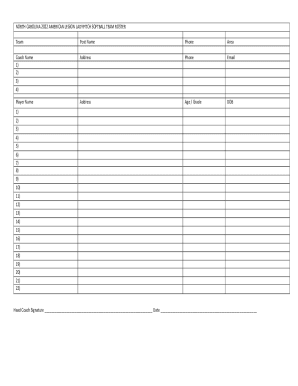

Provide the names and signatures of all parties involved in the agreement.

04

Clearly describe the nature of the transaction or agreement that this release pertains to.

05

Specify any limitations or specific conditions under which the agreement is valid.

06

Include disclaimers regarding liability and the extent of the non-recourse nature of the agreement.

07

Review the document for accuracy and completeness.

08

Make copies for all parties involved before finalizing.

Who needs NON-RECOURSE AGREEMENT AND RELEASE?

01

Individuals or entities entering into a financial transaction where a lender seeks to limit their liability to the collateral provided.

02

Investors looking to protect themselves in case of non-performance by the borrower.

03

Businesses involved in secured loans or financing arrangements.

04

Real estate developers seeking funding while limiting personal liability.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between factor with recourse and without recourse?

Recourse factoring is the most common and means that your company must buy back any invoices that the factoring company is unable to collect payment on. You are ultimately responsible for any non-payment. Non-recourse factoring means the factoring company assumes most of the risk of non-payment by your customers.

What is the meaning of with recourse and without recourse?

Recourse may allow the lender to seize not only pledged collateral, but also deposit accounts, and sources of income. Conversely, "without recourse" financing means that the lender takes the risk of non-payment by the obligor.

What is LC with recourse and without recourse?

- Bank's obligation: With Recourse allows the bank to claim reimbursement, while Without Recourse obliges the bank to bear losses. In general, Without Recourse BG/LC is considered a stronger guarantee, as the bank assumes full liability, providing greater assurance to the beneficiary.

What is the bad acts clause?

The term “Bad Acts” shall mean, with respect to either Landlord or Tenant, as applicable, any gross negligence, fraud, willful or intentional misconduct or criminal conduct by such party or any breach by such party of its respective duties, covenants and obligations under this Agreement that is both knowing, and either

What is a non-recourse agreement?

A nonrecourse debt (loan) does not allow the lender to pursue anything other than the collateral. For example, if a borrower defaults on a nonrecourse home loan, the bank can only foreclose on the home. The bank generally cannot take further legal action to collect the money owed on the debt.

What is the bad boy clause?

If triggered by enumerated bad acts, bad boy guarantees require the borrower and/or guarantor to be personally liable for damages to the lender, or alternatively, converts an otherwise non-recourse loan into a full-recourse loan as against the borrower or guarantor.

What is a non-recourse agreement?

Nonrecourse refers to a type of debt where the creditor may only look to the collateral to satisfy the unpaid loan , and not the debtor's personal assets (as with a recourse loan).

What is an example of a bad boy guarantee?

Actions that can trigger a bad boy guaranty include: Fraud. Misapplication of funds. Unauthorized transfers of the mortgaged real property or other collateral.

What is an example of a bad boy?

The bad boy is a cultural archetype that is variously defined and often used synonymously with the historic terms rake or cad: a male who behaves badly, especially within societal norms. Jim Stark, James Dean's character in Rebel Without a Cause, is considered an example of the bad boy archetype.

What is a non-recourse arrangement?

What does Non-recourse mean? A receivables purchase facility under which the receivables purchaser's right to recourse the receivables are limited. Typically the receivables purchaser may not recourse receivables if the relevant debtor becomes insolvent after the receivable was notified.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit non-recourse agreement and release from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your non-recourse agreement and release into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I fill out non-recourse agreement and release using my mobile device?

Use the pdfFiller mobile app to fill out and sign non-recourse agreement and release on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I fill out non-recourse agreement and release on an Android device?

Complete your non-recourse agreement and release and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is NON-RECOURSE AGREEMENT AND RELEASE?

A non-recourse agreement and release is a legal document in which one party agrees not to pursue further claims or actions against another party for certain liabilities, typically in situations involving loans or financing where the lender's only recourse for repayment is the collateral specified in the agreement.

Who is required to file NON-RECOURSE AGREEMENT AND RELEASE?

Typically, the borrower or party receiving financing is required to file a non-recourse agreement and release, as it outlines the terms of the loan and protects the lender from pursuing other assets beyond the specified collateral.

How to fill out NON-RECOURSE AGREEMENT AND RELEASE?

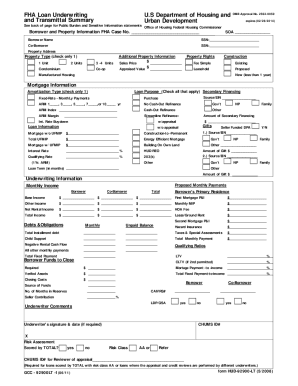

To fill out a non-recourse agreement and release, you should provide the following information: the names and addresses of the parties involved, a detailed description of the collateral, the terms of the loan including repayment details, and any specific clauses regarding the release of liability. It's advisable to have a legal professional review the document before signing.

What is the purpose of NON-RECOURSE AGREEMENT AND RELEASE?

The purpose of a non-recourse agreement and release is to define the terms under which a lender can recover the amount owed through specified collateral only, thereby limiting the lender's ability to pursue other assets of the borrower in case of default.

What information must be reported on NON-RECOURSE AGREEMENT AND RELEASE?

Key information that must be reported on a non-recourse agreement and release includes the identities of the parties, a clear description of the collateral securing the loan, the amount of the loan, the terms and conditions of repayment, and the specific release clauses that limit recourse.

Fill out your non-recourse agreement and release online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Recourse Agreement And Release is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.