Get the free Billing Report

Show details

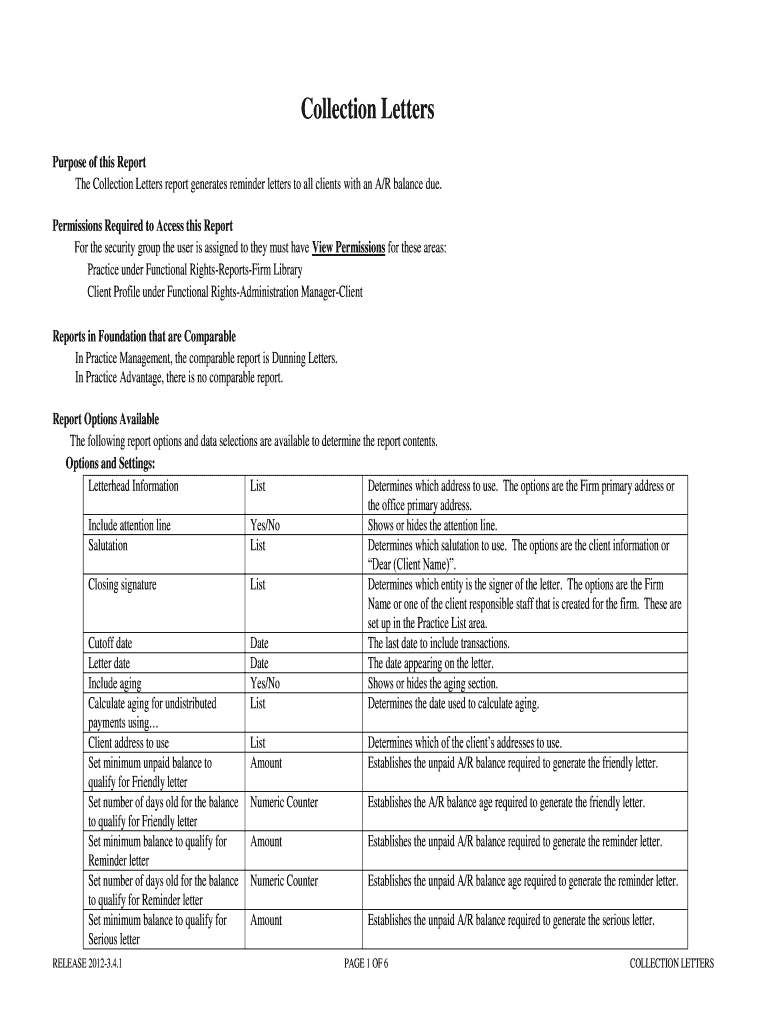

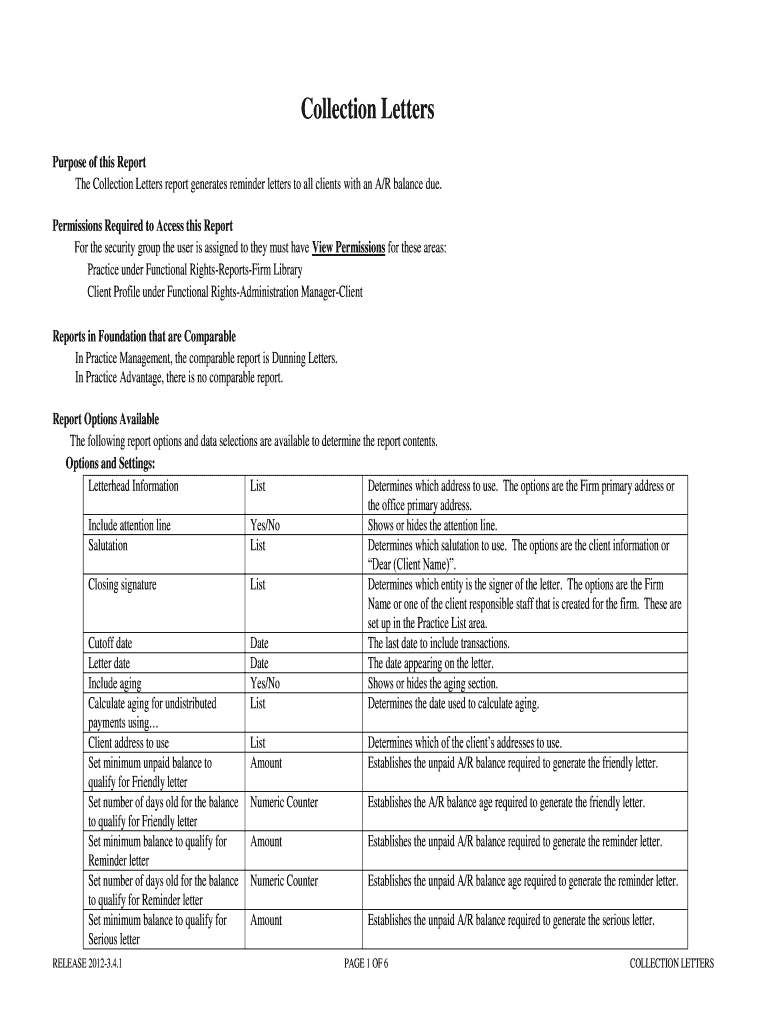

Collection Letters

Purpose of this Report

The Collection Letters report generates reminder letters to all clients with an A/R balance due.

Permissions Required to Access this Report

For the security

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign billing report

Edit your billing report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your billing report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing billing report online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit billing report. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out billing report

How to fill out a billing report:

01

Begin by gathering all relevant financial information such as invoices, receipts, and any supporting documents related to the transactions being reported.

02

Organize the information into a structured format, such as a spreadsheet or accounting software, with clearly labeled columns for the following details: customer/client name, invoice/receipt number, date, description of the charges, amount, and any applicable tax or discounts.

03

Double-check the accuracy of the data entered, ensuring that all numbers and calculations are correct. Accuracy is crucial to avoid any discrepancies or errors in the billing report.

04

Summarize the billing information by sorting or grouping it based on specific criteria, for example, by customer/client or by product/service provided. This will make the report more manageable and easier to analyze.

05

Include any additional information or details that may be required, depending on the purpose of the billing report. This could include explanations for any unusual charges or discrepancies, notes about payment terms or arrangements, and any other relevant information.

06

Proofread the billing report thoroughly, checking for any typos, formatting issues, or missing information. It's essential to present a professional and error-free report.

07

Save a copy of the completed billing report for future reference or auditing purposes. It's recommended to keep records of billing reports for a designated period of time, according to your organization's policies or legal requirements.

Who needs a billing report?

01

Businesses and organizations that provide goods or services on a credit or invoiced basis often require billing reports. These reports are essential for tracking and monitoring the financial transactions, revenue, and accounts receivable of the business.

02

Accounting departments rely on billing reports to generate accurate and up-to-date financial statements, including income statements and balance sheets. These reports help in evaluating the financial performance of an organization and making informed decisions.

03

Individuals or freelancers who invoice clients or customers may also benefit from creating billing reports to track their income and outstanding payments.

04

Government entities, regulatory bodies, or auditors may request billing reports to assess compliance, financial transparency, or to investigate any potential financial irregularities.

By following the steps outlined above, anyone can learn how to effectively fill out a billing report and understand who may need such reports for their specific requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my billing report directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your billing report as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I edit billing report on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing billing report, you need to install and log in to the app.

How do I edit billing report on an Android device?

The pdfFiller app for Android allows you to edit PDF files like billing report. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is billing report?

Billing report is a summary of financial transactions related to services or products rendered by a business to its customers.

Who is required to file billing report?

Any business or organization that provides goods or services and generates invoices for its customers is required to file a billing report.

How to fill out billing report?

To fill out a billing report, businesses need to include details of each invoice issued, such as date, amount, description of goods or services, and customer information.

What is the purpose of billing report?

The purpose of a billing report is to track and document all financial transactions between a business and its customers, ensuring accurate billing and payments.

What information must be reported on billing report?

Information such as invoice number, date, amount, customer name, item description, and payment status must be reported on a billing report.

Fill out your billing report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Billing Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.