Get the free Personal Loan Summary Box

Show details

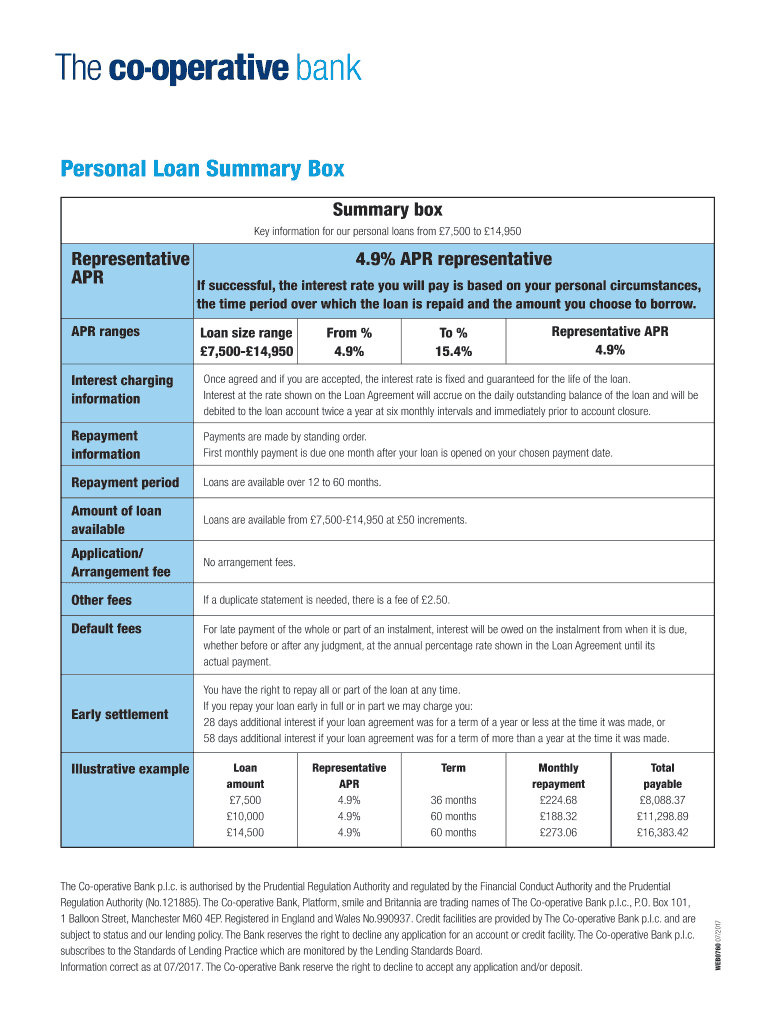

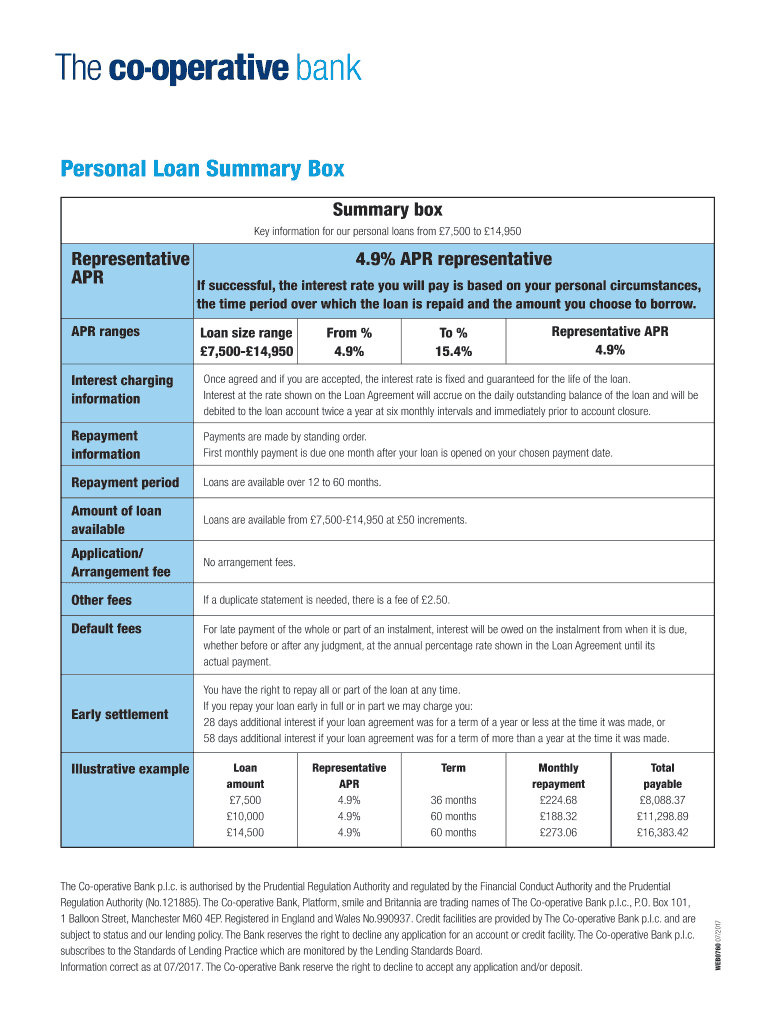

This document provides key information regarding personal loans available from £7,500 to £14,950, including APR rates, repayment terms, fees, and additional conditions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal loan summary box

Edit your personal loan summary box form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal loan summary box form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit personal loan summary box online

Follow the guidelines below to use a professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit personal loan summary box. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal loan summary box

How to fill out Personal Loan Summary Box

01

Gather all necessary information related to your personal loan, including the loan amount, interest rate, term length, and repayment schedule.

02

Locate the Personal Loan Summary Box on the application form or template.

03

Start by filling in the loan amount you are applying for in the appropriate section of the box.

04

Next, indicate the interest rate that will apply to your loan.

05

Specify the term length of the loan (in months or years) in the designated field.

06

Include the repayment schedule details, such as monthly payment amounts and due dates.

07

Review all entries for accuracy before submitting the form.

Who needs Personal Loan Summary Box?

01

Individuals applying for personal loans to better understand the terms of their loan.

02

Financial advisors or loan officers preparing loan documentation for clients.

03

Borrowers comparing different loan options to determine which best suits their financial needs.

Fill

form

: Try Risk Free

People Also Ask about

What is the summary of personal loan?

A personal loan is a loan that does not require collateral or security and is offered with minimal documentation. You can use the funds from this loan for any legitimate financial need. Like any other loan, you must repay it accordance to the agreed terms with the bank.

How do you write loan details?

A personal loan agreement should include the following information: Loan Amount. The amount of money being borrowed should be stated in the agreement. Interest Rate. Repayment Schedule. Payment Amount. Late Payment Penalties. Prepayment Terms. Collateral. Governing Law.

What is a loan summary?

Use the Loan Summary to record basic borrower and loan information. On the Loan Summary you can Enter borrower details, credit information, subject property information, and loan transaction details. You can also view milestone information and complete the qualification milestone.

How to read a personal loan statement?

Your bank statement of Personal Loan typically covers the following points: Loan account number: The unique ID assigned to your loan. Total loan amount: The original sum borrowed. Outstanding balance: The remaining amount that has to be repaid.

How to get loan summary?

The simplest way to get your loan details or know your loan outstanding balance is to go to the nearest branch of the lender and ask for assistance. A representative will ask for your account details. Once verified, you can get your statement.

How to write a loan summary?

Crafting an Effective Loan Summary Preparation Begin by clearly stating the loan's purpose and amount, followed by a brief overview of the borrower's creditworthiness and financial standing. Next, outline the loan terms, including interest rate, repayment period, and any collateral requirements.

How to write a personal loan document?

Information included on personal loan agreements include the names of both parties, the date of the agreement, the principal loan amount, the interest rate, and repayment terms. Personal loan agreements can be used as evidence in court if you fail to make payments.

What's the best thing to say for a personal loan?

Lenders often ask why you need a personal loan, and giving the right reason can help get your application approved. The best reasons include debt consolidation, covering medical bills, home repairs, or major purchases. These show lenders you're borrowing responsibly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Personal Loan Summary Box?

The Personal Loan Summary Box is a summary section that provides key details regarding personal loans, including amounts, terms, and borrower information.

Who is required to file Personal Loan Summary Box?

Lenders who issue personal loans are typically required to file the Personal Loan Summary Box as part of their reporting obligations to regulatory bodies.

How to fill out Personal Loan Summary Box?

To fill out the Personal Loan Summary Box, enter the necessary information such as loan amounts, interest rates, terms, borrower details, and relevant financial disclosures.

What is the purpose of Personal Loan Summary Box?

The purpose of the Personal Loan Summary Box is to provide a clear and concise overview of the loan details, ensuring transparency and compliance with financial regulations.

What information must be reported on Personal Loan Summary Box?

The information that must be reported includes the loan amount, interest rate, loan term, fees, borrower’s identity, payment schedule, and any relevant conditions tied to the loan.

Fill out your personal loan summary box online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Loan Summary Box is not the form you're looking for?Search for another form here.

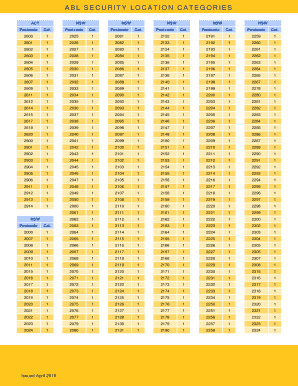

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.