Get the free Credit Report Authorization VERSION 3 - foundcom

Show details

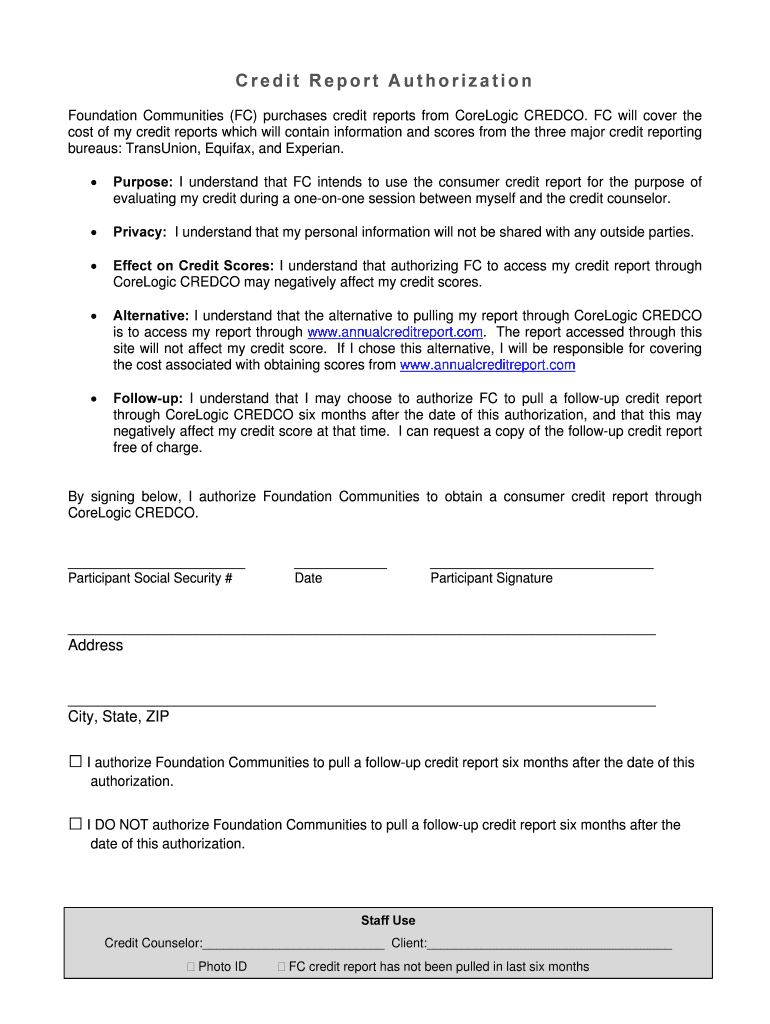

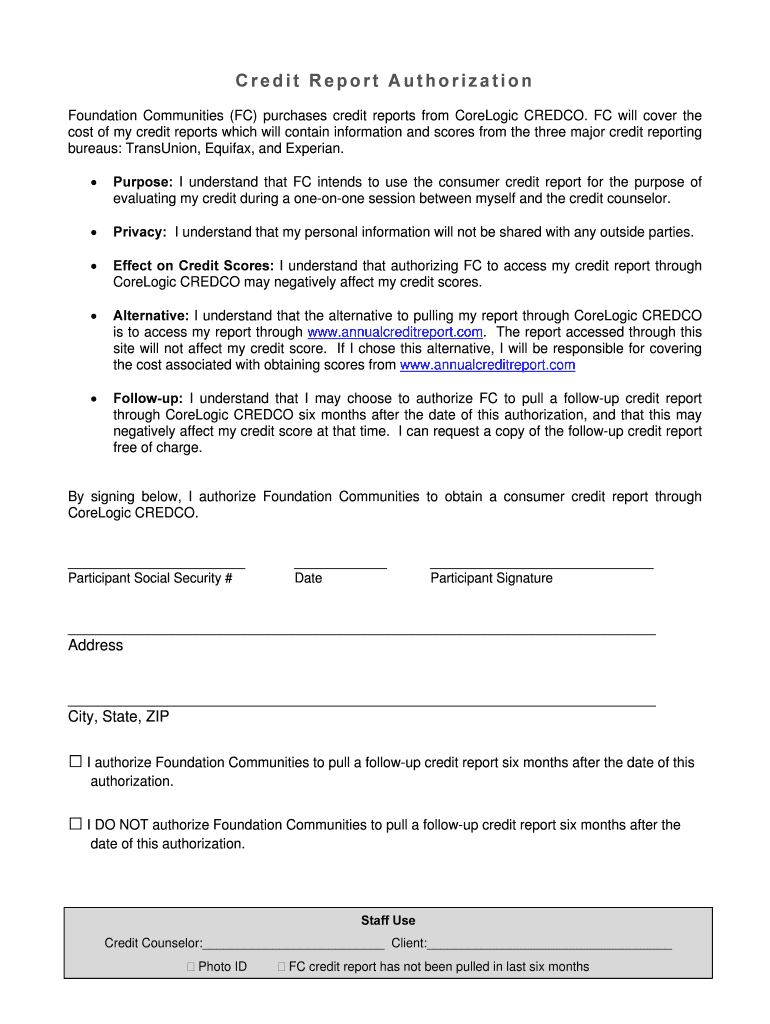

Credit Report Authorization Foundation Communities (FC) purchases credit reports from CoreLogic CREDO. FC will cover the cost of my credit reports which will contain information and scores from the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit report authorization version

Edit your credit report authorization version form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit report authorization version form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit report authorization version online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit credit report authorization version. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit report authorization version

How to fill out credit report authorization version and who needs it:

01

Begin by downloading the credit report authorization version form from a reputable website or obtaining it from your bank or lending institution.

02

Enter your personal information accurately and completely in the required fields. This typically includes your full name, current address, social security number, and date of birth. Make sure to double-check the information for any errors.

03

Provide details about the purpose for which you are requesting the credit report authorization version. Specify whether it is for a loan application, rental application, employment verification, or any other appropriate reason.

04

Review and acknowledge any terms and conditions mentioned in the form. This may involve agreeing to the release of your credit information to the party requesting the authorization or granting permission for the credit reporting agencies to provide your credit report.

05

Sign and date the form in the designated spaces. Ensure that your signature is legible and matches the name provided on the form.

06

Once you have completed the fillable form, make a copy for your own records before submitting it to the appropriate party or institution. In some cases, you may need to mail or hand-deliver the form, while others may allow for electronic submission.

Who needs credit report authorization version?

01

Individuals applying for a loan: Whether it's a mortgage, auto loan, personal loan, or any other type of financing, lenders require a credit report authorization version to assess the borrower's creditworthiness.

02

Landlords/property managers: When renting a property, many landlords require potential tenants to authorize a credit check to evaluate their reliability and ability to make timely rent payments.

03

Employers: Some employers may require a credit report authorization version as part of the pre-employment background check process, particularly for positions with financial responsibilities or access to sensitive financial information.

04

Insurance companies: Certain insurance providers may request a credit report authorization version to help determine insurance rates or assess the level of risk associated with providing coverage.

05

Creditors and financial institutions: Existing creditors or financial institutions may request a credit report authorization version to review and update your creditworthiness for ongoing credit relationships or to assess eligibility for additional credit products.

Remember to always read and understand the terms and conditions of any credit report authorization version before providing your consent. It is essential to protect your personal information and ensure that it is used for legitimate purposes only.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find credit report authorization version?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the credit report authorization version in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I execute credit report authorization version online?

pdfFiller makes it easy to finish and sign credit report authorization version online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit credit report authorization version in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your credit report authorization version, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

What is credit report authorization version?

Credit report authorization version is a form or document that authorizes a lender to access an individual's credit report.

Who is required to file credit report authorization version?

Any individual applying for a loan, mortgage, or credit line may be required to file a credit report authorization version.

How to fill out credit report authorization version?

To fill out a credit report authorization version, the individual must provide their personal information, such as name, address, social security number, and signature.

What is the purpose of credit report authorization version?

The purpose of credit report authorization version is to grant permission to a lender to pull and review an individual's credit report for the purpose of evaluating creditworthiness.

What information must be reported on credit report authorization version?

The information reported on a credit report authorization version typically includes the individual's personal information, consent to pull credit report, and authorization to use the information for credit evaluation purposes.

Fill out your credit report authorization version online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Report Authorization Version is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.