Get the free Insurance Property Checklist - CAA Manitoba

Show details

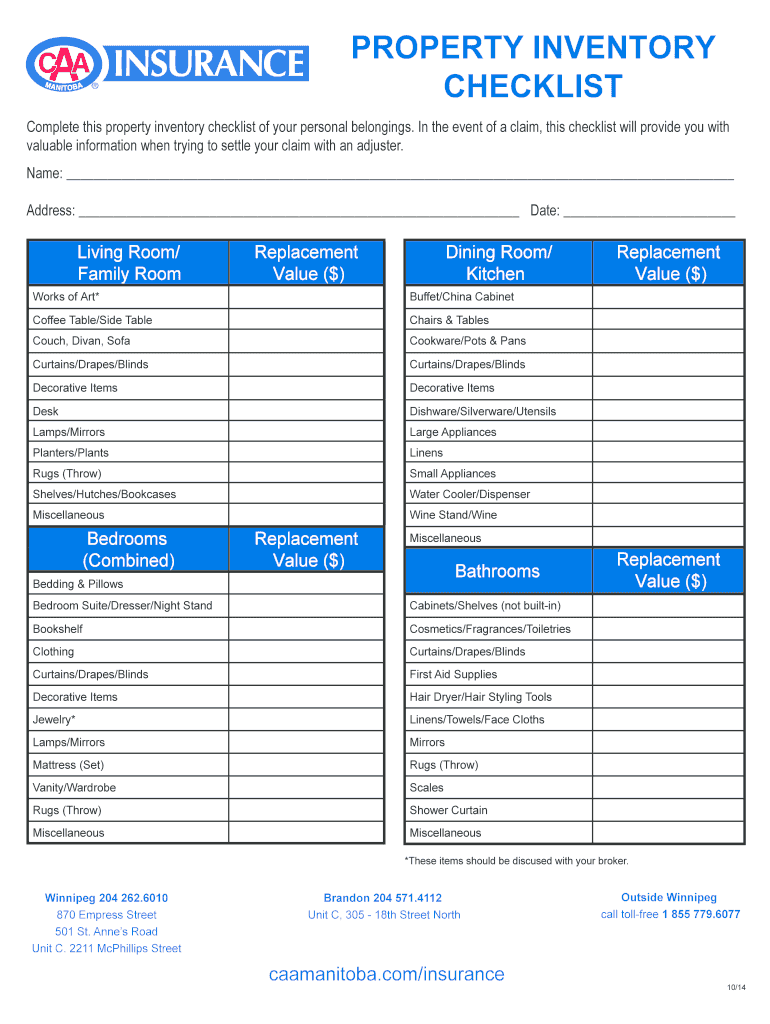

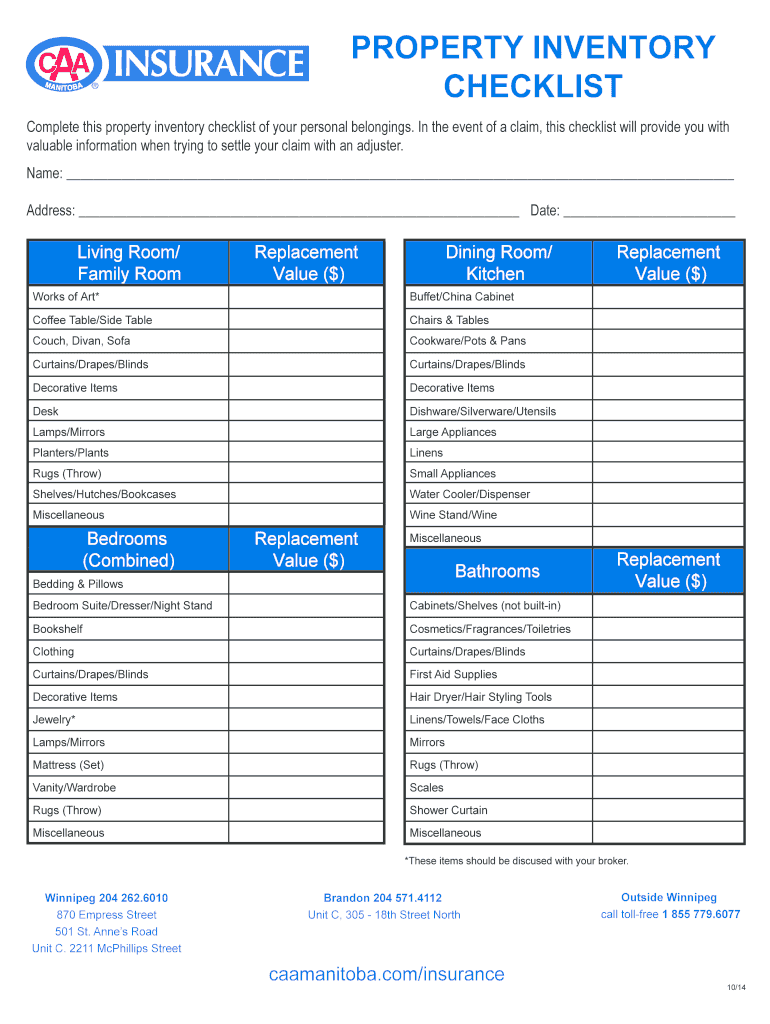

PROPERTY INVENTORY CHECKLIST Complete this property inventory checklist of your personal belongings. In the event of a claim, this checklist will provide you with valuable information when trying

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign insurance property checklist

Edit your insurance property checklist form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insurance property checklist form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit insurance property checklist online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit insurance property checklist. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out insurance property checklist

How to fill out an insurance property checklist:

01

Start by gathering all necessary documents and information related to your property, such as ownership documents, previous insurance policies, and any relevant receipts or appraisals.

02

Begin filling out the checklist by documenting the basic information about your property, including its address, type (e.g., house, apartment, commercial building), and usage (e.g., primary residence, rental property).

03

Assess the value of your property by evaluating its replacement cost. This involves estimating the cost to rebuild or repair the property in case of damage or loss. Include any valuable items or upgrades that should be considered in the overall value.

04

Document the details of your property's structure, including the number of rooms, bathrooms, and any additional features such as a swimming pool, garage, or basement.

05

Evaluate the security measures in place to protect your property, such as burglar alarms, fire alarms, sprinkler systems, or security cameras. Make sure to include any certifications or evidence of these measures.

06

Consider any external factors or risks that may affect your property, such as the proximity to a flood zone, earthquake-prone areas, or high-crime neighborhoods. Note any special coverage or precautions needed for these risks.

07

Review your insurance policy options to ensure comprehensive coverage for your property. Consider factors such as liability coverage, contents coverage, and additional riders or endorsements that may be necessary based on your property's specific needs.

08

Keep in mind any unique features or special considerations for your property, such as historical significance, rare artwork or antiques, or specialized equipment. These may require additional documentation or specific insurance coverage.

Who needs an insurance property checklist:

01

Homeowners: Anyone who owns a property, whether it's a house, condo, or vacation home, should have an insurance property checklist. This helps ensure that all essential details of the property are properly documented for insurance purposes.

02

Rental property owners: Landlords who own rental properties should maintain an insurance property checklist to accurately assess the value of their investment and determine appropriate coverage for potential damages caused by tenants or other risks.

03

Business owners: Commercial property owners, including those who own retail stores, offices, or warehouses, need an insurance property checklist to evaluate the value of their business assets and protect against potential risks and liabilities.

04

Property managers: Individuals or companies responsible for managing multiple properties, such as apartment complexes or condominium associations, can benefit from an insurance property checklist to keep track of important details for each property and ensure overall coverage.

In conclusion, filling out an insurance property checklist involves gathering necessary documents, assessing the value and details of the property, considering security measures and risks, reviewing insurance policy options, and documenting any unique features or considerations. This checklist is essential for homeowners, rental property owners, business owners, and property managers to accurately evaluate their assets and ensure adequate insurance coverage.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my insurance property checklist directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your insurance property checklist and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I edit insurance property checklist online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your insurance property checklist to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I complete insurance property checklist on an Android device?

Complete your insurance property checklist and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is insurance property checklist?

Insurance property checklist is a document used to assess and document the condition of a property for insurance purposes.

Who is required to file insurance property checklist?

Property owners or managers are typically required to file insurance property checklist.

How to fill out insurance property checklist?

Insurance property checklist should be filled out by providing accurate information about the property's condition, features, and potential risks.

What is the purpose of insurance property checklist?

The purpose of insurance property checklist is to help insurance companies evaluate the risk associated with insuring a specific property.

What information must be reported on insurance property checklist?

Information such as property details, safety features, hazards, and previous insurance claims must be reported on insurance property checklist.

Fill out your insurance property checklist online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Insurance Property Checklist is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.