Get the free Personal Credit Card Application

Show details

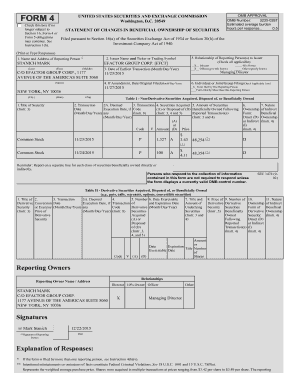

An application form for individuals wishing to apply for a Personal Credit Card, requiring personal and financial information from both primary applicants and co-signers.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal credit card application

Edit your personal credit card application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal credit card application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing personal credit card application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit personal credit card application. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal credit card application

How to fill out Personal Credit Card Application

01

Gather your personal identification documents, such as your driver's license or passport.

02

Collect information on your income, including employment details and monthly salary.

03

Prepare your social security number or taxpayer identification number.

04

Choose the type of credit card you want to apply for based on your needs and credit history.

05

Visit the bank or credit card issuer's website or physical location to access the application form.

06

Fill out the application form with accurate personal details, including your address and contact information.

07

Specify your income and employment details as required on the form.

08

Review the credit card terms and conditions before submitting the application.

09

Submit the application form along with any required documents as instructed.

10

Wait for a response from the issuer regarding your application status.

Who needs Personal Credit Card Application?

01

Individuals looking to establish or improve their credit history.

02

People wanting to make purchases online or in-store without using cash.

03

Individuals who need a financial backup for emergencies or unexpected expenses.

04

Students seeking to build credit while managing their own finances.

05

Those who want to take advantage of rewards, cashback, or travel points offered by credit cards.

Fill

form

: Try Risk Free

People Also Ask about

What is the golden rule of credit cards?

The golden rule of Credit Cards is simple: pay your full balance on time, every time. This Credit Card payment rule helps you avoid interest charges, late fees, and potential damage to your credit score.

What is the 5 24 rule for credit cards?

Chase's 5/24 rule means that you can't be approved for most Chase cards if you've opened five or more personal credit cards (from any card issuer) within the past 24 months.

What is the 1 6 rule?

You can have as many business cards as you'd like, and they don't count against your 5/24 status. But for this rule, you cannot get one personal and one business card within 6 months. It's a 1 card per 6 month policy, regardless of whether the cards are personal or business.

How to get a credit card personal?

Get all your documents ready – a bank will usually ask for identity, address and income proofs. If you are an existing customer that may not be necessary. Apply online or at an ATM or visit your nearest branch with the required documents.

What is the 2 3 4 rule for credit cards?

1. What is the 2/3/4 rule for credit cards? The 2/3/4 rule generally refers to application limits for certain issuers, like Chase, meaning no more than 2 cards in 30 days, 3 in 90 days, and 4 in 120 days. This helps prevent excessive applications in a short time frame.

What is the easiest credit card to get approved for?

The OpenSky® Secured Visa® Credit Card could be a good option if you're struggling to get approved for your first credit card. This card has an approval rate of 89%, according to its website (based on Q1 2024).

How to get a US credit card for non-residents?

Requirements for Non-Residents Applying for a U.S. Credit Card Legal Residency. Some credit card issuers may ask for proof of your legal residency status, such as a visa or green card. Credit History. Most U.S. credit cards require applicants to have a credit history. SSN or ITIN. U.S. Billing Address.

What is the 50 30 20 rule for credit cards?

This budgeting method divides your monthly income among three main categories: 50% for needs, 30% for wants and 20% for savings and debt repayment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Personal Credit Card Application?

A Personal Credit Card Application is a formal request submitted by an individual to a financial institution or credit card issuer to obtain a credit card for personal use.

Who is required to file Personal Credit Card Application?

Individuals who wish to obtain a personal credit card must file a Personal Credit Card Application, typically including those over the age of 18 with a valid identification and a steady income.

How to fill out Personal Credit Card Application?

To fill out a Personal Credit Card Application, one must provide personal information such as name, address, Social Security number, income details, and employment information, and then review the application for accuracy before submitting it to the credit card issuer.

What is the purpose of Personal Credit Card Application?

The purpose of a Personal Credit Card Application is to assess the applicant's creditworthiness and financial background to determine eligibility for a personal credit card.

What information must be reported on Personal Credit Card Application?

The information typically required on a Personal Credit Card Application includes personal identification details, income information, employment status, and existing debt obligations, among other financial disclosures.

Fill out your personal credit card application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Credit Card Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.