Get the free STANDBY LETTER OF CREDIT APPLICATION

Show details

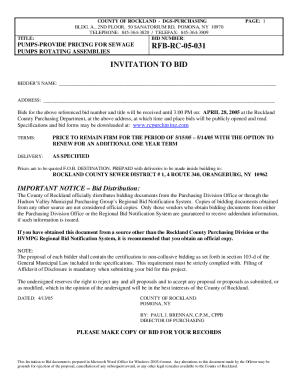

This document is a formal application to issue an irrevocable standby letter of credit through FirstMerit Bank, N.A., including various options and requirements related to the issuance of that credit.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign standby letter of credit

Edit your standby letter of credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your standby letter of credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing standby letter of credit online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit standby letter of credit. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out standby letter of credit

How to fill out STANDBY LETTER OF CREDIT APPLICATION

01

Obtain the Standby Letter of Credit Application form from your financial institution.

02

Fill in your personal or business details, including name and address.

03

Provide the name and address of the beneficiary who will receive the credit.

04

Specify the amount of the standby letter of credit.

05

Indicate the purpose of the letter of credit, including any specific terms and conditions.

06

Include the duration for which the standby letter of credit will be valid.

07

Provide any relevant documentation that supports the application, if required.

08

Review all information for accuracy and completeness.

09

Sign and date the application in the designated area.

10

Submit the completed application to your bank or financial institution.

Who needs STANDBY LETTER OF CREDIT APPLICATION?

01

Individuals or businesses looking to secure a financial obligation.

02

Contractors who need to assure clients of project completion.

03

Exporters wanting to guarantee payment from foreign buyers.

04

Companies involved in government contracts requiring financial assurance.

Fill

form

: Try Risk Free

People Also Ask about

What's the difference between LC and SBLc?

A Standby Letter of Credit is different from a Letter of Credit. An SBLC is paid when called on after conditions have not been fulfilled. However, a Letter of Credit is the guarantee of payment when certain specifications are met and documents received from the selling party.

How to apply for an SBLc?

Here's a step-by-step breakdown of the SBLC application process: Application Form: Fill out the application form provided by the bank. Document Submission: Submit all required documents as outlined by your bank. Application Review: The bank will review your application and documents to ensure they meet their criteria.

How do I get a standby letter of credit?

The process of obtaining an SBLC is similar to a loan application process. The process starts when the buyer applies for an SBLC at a commercial bank. The bank will perform its due diligence on the buyer to assess its creditworthiness, based on past credit history and the most recent credit report.

Is SBLc a collateral?

The SBLC itself is not usually considered collateral. However, a bank may require the buyer to provide collateral before issuing an SBLC if the bank feels the buyer's creditworthiness is not up to par.

What are the disadvantages of SBLc?

One of the main risks is that the applicant might lose the SBLC amount if the beneficiary makes a wrongful or fraudulent demand on the bank. This could happen if the beneficiary misinterprets or breaches the contract, or if there is a disagreement or dispute over the performance or quality of the goods or services.

What is a standby letter of credit with an example?

Financial SBLC For example, if a crude oil company ships oil to a foreign buyer with an expectation that the buyer will pay within 30 days from the date of shipment, and the payment is not made by the required date, the crude oil seller can collect the payment for goods delivered from the buyer's bank.

What is a standby letter of credit example?

Definition: Ensures repayment in case an advance payment is made but the agreed-upon goods or services are not delivered. Example: A manufacturer receiving an advance payment for a large order might provide an Advance Payment SBLC to assure the buyer that the products will be delivered as agreed.

What is SBLC in English?

A Standby Letter of Credit (SBLC / SLOC) is a guarantee that is made by a bank on behalf of a client, which ensures payment will be made even if their client cannot fulfill the payment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is STANDBY LETTER OF CREDIT APPLICATION?

A Standby Letter of Credit Application is a request submitted by a customer to a bank, asking the bank to issue a standby letter of credit. This financial instrument serves as a guarantee for payment, ensuring that the bank will pay the beneficiary if the customer fails to meet their financial or contractual obligations.

Who is required to file STANDBY LETTER OF CREDIT APPLICATION?

Any individual or business entity that seeks to establish a standby letter of credit with a bank must file an application. This typically includes parties involved in commercial transactions where assurance of payment is necessary.

How to fill out STANDBY LETTER OF CREDIT APPLICATION?

To fill out a Standby Letter of Credit Application, you must provide details including your personal or business information, the beneficiary's details, the amount and type of credit requested, the purpose of the letter of credit, and any specific conditions or expiration dates.

What is the purpose of STANDBY LETTER OF CREDIT APPLICATION?

The purpose of the Standby Letter of Credit Application is to formalize a request for a standby letter of credit, which acts as a safety net in financial transactions, protecting the interests of the beneficiary by ensuring payment in case of default by the applicant.

What information must be reported on STANDBY LETTER OF CREDIT APPLICATION?

The information that must be reported on a Standby Letter of Credit Application includes the applicant's name and address, the beneficiary's name and address, the amount of credit sought, the specific terms of the credit, and any relevant dates or conditions pertaining to the agreement.

Fill out your standby letter of credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Standby Letter Of Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.