Get the free Non-Owned Auto Coverage - Garage - Argenia

Show details

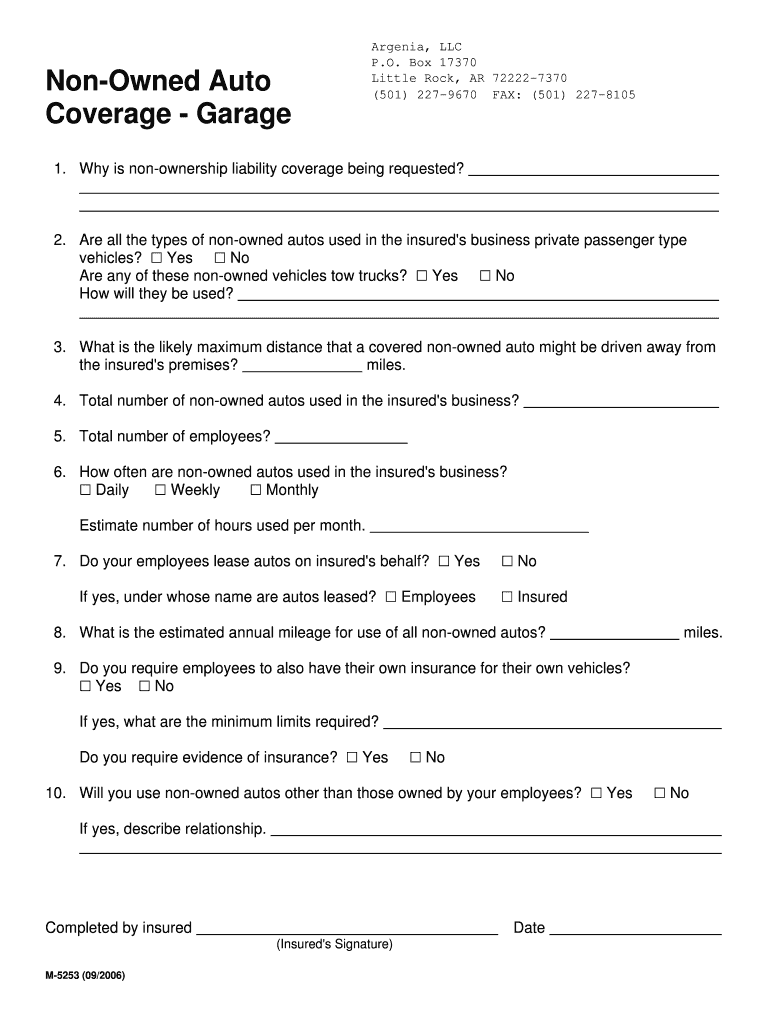

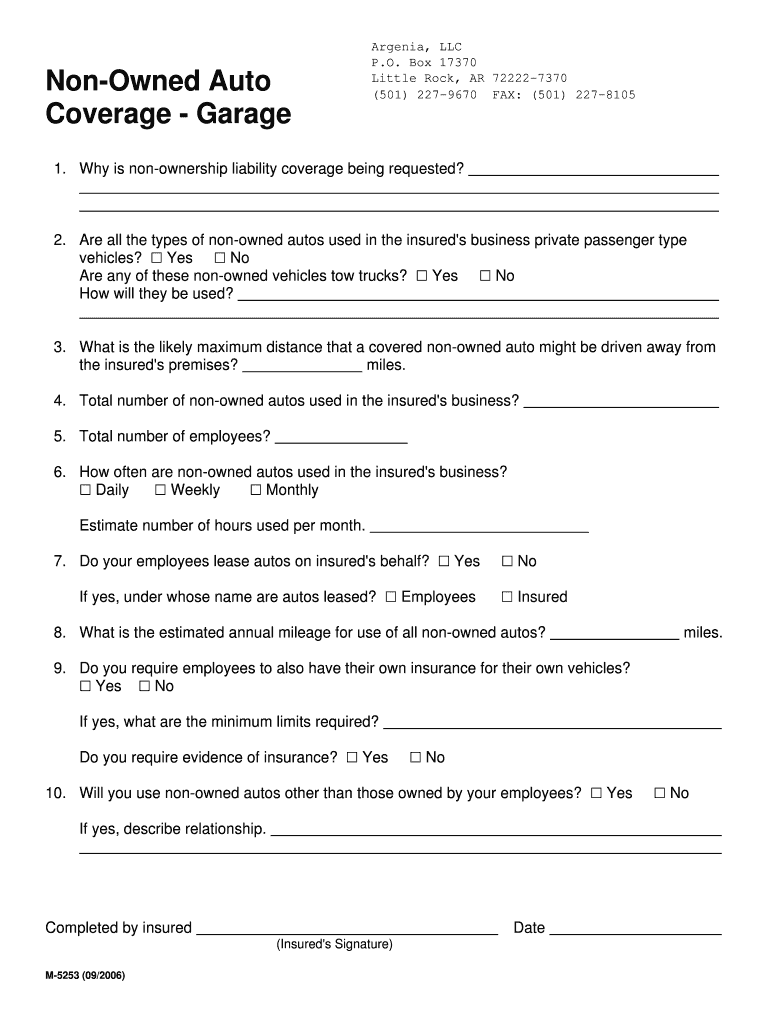

Renowned Auto Coverage Garage Armenia, LLC P.O. Box 17370 Little Rock, AR 722227370 (501) 2279670 FAX: (501) 2278105 1. Why is nonownership liability coverage being requested? 2. Are all the types

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-owned auto coverage

Edit your non-owned auto coverage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-owned auto coverage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit non-owned auto coverage online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit non-owned auto coverage. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non-owned auto coverage

How to fill out non-owned auto coverage:

01

Gather necessary information: Before filling out non-owned auto coverage, you'll need to gather specific details. This includes information about the vehicle you intend to drive, such as the make, model, and year, as well as its identification number (VIN). Additionally, you'll need to provide personal information like your name, address, and driver's license number.

02

Contact your insurance provider: Reach out to your insurance company to inquire about adding non-owned auto coverage to your policy. They will provide you with the necessary forms or guide you through the process online.

03

Review coverage options: Make sure to thoroughly review the coverage options available to you when filling out non-owned auto coverage. This could include liability coverage, which pays for damages or injuries in the event of an accident, or physical damage coverage, which protects against theft, vandalism, or collision damage to the vehicle.

04

Select coverage limits: Determine the appropriate coverage limits for your non-owned auto coverage. Consider the value of the vehicle you'll be driving and the potential risks associated with it. Higher coverage limits may provide more protection, but they may also come with higher premiums.

05

Provide accurate information: Ensure that all the information you provide on the non-owned auto coverage form is accurate and up to date. Any errors or omissions could potentially result in a denial of coverage or complications if you need to file a claim in the future.

06

Pay the premium: Once you have completed the form and selected your coverage options, you will be required to pay the premium for the non-owned auto coverage. The cost will vary depending on factors such as your driving history, location, and insurance provider.

Who needs non-owned auto coverage:

01

Individuals who frequently rent or borrow vehicles: Non-owned auto coverage is particularly relevant for individuals who regularly rent or borrow cars or other vehicles. It provides protection in case of an accident or damage to the vehicle that they do not own.

02

Employees who use personal vehicles for work purposes: If you use your personal vehicle for work-related activities, such as running errands or making deliveries, it is crucial to have non-owned auto coverage. This coverage will protect you in case of an accident or damage while you are using your vehicle for work.

03

Businesses that rely on employee vehicle usage: Businesses that allow employees to use their personal vehicles for work purposes should consider providing non-owned auto coverage. This coverage safeguards both the employee and the business in case of accidents or damages that occur during work-related driving.

Overall, anyone who may have access to vehicles that they do not personally own or who relies on personal vehicles for work purposes should consider obtaining non-owned auto coverage to protect themselves and others in the event of an accident or damage.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my non-owned auto coverage directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your non-owned auto coverage and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I complete non-owned auto coverage online?

pdfFiller has made it simple to fill out and eSign non-owned auto coverage. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How can I fill out non-owned auto coverage on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your non-owned auto coverage from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is non-owned auto coverage?

Non-owned auto coverage provides liability protection for employees who use their own vehicles for business purposes.

Who is required to file non-owned auto coverage?

Employers are typically required to file non-owned auto coverage to protect their employees while they are using their personal vehicles for work.

How to fill out non-owned auto coverage?

Non-owned auto coverage can be filled out by providing information about the company, employee driving record, type of coverage needed, and other relevant details.

What is the purpose of non-owned auto coverage?

The purpose of non-owned auto coverage is to provide liability protection for employees and employers in case of an accident while using a personal vehicle for work.

What information must be reported on non-owned auto coverage?

Information such as employee name, driver's license number, vehicle make and model, coverage limits, and proof of insurance may be required for non-owned auto coverage.

Fill out your non-owned auto coverage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Owned Auto Coverage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.