Get the free sbi life insurance maturity form pdf

Show details

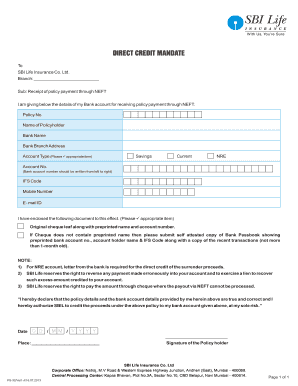

This document is used for the maturity claim and advance discharge of an insurance policy, facilitating the process to receive maturity proceeds and providing necessary details associated with the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sbi life insurance maturity

Edit your sbi life insurance maturity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sbi life insurance maturity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sbi life insurance maturity online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sbi life insurance maturity. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sbi life insurance maturity

How to fill out maturity discharge voucher:

01

Obtain the maturity discharge voucher form from the relevant financial institution or download it from their website.

02

Carefully read the instructions provided on the form or any accompanying guide to understand the required information and documentation.

03

Fill in your personal information such as your full name, address, contact details, and identification number as requested.

04

Provide the necessary details regarding the maturity of the financial instrument, such as the account number, date of maturity, and the type of investment.

05

If applicable, indicate any reinvestment options or instructions regarding the maturity proceeds.

06

Double-check all the information you have entered to ensure its accuracy and make any necessary corrections before submitting the form.

07

Sign and date the maturity discharge voucher as required.

08

Attach any supporting documents or proof of identity that may be requested by the financial institution.

09

Submit the completed voucher to the designated authority, either in person or by post, as per the instructions mentioned on the form.

Who needs maturity discharge voucher:

01

Individuals who have invested in financial instruments such as fixed deposits, bonds, or certificates of deposit that are reaching maturity.

02

Customers of banks, credit unions, or other financial institutions who have chosen to receive their maturity proceeds by using a discharge voucher.

03

It is essential for all those who meet the above criteria and wish to redeem their investment and collect the maturity amount.

Fill

form

: Try Risk Free

People Also Ask about

Is LIC maturity amount guaranteed?

Now, when your tenure ends and if you outlive the policy period, LIC is likely to pay you the complete sum assured. This amount is called the maturity benefit.

What will be the amount of LIC after maturity?

Q: How much maturity benefit can one expect on the expiration of the LIC policy? Ans: If the insured or policyholder meets the terms of the policy at the expiration of the policy, they are entitled to receive 40% of the initial Sum assured in addition to various related bonuses and also the additional bonus amount.

What is claim discharge voucher?

A discharge voucher or settlement intimation voucher is a signed form the insurer takes from the insured. Such a voucher is taken at the time of claim settlement. The form states the amount that will be payable to the customer and he/she has to acknowledge the amount by signing the form.

How can I claim my SBI Life maturity amount?

Mandatory Documents Claim Form. Certificate of Insurance. Original Death Certificate issued by Local Authority OR Attested* copy of Death Certificate. Banker's Certificate (Only for Super Suraksha – Home Loan, Car Loan, Tractor Loan Policies) Claimant's current address proof. Claimant's photo ID proof.

How can I claim my LIC maturity amount?

Maturity Claims: The servicing Branch usually sends maturity claim intimations two months in advance. Please submit your Discharged Receipt in Form No.3825 with original policy document atleast one month before the due date so that the payment is received before the due date of maturity claim.

What is maturity of LIC policy?

Maturity Amount of LIC Plans The maturity amount is calculated by adding the sum assured, which is decided upon by the customer and the company at the time of purchasing the plan, the bonus amounts or profits received throughout the plan's tenure, and additional bonuses if mentioned by the Corporation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sbi life insurance maturity to be eSigned by others?

When your sbi life insurance maturity is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit sbi life insurance maturity online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your sbi life insurance maturity to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I complete sbi life insurance maturity on an Android device?

Complete your sbi life insurance maturity and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is maturity discharge voucher?

A maturity discharge voucher is a document that signifies the completion of a financial obligation, such as a loan or investment, and serves as proof of discharge or settlement of that obligation.

Who is required to file maturity discharge voucher?

The borrower or the investor who has completed the term of their investment or loan agreement is required to file a maturity discharge voucher to officially close out the account.

How to fill out maturity discharge voucher?

To fill out a maturity discharge voucher, individuals must provide their personal details, account information, asset type, maturity date, and signatures as required by the lending or investment institution.

What is the purpose of maturity discharge voucher?

The purpose of a maturity discharge voucher is to document the settlement of a loan or investment, providing a formal acknowledgment that all obligations have been met and the account is closed.

What information must be reported on maturity discharge voucher?

The information that must be reported on a maturity discharge voucher typically includes the borrower or investor's name, account number, maturity date, details of the transaction, and necessary signatures.

Fill out your sbi life insurance maturity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sbi Life Insurance Maturity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.