Get the free TRUST TRANSFER DEED - Western Resources Title

Show details

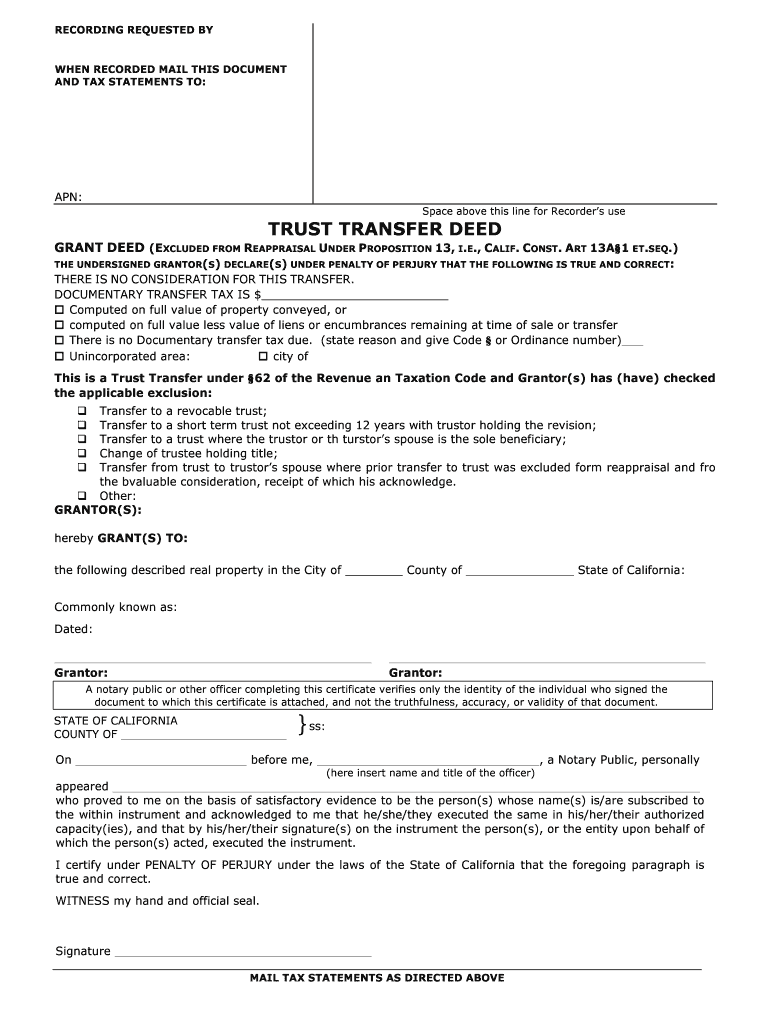

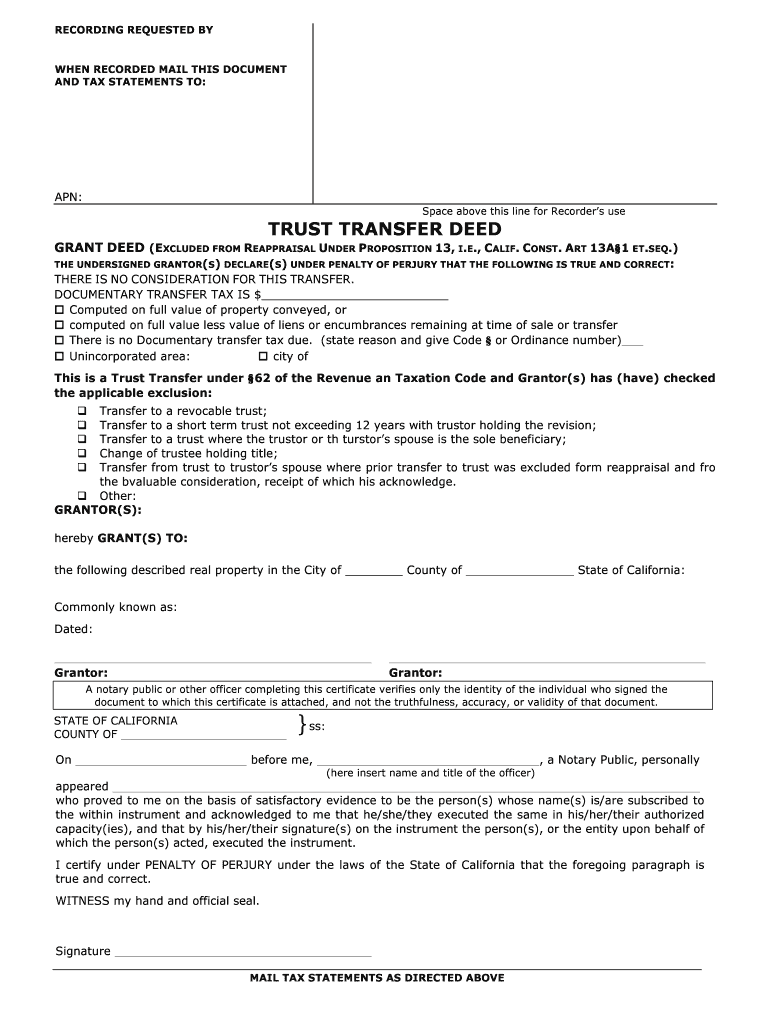

RECORDING REQUESTED BY WHEN RECORDED MAIL THIS DOCUMENT AND TAX STATEMENTS TO: APN: Space above this line for Recorders use TRUST TRANSFER DEED GRANT DEED (EXCLUDED FROM REAPPRAISAL UNDER PROPOSITION

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign trust transfer deed

Edit your trust transfer deed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your trust transfer deed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing trust transfer deed online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit trust transfer deed. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out trust transfer deed

To fill out a trust transfer deed, follow these steps:

01

Begin by obtaining a copy of the trust transfer deed form from your local county recorder's office or website. This form is typically specific to the county in which the property is located.

02

Read and understand the instructions provided with the trust transfer deed form. These instructions will outline the necessary information and steps required to complete the form accurately.

03

Identify the grantor and the trustee(s) involved in the transfer. The grantor is the current owner of the property, while the trustee is the individual or entity who will hold the property in trust.

04

Provide a legal description of the property being transferred. This typically includes the property's physical address, parcel number, and any other relevant details that uniquely identify the property.

05

Indicate the type of trust being created or modified with the transfer deed. This could be a revocable living trust, irrevocable trust, or another type as specified by the grantor.

06

Include the effective date of the trust transfer deed. This is the date when the transfer will become legally valid and the property will be held in trust.

07

Specify any conditions or limitations associated with the trust transfer, if applicable. For example, if the transfer is subject to certain restrictions or provisions, they should be clearly outlined in the deed.

08

Obtain the necessary signatures. The grantor must sign the trust transfer deed, typically in the presence of a notary public. In some cases, additional signatures may be required, such as those of the trustee(s) or witnesses.

09

Submit the completed trust transfer deed form to the county recorder's office for recording. This ensures that the transfer is legally documented and becomes a matter of public record.

Who needs a trust transfer deed?

A trust transfer deed is typically required in situations where a property owner wishes to transfer ownership of real estate into a trust. This could be necessary for various reasons, such as estate planning, asset protection, or ensuring a smooth transfer of property upon the owner's death or incapacitation.

Individuals or entities who have created a trust and seek to transfer property into that trust would need a trust transfer deed. This could include individuals creating a revocable living trust to simplify their estate planning, or families establishing an irrevocable trust to protect their assets from potential creditors.

Ultimately, anyone seeking to transfer real estate property into a trust for legal, financial, or estate planning purposes may require a trust transfer deed. It is advisable to consult with a qualified legal professional or estate planner to determine if a trust transfer deed is necessary in your specific situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify trust transfer deed without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your trust transfer deed into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send trust transfer deed to be eSigned by others?

Once your trust transfer deed is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How can I fill out trust transfer deed on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your trust transfer deed. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is trust transfer deed?

A trust transfer deed is a legal document used to transfer ownership of property into a trust.

Who is required to file trust transfer deed?

The person transferring ownership of property into a trust is required to file the trust transfer deed.

How to fill out trust transfer deed?

To fill out a trust transfer deed, you will need to include details of the property being transferred, the name of the trust, and the signatures of all parties involved.

What is the purpose of trust transfer deed?

The purpose of a trust transfer deed is to officially transfer ownership of property into a trust, often for the purpose of estate planning or asset protection.

What information must be reported on trust transfer deed?

The trust transfer deed must include details of the property being transferred, the name of the trust, and the signatures of all parties involved.

Fill out your trust transfer deed online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Trust Transfer Deed is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.