Get the free TRANSFER ON DEATH DEED - Stevens-Ness

Show details

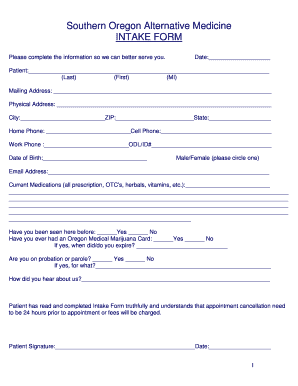

SA M PL E After recording, return to (Name, Address, Zip): TRANSFER ON DEATH DEED Granter(s): Grantee(s) (Beneficiary): Abbreviated Legal Description: Assessors Property Tax Parcel or Account No:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign transfer on death deed

Edit your transfer on death deed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your transfer on death deed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing transfer on death deed online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit transfer on death deed. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out transfer on death deed

How to fill out a transfer on death deed:

01

Research the requirements: Start by familiarizing yourself with the laws and regulations in your state regarding transfer on death deeds. Each state may have different rules and requirements, so it is important to ensure you understand the specific steps and forms needed.

02

Obtain the necessary forms: Contact your county or state office to request the appropriate transfer on death deed form. These forms are typically provided by the county recorder's office or the department responsible for real estate transactions.

03

Gather the required information: Fill out the form accurately and completely. This may include providing your personal information, such as your name, address, and contact details, as well as information about the property being transferred, such as the legal description and address.

04

Choose your beneficiaries: Identify the individuals or organizations who will inherit the property upon your death. You will need to provide their names, addresses, and relationship to you. It is advisable to discuss your intentions with the intended beneficiaries beforehand to ensure they are willing and able to accept the property.

05

Sign the deed: Once the form is completed, you will need to sign it in the presence of a notary public. The notary will also need to sign and stamp the form to validate it. It is crucial to follow your state's specific instructions on signing and notarization to ensure the deed is legally enforceable.

06

Record the deed: Take the executed deed to the county recorder's office or the appropriate department for recording. There may be a fee associated with recording the document, so be prepared to pay the necessary charges.

Who needs a transfer on death deed?

01

Homeowners: Transfer on death deeds are commonly used by homeowners who wish to ensure a quick and easy transfer of their property upon their death. This process can help avoid the need for probate, which can be time-consuming and costly.

02

Individuals without a will or trust: If you do not have a will or trust specifying the distribution of your property after your death, a transfer on death deed can be a useful tool to ensure your property goes to the intended beneficiaries.

03

Those seeking to avoid probate: By using a transfer on death deed, you can potentially bypass the probate process, which can save your beneficiaries time, money, and potential disputes.

04

Property owners with specific wishes: If you have specific intentions regarding who should inherit your property after your death, a transfer on death deed enables you to clearly state your desires and prevent any ambiguity or confusion.

Note: It is recommended to seek legal advice or consult with a qualified professional to ensure the transfer on death deed is properly executed according to your specific circumstances and state laws.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify transfer on death deed without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your transfer on death deed into a dynamic fillable form that you can manage and eSign from anywhere.

How can I send transfer on death deed for eSignature?

Once you are ready to share your transfer on death deed, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an electronic signature for signing my transfer on death deed in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your transfer on death deed right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is transfer on death deed?

A transfer on death deed is a legal document that allows an individual to transfer real property to a beneficiary upon their death, without the need for probate.

Who is required to file transfer on death deed?

The property owner is typically required to file a transfer on death deed in order to designate a beneficiary.

How to fill out transfer on death deed?

To fill out a transfer on death deed, the property owner will need to include the legal description of the property, the name of the beneficiary, and sign the document in front of a notary public.

What is the purpose of transfer on death deed?

The purpose of a transfer on death deed is to allow for the seamless transfer of property to a beneficiary without the need for probate proceedings.

What information must be reported on transfer on death deed?

The transfer on death deed must include the legal description of the property, the name of the beneficiary, and the signature of the property owner.

Fill out your transfer on death deed online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Transfer On Death Deed is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.