Get the free Milford Bank Passbook Savings Account

Show details

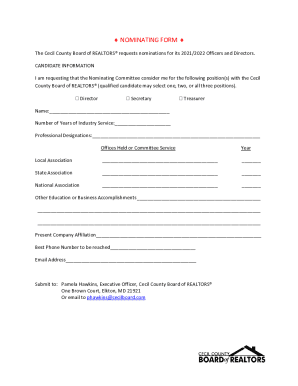

This document is an application form for opening a Passbook Savings Account for children at Milford Bank, requiring personal information of both the child and the custodian.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign milford bank passbook savings

Edit your milford bank passbook savings form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your milford bank passbook savings form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing milford bank passbook savings online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit milford bank passbook savings. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out milford bank passbook savings

How to fill out Milford Bank Passbook Savings Account

01

Visit the nearest Milford Bank branch.

02

Request a Passbook Savings Account application form.

03

Fill in your personal information including name, address, and contact details.

04

Provide identification documents as required, such as a government-issued ID and Social Security number.

05

Specify the initial deposit amount you wish to deposit.

06

Review all information for accuracy.

07

Submit the completed application form and required documents to the bank representative.

08

Receive your passbook and account details once approved.

Who needs Milford Bank Passbook Savings Account?

01

Individuals looking for a traditional savings option.

02

People who prefer a physical record of their transactions.

03

Those who want to earn interest on their savings while maintaining easy access to funds.

04

Parents or guardians opening an account for minors to teach them about saving.

Fill

form

: Try Risk Free

People Also Ask about

Do banks still issue passbooks?

A bank passbook is still a recognized and vital banking document in India. You can use it as verifiable proof of your bank account details in many cases.

Why are nationwide getting rid of passbooks?

Why did you remove passbooks? We are committed to giving our customers choice in how they bank with us. We also want them to receive smooth and efficient service by ensuring our systems are the best they can be. It is vital that the systems and platforms all our accounts operate on are up to date, efficient and robust.

What is a disadvantage of a passbook savings account?

A major disadvantage of passbook savings accounts is that you can't access your money electronically. You have to go to a branch in person to withdraw or deposit funds. You usually can't even get an account summary online; instead, your physical passbook is the only source of information you have about the account.

Can you still get a passbook savings account?

Passbook savings accounts at a glance Whilst more banks and building societies stop offering passbooks, lots of our Members tell us they still prefer using them to manage their money. That's why we've committed to offering passbooks for savings accounts opened in branch for as long as our Members continue to want them.

Do passbook savings accounts still exist?

Passbook savings accounts can still be useful for children and young adults who are learning how to manage money. These accounts offer a simple, hands-on way to see how saving works.

How can I check my savings account details?

Checking & Verifying Account Number Online Almost every bank provides online platforms where you can easily access your savings account details. Online Banking Portal: Log in and navigate to account details to check account number online. Mobile Banking App: Check under the 'My Account' or similar tab.

Do passbooks still exist?

Although technology has transformed the way people manage their finances, passbooks continue to play a vital role for many customers. Here are some reasons why passbooks remain in use: Simplicity: Passbooks offer a straightforward, easy-to-understand method of recording transactions.

Can you still get a passbook savings account?

Passbook savings accounts at a glance Whilst more banks and building societies stop offering passbooks, lots of our Members tell us they still prefer using them to manage their money. That's why we've committed to offering passbooks for savings accounts opened in branch for as long as our Members continue to want them.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Milford Bank Passbook Savings Account?

The Milford Bank Passbook Savings Account is a type of savings account that allows customers to deposit and withdraw funds while earning interest. Account holders receive a passbook that tracks their deposits, withdrawals, and interest earned.

Who is required to file Milford Bank Passbook Savings Account?

Individuals and entities who have an account with Milford Bank and earn interest on their savings may be required to file reports related to their Passbook Savings Account for tax purposes.

How to fill out Milford Bank Passbook Savings Account?

To fill out a Milford Bank Passbook Savings Account, customers must provide personal information, such as their name, address, Social Security number, and initial deposit amount in accordance with the bank's application process.

What is the purpose of Milford Bank Passbook Savings Account?

The purpose of the Milford Bank Passbook Savings Account is to encourage savings by providing a secure place for individuals to save money while earning interest on their balance.

What information must be reported on Milford Bank Passbook Savings Account?

The information that must be reported includes interest earned, total deposits, total withdrawals, and the account balance at the end of the reporting period.

Fill out your milford bank passbook savings online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Milford Bank Passbook Savings is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.