Get the free Living annuity withdrawal instruction - Allan Gray

Show details

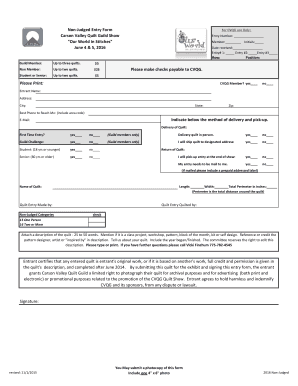

LIVING ANNUITY WITHDRAWAL INSTRUCTION Make an informed decision: Read our Product Range brochure if you need to review the rules of this product. Refer to the fund fact sheets (minimum disclosure

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign living annuity withdrawal instruction

Edit your living annuity withdrawal instruction form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your living annuity withdrawal instruction form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit living annuity withdrawal instruction online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit living annuity withdrawal instruction. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out living annuity withdrawal instruction

How to Fill Out Living Annuity Withdrawal Instruction:

01

Obtain the necessary withdrawal instruction form from your annuity provider. This form is designed specifically for requesting withdrawals from your living annuity.

02

Begin by providing your personal details, including your full name, address, and contact information. This information is essential for the annuity provider to process your withdrawal request correctly.

03

Enter your annuity policy number or any other identifying information required by your provider. This ensures that your withdrawal request is linked to the correct annuity account.

04

Indicate the desired withdrawal amount. Specify whether you want a fixed amount or a percentage of your annuity's value. Some providers may have specific requirements or limitations on the withdrawal amount.

05

Choose the frequency of withdrawals. You may have the option to receive withdrawals monthly, quarterly, semi-annually, or annually. Select the frequency that aligns with your financial needs and goals.

06

Consider any additional withdrawal instructions or preferences. For example, you might want to specify whether the withdrawal should be made by check, electronic transfer, or any other preferred method. Some providers also offer the option to automatically increase or decrease withdrawal amounts over time.

07

Review the completed withdrawal instruction form thoroughly. Make sure all the information provided is accurate and matches your intentions. Double-check numerical figures and calculations to avoid any errors or misunderstandings.

08

Sign and date the form. Your signature certifies that the withdrawal instruction is accurate and that you understand the implications and consequences of the requested withdrawals.

09

Submit the completed form to your annuity provider as instructed. This may involve mailing the form, submitting it online, or visiting a local branch, depending on the provider's guidelines.

Who Needs Living Annuity Withdrawal Instruction:

01

Individuals who have a living annuity as part of their retirement plan may need to complete a withdrawal instruction. Living annuities allow retirees to receive regular income payments, and a withdrawal instruction guides the annuity provider on when and how much money to distribute.

02

Anyone who wishes to access funds from their living annuity account for personal or financial reasons should complete a withdrawal instruction. This could include covering living expenses, paying for medical bills, funding education or travel, or managing unexpected financial challenges.

03

Retirees who have reached the age of compulsory annuitization – typically around 75 years old depending on local regulations – may be required to complete a withdrawal instruction to start receiving regular income payments from their living annuity.

Remember to consult with a financial advisor or professional specializing in retirement planning to ensure that your withdrawal instructions align with your overall financial strategy and goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute living annuity withdrawal instruction online?

pdfFiller has made filling out and eSigning living annuity withdrawal instruction easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I make changes in living annuity withdrawal instruction?

The editing procedure is simple with pdfFiller. Open your living annuity withdrawal instruction in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit living annuity withdrawal instruction on an Android device?

The pdfFiller app for Android allows you to edit PDF files like living annuity withdrawal instruction. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is living annuity withdrawal instruction?

Living annuity withdrawal instruction is a form that specifies how much money a retiree wishes to withdraw from their living annuity each year.

Who is required to file living annuity withdrawal instruction?

Any individual who has a living annuity and wishes to make withdrawals from it is required to file a living annuity withdrawal instruction.

How to fill out living annuity withdrawal instruction?

Living annuity withdrawal instruction can typically be filled out online, through a financial advisor, or directly with the financial institution managing the living annuity.

What is the purpose of living annuity withdrawal instruction?

The purpose of living annuity withdrawal instruction is to inform the financial institution managing the living annuity how much money the retiree would like to withdraw periodically.

What information must be reported on living annuity withdrawal instruction?

Living annuity withdrawal instruction typically requires information such as the desired withdrawal amount, frequency of withdrawals, and any specific instructions regarding investment options.

Fill out your living annuity withdrawal instruction online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Living Annuity Withdrawal Instruction is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.