Get the free This IRS Audit Letter 797 sample is provided by TaxAudit

Show details

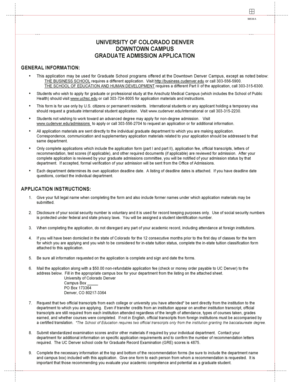

This IRS Audit Letter 797 sample is provided by TaxAudit.com, the nations

leading Tax Audit Defense firm. For more information, please visit TaxAudit.com. Department of the Treasury

Internal Revenue

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign this irs audit letter

Edit your this irs audit letter form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your this irs audit letter form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit this irs audit letter online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit this irs audit letter. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out this irs audit letter

Instructions for filling out an IRS audit letter:

01

Gather all necessary documents: Start by collecting all the documents requested in the IRS audit letter. This may include tax returns, financial statements, receipts, invoices, and any other supporting documentation.

02

Review the audit letter: Carefully read through the audit letter to understand the specific issues being addressed, the years being audited, and any deadlines mentioned. This will help you stay focused and organized throughout the process.

03

Understand the requirements: Familiarize yourself with the tax laws and regulations relevant to the audit. This will enable you to accurately respond to the IRS's inquiries and provide any necessary explanations or justifications.

04

Organize your response: Create a clear and organized response to the audit letter. Label or number each document or piece of information to correspond with the audit letter's requests. This will make it easier for the IRS to navigate your response and locate the appropriate information.

05

Be thorough and accurate: When providing responses, ensure that the information you provide is accurate, complete, and relevant to the audit. Double-check your calculations and review all documentation for any errors or inconsistencies.

06

Explain any discrepancies: If the IRS identifies discrepancies or inconsistencies, be prepared to provide explanations for these discrepancies. It's important to be transparent and honest in your responses. If possible, provide supporting evidence or documentation to substantiate your explanations.

07

Meet deadlines: Pay close attention to any deadlines mentioned in the audit letter. Ensure that you respond within the specified time frame to avoid potential penalties or further complications.

08

Seek professional assistance if needed: If you find the audit process complex or overwhelming, consider seeking assistance from a tax professional, such as a certified public accountant (CPA) or a tax attorney. They can provide guidance, represent you during the audit, and help ensure compliance with IRS regulations.

Who needs this IRS audit letter?

Individuals or entities who have been selected for an audit by the IRS will receive an IRS audit letter. This letter is typically sent to taxpayers whose tax returns have been chosen for further review to verify the accuracy and completeness of the reported information. The IRS may initiate an audit for various reasons, including random selection, potential errors or inconsistencies in the reported information, or suspicion of fraudulent activity. It is important to respond promptly and appropriately to the IRS audit letter to comply with their requests and address any potential issues.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send this irs audit letter for eSignature?

When you're ready to share your this irs audit letter, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I make edits in this irs audit letter without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your this irs audit letter, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How can I fill out this irs audit letter on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your this irs audit letter by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

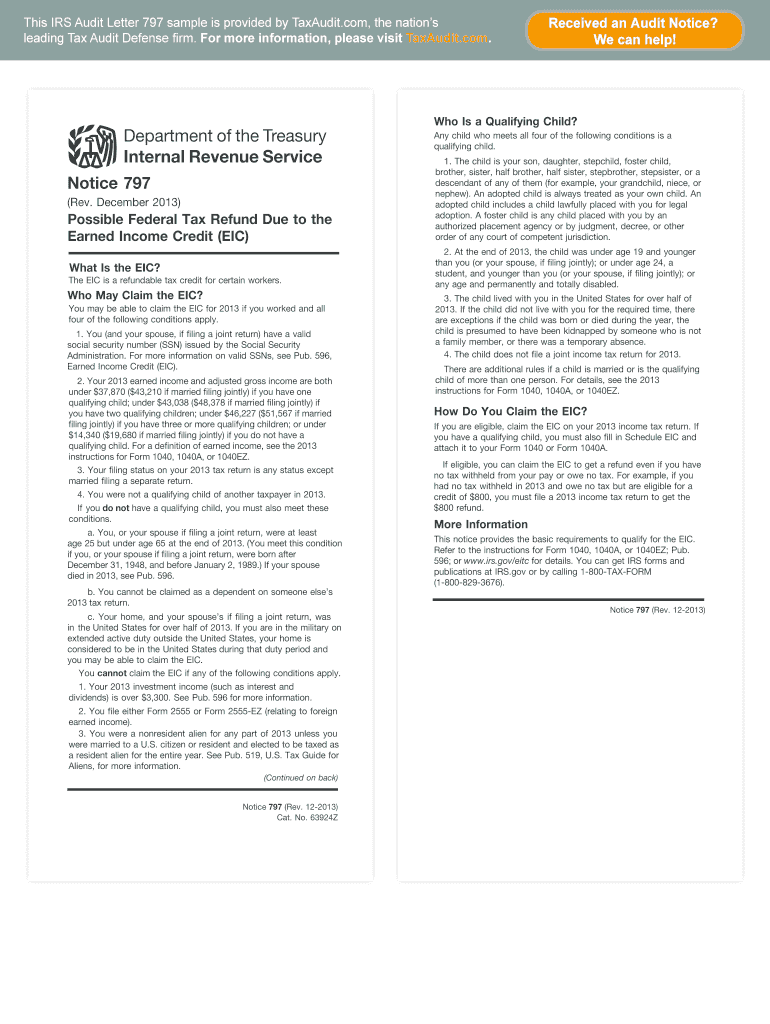

What is this irs audit letter?

The IRS audit letter is a notification from the Internal Revenue Service informing a taxpayer that their tax return has been selected for an audit.

Who is required to file this irs audit letter?

Taxpayers who receive the notification from the IRS that their tax return has been selected for an audit are required to file the IRS audit letter.

How to fill out this irs audit letter?

The IRS audit letter typically includes instructions on how to respond with the necessary documentation and information requested by the IRS.

What is the purpose of this irs audit letter?

The purpose of the IRS audit letter is to review and verify the accuracy of the taxpayer's reported income, deductions, and credits.

What information must be reported on this irs audit letter?

The taxpayer must provide the requested documentation, receipts, and any other relevant information to support their reported income, deductions, and credits.

Fill out your this irs audit letter online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

This Irs Audit Letter is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.