Get the free Rule 144 – Seller’s Representation Letter

Show details

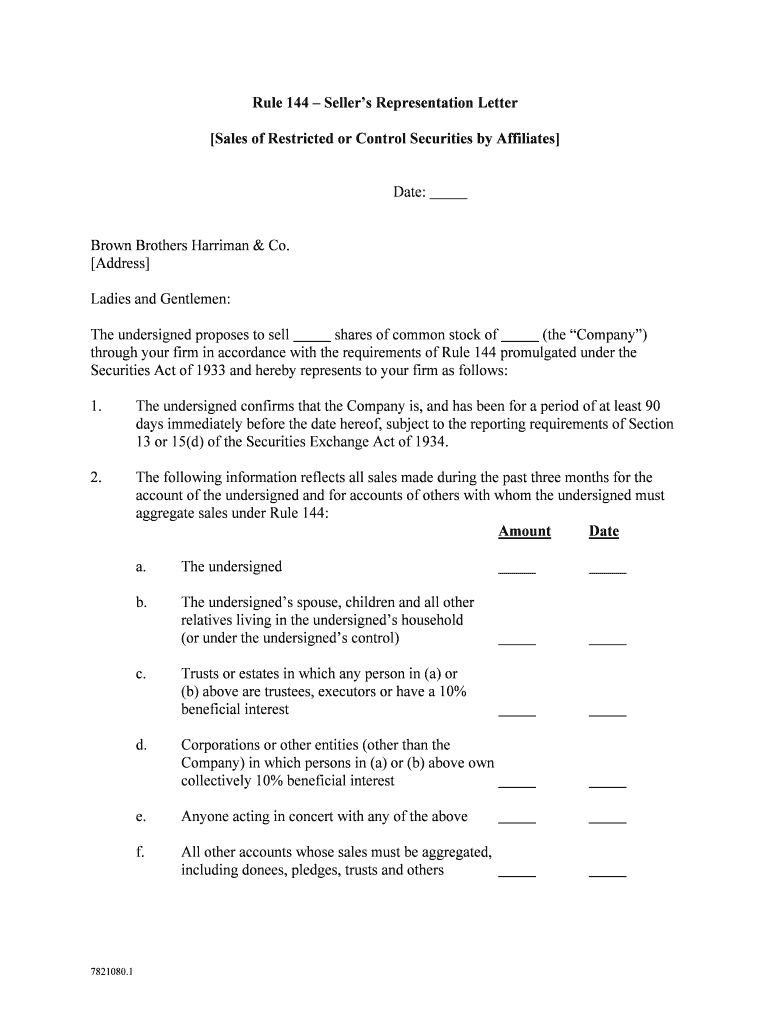

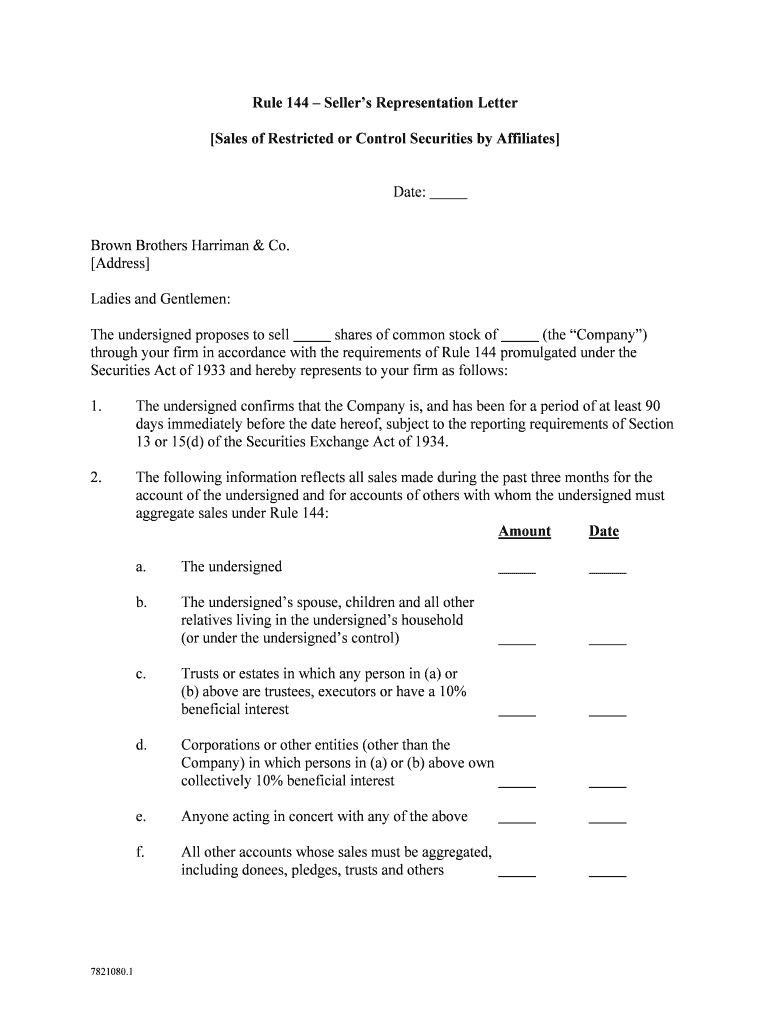

A letter used by affiliates of a company to represent their compliance with the requirements of Rule 144 when selling restricted or control securities.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rule 144 sellers representation

Edit your rule 144 sellers representation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rule 144 sellers representation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rule 144 sellers representation online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit rule 144 sellers representation. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rule 144 sellers representation

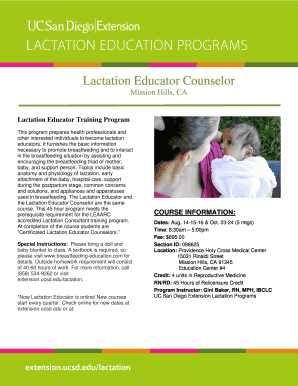

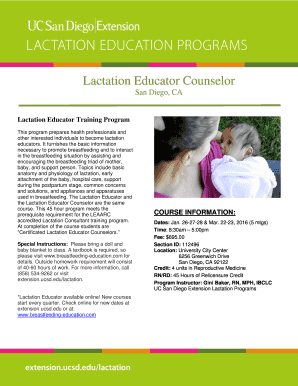

How to fill out Rule 144 – Seller’s Representation Letter

01

Obtain the Rule 144 – Seller's Representation Letter template from a reliable source.

02

Fill in the seller's name and contact information at the top of the document.

03

Specify the details of the securities being sold, including the number and type of securities.

04

Indicate the date of the sale and the method of sale (e.g., public offering, private placement).

05

Provide representations and warranties as required, confirming compliance with Rule 144 conditions.

06

Sign and date the document to validate the representations.

07

Submit the completed letter along with any required documentation to the broker-dealer or financial institution handling the sale.

Who needs Rule 144 – Seller’s Representation Letter?

01

Individuals or entities looking to sell restricted or control securities in compliance with Rule 144.

02

Sellers who need to establish that their sale falls within the exemptions provided by Rule 144.

03

Investors or shareholders who hold securities that cannot be sold freely and require documentation for legitimate sale processes.

Fill

form

: Try Risk Free

People Also Ask about

What is Rule 144 simplified?

Rule 144 requires restricted stock to be held by its investors for 6 months before resale. After this time period, the investor can sell their shares.

What is the Rule 144 opinion letter?

Rule 144 provides a "safe harbor" for selling these securities without registration. The opinion letter confirms that your sale meets the requirements of Rule 144. This letter is vital to show you have complied with the rules and regulations. Stock certificates often have restrictive legends.

What are the rules for Form 144?

1 An entity filing a Form 144 must have a bona fide intention to sell the securities referred to in the form within a reasonable time after the filing of the Form. While the SEC does not require the form to be sent electronically to the SEC's EDGAR database, some filers choose to do so.

Who is an affiliate for Rule 144?

(1) An affiliate of an issuer is a person that directly, or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, such issuer.

What is the rule of 144 in investing?

Rule 144 provides an exemption and permits the public resale of restricted or control securities if a number of conditions are met, including how long the securities are held, the way in which they are sold, and the amount that can be sold at any one time.

What is Rule 144 simplified?

Rule 144 requires restricted stock to be held by its investors for 6 months before resale. After this time period, the investor can sell their shares.

What is the Rule 144 for sellers?

Rule 144 provides an exemption and permits the public resale of restricted or control securities if a number of conditions are met, including how long the securities are held, the way in which they are sold, and the amount that can be sold at any one time.

What is the Rule 144 selling?

Rule 144 allows selling restricted, unregistered, or controlled securities publicly without registration if certain requirements are met. Holding period is 6 months for public companies, 1 year for non-reporting companies, and up to 2 years for non-reporting companies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Rule 144 – Seller’s Representation Letter?

Rule 144 – Seller’s Representation Letter is a document that represents a seller's intention to sell restricted or controlled securities under the SEC's Rule 144. The letter certifies that the seller meets specific criteria for resale of these securities.

Who is required to file Rule 144 – Seller’s Representation Letter?

Individuals or entities looking to sell restricted or control securities after a holding period, and who want to ensure compliance with the requirements of Rule 144, are required to file the Seller’s Representation Letter.

How to fill out Rule 144 – Seller’s Representation Letter?

To fill out the Rule 144 – Seller’s Representation Letter, the seller must provide their name, the name of the issuer, details about the securities (including the number of shares), the holding period, and affirm that they meet the conditions of Rule 144 for selling the securities.

What is the purpose of Rule 144 – Seller’s Representation Letter?

The purpose of Rule 144 – Seller’s Representation Letter is to document the seller's status and qualifications under Rule 144, ensuring that the sale of securities complies with SEC regulations and provides necessary assurances to buyers.

What information must be reported on Rule 144 – Seller’s Representation Letter?

The Rule 144 – Seller’s Representation Letter must report the seller's identity, issuer details, description of the securities being sold, the seller's relationship with the issuer, the duration of holding, and any other relevant information that supports the qualifications for resale under Rule 144.

Fill out your rule 144 sellers representation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rule 144 Sellers Representation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.