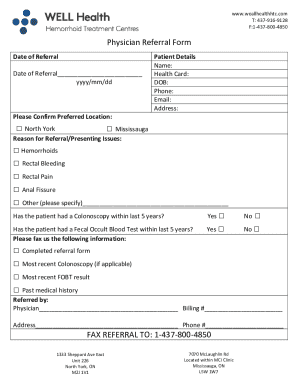

Get the free Westpac Self-Funding Instalments Supplementary Product Disclosure Statement

Show details

This document supplements the Westpac Self-Funding Instalments (Westpac SFIs) Product Disclosure Statement dated 1 July 2013, providing updates on series, fee disclosure, and privacy updates.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign westpac self-funding instalments supplementary

Edit your westpac self-funding instalments supplementary form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your westpac self-funding instalments supplementary form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit westpac self-funding instalments supplementary online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit westpac self-funding instalments supplementary. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out westpac self-funding instalments supplementary

How to fill out Westpac Self-Funding Instalments Supplementary Product Disclosure Statement

01

Gather all required personal and financial information, including identification and income details.

02

Obtain the Westpac Self-Funding Instalments Supplementary Product Disclosure Statement from the Westpac website or branch.

03

Read through the entire document to understand the terms and conditions associated with the product.

04

Fill out personal details including your name, address, and contact information in the specified sections.

05

Provide accurate financial information, including income sources and estimated expenses.

06

Review any risk disclosures and ensure you are aware of potential risks associated with self-funding.

07

Sign the application form where required, and ensure that all required supporting documents are attached.

08

Submit the completed application form and supporting documents to Westpac via the prescribed method.

Who needs Westpac Self-Funding Instalments Supplementary Product Disclosure Statement?

01

Individuals looking for a structured financing option for investments.

02

Investors who prefer to manage instalments on their own terms.

03

Clients of Westpac seeking detailed information about self-funding options.

04

People interested in understanding the risks and benefits associated with self-funding investments.

Fill

form

: Try Risk Free

People Also Ask about

How to do self-funding?

Ways to Self-Fund Your Business Cash - Checking & Personal Savings. Friends & Family. Rollovers for Business Start-ups (ROBS) Crowd Funding. Bootstrapping.

What are self-funding instalments?

Self-Funding Instalments (SFIs) are instalment warrants that use any dividends paid on the underlying share to reduce your final instalment amount. Like other instalment warrants, they give you exposure to an underlying share for a portion of its current price.

What does self-funded mean?

To be self-funded means to pay for things yourself or receive support from family, friends or other non-governmental organisations. In terms of postgraduate education, being self-funded means paying for the majority of your fees yourself.

What are the risks of self funding?

One major drawback is the risk of insufficient funds, which can limit your ability to invest in necessary resources or seize growth opportunities. Additionally, self-funding may result in slow growth potential as you rely solely on your own financial resources.

What is an example of an Instalment warrant?

A specific example of an instalment warrant in action So say for example, a client went to buy 10,000 Commonwealth Bank shares worth $300,000; they only had to contribute $150,000. Now over the next five years, the dividends of the Commonwealth Bank paid off that $150,000 loan.

How to get a Westpac statement?

In Online Banking Go to Overview and then Statements. Select an Account under Active accounts. Enter date range or select a preset range, and select Search. Select Download PDF to view the statement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Westpac Self-Funding Instalments Supplementary Product Disclosure Statement?

The Westpac Self-Funding Instalments Supplementary Product Disclosure Statement (SPDS) is a document that provides additional information about the self-funding instalment products offered by Westpac to help investors understand the features, risks, and terms associated with these financial products.

Who is required to file Westpac Self-Funding Instalments Supplementary Product Disclosure Statement?

Issuers and distributors of the Westpac Self-Funding Instalments are required to file the Supplementary Product Disclosure Statement to ensure compliance with regulatory obligations and to provide potential investors with comprehensive information.

How to fill out Westpac Self-Funding Instalments Supplementary Product Disclosure Statement?

To fill out the Westpac Self-Funding Instalments SPDS, individuals should carefully review the guidance provided within the document, complete any required sections with accurate information, and ensure that they understand the terms before submitting or using the document for investment purposes.

What is the purpose of Westpac Self-Funding Instalments Supplementary Product Disclosure Statement?

The purpose of the Westpac Self-Funding Instalments SPDS is to provide essential information to investors regarding the self-funding instalments, including key features, risks, and terms, thereby aiding in informed decision-making.

What information must be reported on Westpac Self-Funding Instalments Supplementary Product Disclosure Statement?

The Westpac Self-Funding Instalments SPDS must report information regarding product features, risks, fees, the calculation of instalments, potential tax implications, and any other relevant details that may affect an investor's decision.

Fill out your westpac self-funding instalments supplementary online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Westpac Self-Funding Instalments Supplementary is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.