Get the free 403b Salary Reduction Agreement - nbsbenefitscom

Show details

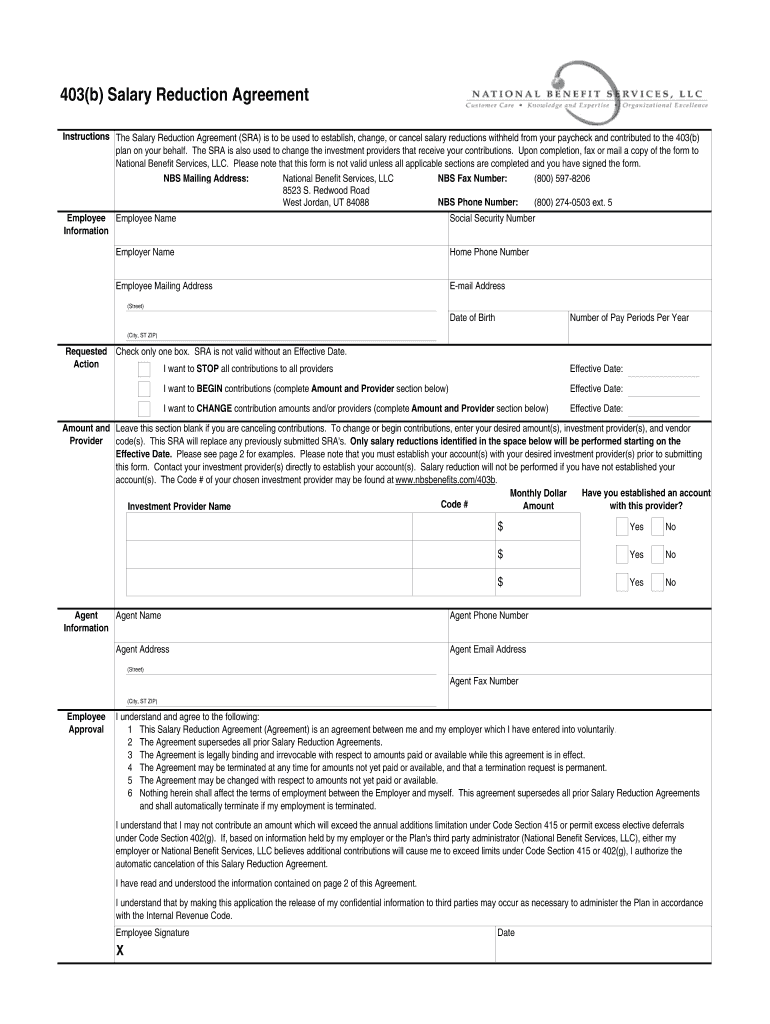

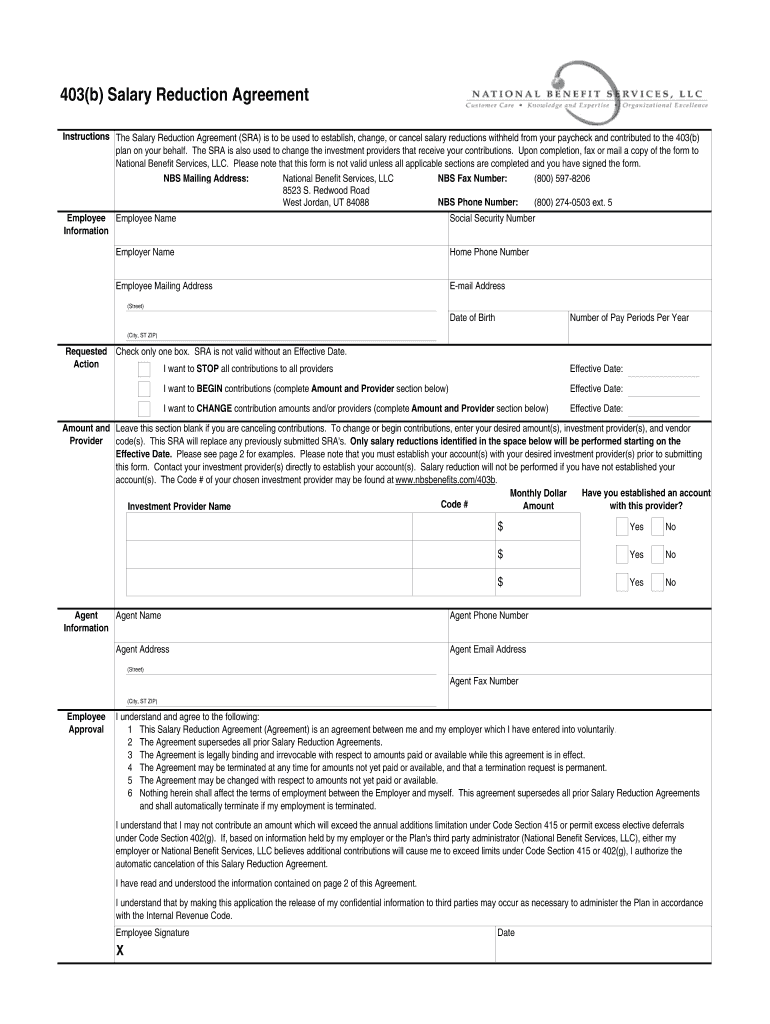

NBSbenefits.com ... The Salary Reduction Agreement (SRA) is used to establish, change, or cancel salary ... copy of the form to National Benefit Services, LLC.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 403b salary reduction agreement

Edit your 403b salary reduction agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 403b salary reduction agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 403b salary reduction agreement online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 403b salary reduction agreement. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 403b salary reduction agreement

To fill out a 403b salary reduction agreement, follow these steps:

01

Obtain the necessary form: Contact your employer or human resources department to request the 403b salary reduction agreement form. Alternatively, you may find it on your employer's intranet or retirement plan provider's website.

02

Provide personal information: Fill in your personal details such as your name, social security number, and contact information. Make sure to double-check the accuracy of this information before submitting the form.

03

Indicate contribution amount: Specify the percentage or dollar amount you wish to contribute to your 403b account. This is the portion of your salary that will be deducted and invested in the retirement plan.

04

Choose contribution type: Decide whether you want to make traditional pre-tax contributions or Roth after-tax contributions. Pre-tax contributions reduce your taxable income, while Roth contributions provide tax-free withdrawals in retirement.

05

Review investment options: Your employer's 403b plan may offer various investment options such as mutual funds or annuities. Take the time to review these options and select the ones that align with your financial goals and risk tolerance.

06

Designate beneficiaries: In the event of your passing, beneficiaries will receive the funds in your 403b account. Name your primary and contingent beneficiaries, ensuring their accurate contact information is provided.

07

Understand plan rules: Familiarize yourself with the rules and regulations governing your 403b plan. This includes understanding any limitations on contributions, withdrawal policies, and potential penalties for early withdrawals.

Who needs a 403b salary reduction agreement?

A 403b salary reduction agreement is typically required for employees who work for certain tax-exempt organizations, such as public schools, universities, and nonprofit organizations. These individuals may opt to contribute a portion of their salary to a 403b retirement plan, allowing them to save for retirement while also receiving potential tax advantages.

It's important to note that eligibility criteria may vary depending on the employer and the specific retirement plan. Therefore, it is recommended to consult with your employer or plan administrator to determine if you qualify for a 403b salary reduction agreement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 403b salary reduction agreement directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your 403b salary reduction agreement and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Can I create an eSignature for the 403b salary reduction agreement in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your 403b salary reduction agreement right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Can I edit 403b salary reduction agreement on an Android device?

The pdfFiller app for Android allows you to edit PDF files like 403b salary reduction agreement. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is 403b salary reduction agreement?

A 403b salary reduction agreement is a form signed by an employee to authorize their employer to deduct a specific amount from their salary and contribute it to their 403b retirement plan.

Who is required to file 403b salary reduction agreement?

Employees who wish to make contributions to their 403b retirement plan through salary deductions are required to file a 403b salary reduction agreement.

How to fill out 403b salary reduction agreement?

To fill out a 403b salary reduction agreement, an employee needs to provide their personal information, specify the contribution amount, and sign the form to authorize the deduction from their salary.

What is the purpose of 403b salary reduction agreement?

The purpose of a 403b salary reduction agreement is to facilitate retirement savings by allowing employees to contribute a portion of their salary directly to their 403b plan.

What information must be reported on 403b salary reduction agreement?

The 403b salary reduction agreement must include the employee's name, social security number, contribution amount, and signature to be valid.

Fill out your 403b salary reduction agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

403b Salary Reduction Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.